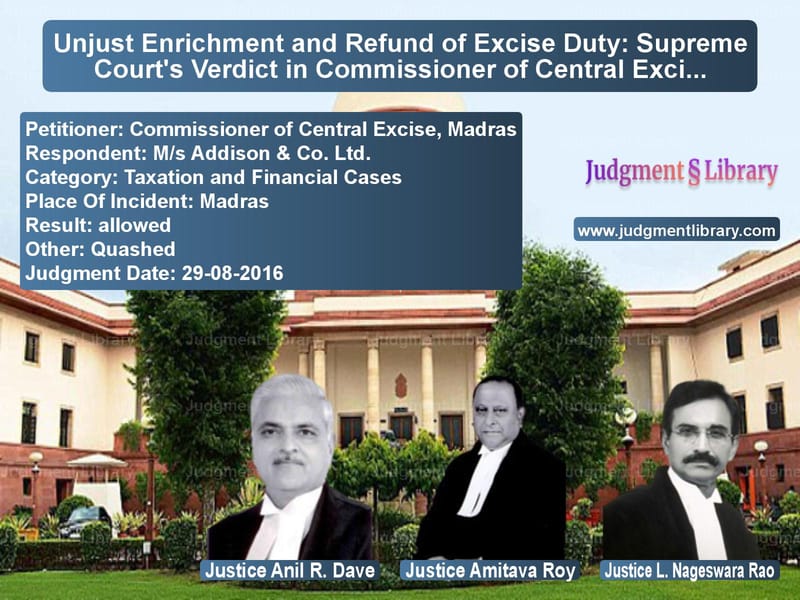

Unjust Enrichment and Refund of Excise Duty: Supreme Court’s Verdict in Commissioner of Central Excise vs. M/s Addison & Co. Ltd.

The Supreme Court of India, in the case of Commissioner of Central Excise, Madras vs. M/s Addison & Co. Ltd., addressed critical issues related to the refund of excise duty and the doctrine of unjust enrichment. This case primarily revolved around whether the refund of excise duty could be granted to a manufacturer who had already passed the burden of duty to buyers, and the legal interpretation of Sections 11-B, 12-A, and 12-B of the Central Excise Act, 1944.

Background of the Case

The respondent, M/s Addison & Co. Ltd., is a manufacturer of cutting tools. The dispute originated when the company filed a refund claim amounting to Rs. 40,22,133 on July 19, 1988, along with a supplementary refund claim for Rs. 5,44,688 on June 15, 1989. These claims were made towards excise duty paid on various discounts and taxes, such as turnover tax, surcharge, additional sales discounts, transitory insurance, excise discounts, additional discounts, and turnover discounts.

The Department of Central Excise, however, rejected a significant portion of the claim, arguing that the manufacturer had already passed on the duty burden to buyers, making it ineligible for a refund under the principle of unjust enrichment.

Legal Journey of the Case

The case went through multiple levels of adjudication:

- The Assistant Collector rejected the refund claim, stating that turnover and additional discounts were not deductible from excise duty.

- The Collector of Central Excise Appeals reversed this decision and held that the manufacturer was entitled to a refund.

- The Customs, Excise, and Gold (Control) Appellate Tribunal (CEGAT) overturned this ruling, emphasizing that a refund could be granted only if the manufacturer had not passed on the duty burden.

- The Madras High Court ruled in favor of the manufacturer, stating that refund eligibility should be determined based on whether the duty had been retained by the manufacturer.

- The Revenue appealed against this decision before the Supreme Court.

Arguments by the Petitioner

The Commissioner of Central Excise, representing the Revenue, presented the following arguments:

- As per Section 12-B of the Central Excise Act, there is a statutory presumption that the incidence of duty is passed on to the buyer.

- The refund of duty should only be granted to the person who ultimately bears the burden of tax.

- Issuance of credit notes post-sale does not negate the fact that the duty was initially passed on.

- Allowing refunds in such cases would lead to unjust enrichment.

Arguments by the Respondent

The respondent, M/s Addison & Co. Ltd., countered these claims, arguing:

- Turnover discounts were known at the time of sale and were an admissible deduction.

- The credit notes issued to buyers included the duty component, meaning the duty was effectively returned.

- As the manufacturer had not retained the duty amount, there was no question of unjust enrichment.

- The refund should be granted based on Section 11-B of the Central Excise Act.

Supreme Court’s Observations

The Supreme Court examined whether the claim for refund was valid and if allowing such refunds would result in unjust enrichment. The Court held:

“The doctrine of unjust enrichment applies when a person receives a benefit at the expense of another without a legal justification. If the manufacturer has already passed on the burden of duty, allowing a refund would result in double recovery.”

Further, the Court noted:

“There is a statutory presumption under Section 12-B of the Act that the duty has been passed on to the ultimate consumer. The burden to prove otherwise rests on the claimant.”

Final Judgment

The Supreme Court ruled in favor of the Revenue, stating that M/s Addison & Co. Ltd. was not entitled to the refund as it had already transferred the burden of excise duty to its buyers. The Court reversed the High Court’s ruling and upheld the principle that refunds should only be granted when the duty burden has not been passed on.

Implications of the Judgment

This judgment has far-reaching implications for excise duty refunds and tax administration:

- Reaffirmation of Unjust Enrichment Principle: The ruling reinforces that refunds cannot be granted when the tax burden has been shifted down the supply chain.

- Stricter Burden of Proof on Manufacturers: Companies must provide substantial evidence that they have not passed on the duty to claim a refund.

- Precedent for Future Refund Claims: The ruling serves as a benchmark for handling similar cases under indirect tax laws.

Conclusion

The Supreme Court’s decision in Commissioner of Central Excise vs. M/s Addison & Co. Ltd. upholds the doctrine of unjust enrichment and ensures that excise duty refunds are granted only in legitimate cases. By dismissing the manufacturer’s claim for refund, the Court has reinforced legal provisions aimed at preventing double recovery and protecting the integrity of tax administration.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Commissioner of Cent vs Ms Addison & Co. Lt Supreme Court of India Judgment Dated 29-08-2016-1741878557685.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in GST Law

See all petitions in Tax Refund Disputes

See all petitions in Judgment by Anil R. Dave

See all petitions in Judgment by Amitava Roy

See all petitions in Judgment by L. Nageswara Rao

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments August 2016

See all petitions in 2016 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category