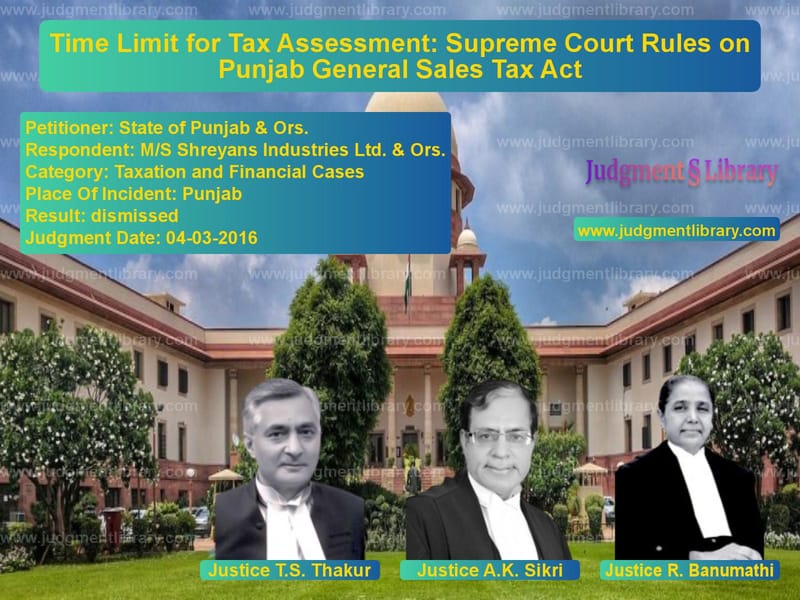

Time Limit for Tax Assessment: Supreme Court Rules on Punjab General Sales Tax Act

The Supreme Court of India, in the case of State of Punjab & Ors. vs. M/S Shreyans Industries Ltd. & Ors., examined the crucial issue of whether the Commissioner of Sales Tax in Punjab could extend the time limit for assessment beyond the prescribed three-year period. The judgment, delivered by Chief Justice T.S. Thakur, Justice A.K. Sikri, and Justice R. Banumathi, upheld the decision of the Punjab and Haryana High Court, ruling that the Commissioner cannot extend the time limit after the prescribed period has lapsed.

Background of the Case

The case arose from tax assessments for the years 2000-01, 2001-02, 2002-03, and 2003-04 under the Punjab General Sales Tax Act, 1948. The Assessing Officer issued notices for these years after the expiry of the statutory three-year period. The assessees challenged these notices, arguing that they were time-barred and that the Commissioner had no authority to extend the period after its expiration.

Key Legal Issues

- Can the Commissioner extend the period for tax assessment beyond the statutory three years under Section 11(10) of the Punjab General Sales Tax Act?

- Does an extension of time after the expiration of the statutory period violate the rights of the assessee?

- How should the term ‘extension’ be interpreted in the context of tax laws?

Arguments of the Parties

Petitioner’s Arguments (State of Punjab)

The State of Punjab contended that under Section 11(10) of the Act, the Commissioner had the power to extend the assessment period without any prescribed upper limit. The government argued that the term ‘extension’ implied that the power could be exercised even after the original limitation period expired.

Respondent’s Arguments (M/S Shreyans Industries Ltd. & Ors.)

The respondents argued that once the statutory three-year period expired, the right to assess ceased to exist. They contended that the Commissioner could only extend the period before its expiration, not retrospectively. They also pointed out that similar interpretations had been adopted by the Karnataka and Gujarat High Courts.

Supreme Court’s Observations

Justice A.K. Sikri, delivering the judgment, stated:

“Once the period of limitation expires, the immunity against being subject to assessment sets in, and the right to make an assessment gets extinguished.”

The Court emphasized that allowing the Commissioner to extend the time limit after the statutory period had expired would undermine the taxpayer’s rights and lead to uncertainty in taxation matters. The Court agreed with the Punjab and Haryana High Court’s reliance on decisions from the Karnataka and Gujarat High Courts.

Final Verdict

The Supreme Court upheld the decision of the Punjab and Haryana High Court and dismissed the appeals of the State of Punjab. It ruled that the Commissioner does not have the power to extend the assessment period beyond the prescribed three years once it has expired.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: State of Punjab & Or vs MS Shreyans Industr Supreme Court of India Judgment Dated 04-03-2016-1741853832987.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Judgment by T.S. Thakur

See all petitions in Judgment by A.K. Sikri

See all petitions in Judgment by R. Banumathi

See all petitions in dismissed

See all petitions in supreme court of India judgments March 2016

See all petitions in 2016 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category