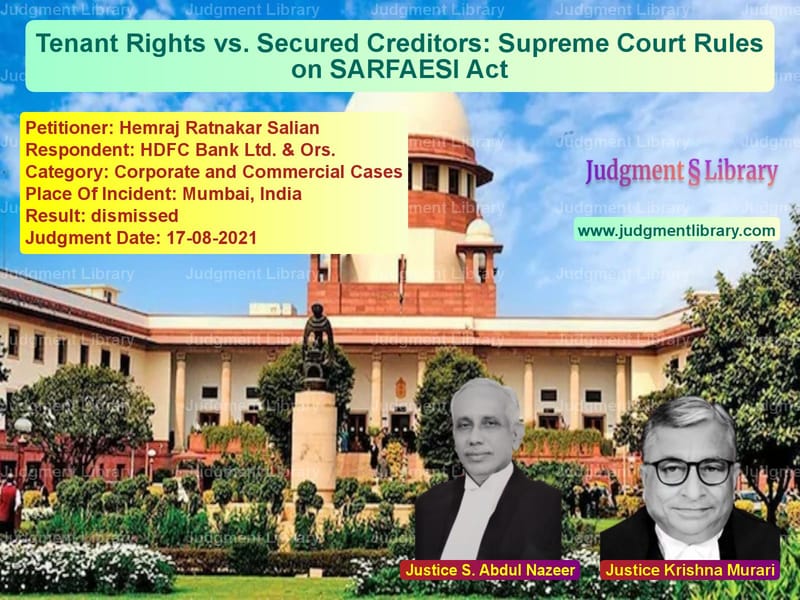

Tenant Rights vs. Secured Creditors: Supreme Court Rules on SARFAESI Act

The case of Hemraj Ratnakar Salian vs. HDFC Bank Ltd. & Ors. is a landmark ruling that clarifies the rights of tenants when a secured creditor initiates proceedings under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act). The Supreme Court had to decide whether an unregistered tenancy could protect a tenant from eviction when the secured creditor took possession of the mortgaged property.

The appeal arose from the rejection of an application by the Chief Metropolitan Magistrate, Esplanade, Mumbai, which sought to restrain HDFC Bank from taking possession of the property in the appellant’s possession. The Supreme Court upheld the bank’s right to take possession, ruling against the tenant.

Background of the Case

The case revolved around a financial loan provided by HDFC Bank to the borrowers (respondent nos. 2 and 3) amounting to Rs. 5.5 crores. To secure this loan, the borrowers mortgaged a property—Flat No. 501, Solitaire, Powai, Mumbai.

Key events in the case:

- The borrowers defaulted on loan payments, and the account was classified as a Non-Performing Asset (NPA) on October 31, 2013.

- The bank issued a Section 13(2) notice under the SARFAESI Act to the borrowers on January 25, 2014, demanding repayment.

- The appellant, claiming to be a tenant since June 12, 2012, filed an application before the Magistrate to prevent the bank from taking possession.

- The Magistrate rejected the application, stating that there was no proof of a registered tenancy.

Petitioner’s Arguments

The appellant, Hemraj Ratnakar Salian, argued that:

- He was a protected tenant under the Maharashtra Rent Control Act, 1999.

- He had been paying rent regularly and had advance rent receipts up to December 17, 2018.

- His tenancy was based on an oral agreement and had continued since June 12, 2012.

- Under tenancy laws, he could not be evicted without due legal process.

Respondent’s Arguments

HDFC Bank countered these claims by stating that:

- The rent receipt presented by the appellant was dated May 12, 2013, after the creation of the mortgage.

- There was no valid registered tenancy agreement.

- At the time of the loan, the property was occupied by the borrowers, and no third-party tenancy was disclosed.

- The tenancy claim was an afterthought to resist possession proceedings.

Key Legal Considerations

The Supreme Court analyzed the following legal provisions:

1. Tenancy Protection under the Transfer of Property Act

Under Section 107 of the Transfer of Property Act, 1882, a lease exceeding one year must be made through a registered instrument. Since the appellant’s lease was neither registered nor written, it could not be legally enforced beyond a year.

Read also: https://judgmentlibrary.com/corporate-debt-and-insolvency-understanding-the-landmark-judgment/

2. Section 13 of the SARFAESI Act

Section 13(2) empowers secured creditors to take possession of the mortgaged asset if the borrower defaults. Under Section 13(13), any lease or sale by the borrower after the notice date is invalid unless the secured creditor consents.

3. Precedents on Tenant Rights

The Court relied on past judgments, including:

- Harshad Govardhan Sondagar vs. International Asset Reconstruction Co. Ltd. (2014): Held that unregistered tenancies exceeding a year are not valid against secured creditors.

- Bajarang Shyamsunder Agarwal vs. Central Bank of India (2019): Established that a lease predating the mortgage is protected only if registered.

Court’s Observations

The Supreme Court noted that:

“The tenancy claimed by the appellant is an oral tenancy, unsupported by any registered document. The rent receipts do not establish that the tenancy predated the mortgage.”

The Court further held:

“The Borrowers, at the time of securing the loan, never disclosed that any tenant was occupying the Secured Asset. There is no evidence proving that tenancy was created before the mortgage.”

Final Verdict

The Supreme Court dismissed the appeal and ruled that:

- The appellant was not a legally protected tenant under tenancy laws.

- HDFC Bank had the right to take possession under the SARFAESI Act.

- Unregistered tenancy claims cannot override secured creditors’ rights.

- The tenant had no valid claim for continued possession.

Thus, the Court upheld HDFC Bank’s right to recover the mortgaged property.

Implications of the Judgment

This ruling has significant implications for both tenants and financial institutions:

- Importance of Registered Leases: Tenants must ensure that leases exceeding one year are registered to claim legal protection.

- Strengthened Secured Creditors’ Rights: Banks can take possession of mortgaged assets without being blocked by unregistered tenancies.

- Clarity in Mortgage Laws: Borrowers must disclose existing tenancies to lenders to avoid legal conflicts.

- Protection Against Fraudulent Tenancy Claims: The judgment discourages borrowers from creating fake tenancies to delay loan recovery.

Overall, this decision reinforces the need for compliance with property and tenancy laws while protecting the rights of secured creditors.

Petitioner Name: Hemraj Ratnakar Salian.Respondent Name: HDFC Bank Ltd. & Ors..Judgment By: Justice S. Abdul Nazeer, Justice Krishna Murari.Place Of Incident: Mumbai, India.Judgment Date: 17-08-2021.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: hemraj-ratnakar-sali-vs-hdfc-bank-ltd.-&-ors-supreme-court-of-india-judgment-dated-17-08-2021.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Bankruptcy and Insolvency

See all petitions in Corporate Compliance

See all petitions in Company Law

See all petitions in unfair trade practices

See all petitions in Property Disputes

See all petitions in Judgment by S. Abdul Nazeer

See all petitions in Judgment by Krishna Murari

See all petitions in dismissed

See all petitions in supreme court of India judgments August 2021

See all petitions in 2021 judgments

See all posts in Corporate and Commercial Cases Category

See all allowed petitions in Corporate and Commercial Cases Category

See all Dismissed petitions in Corporate and Commercial Cases Category

See all partially allowed petitions in Corporate and Commercial Cases Category