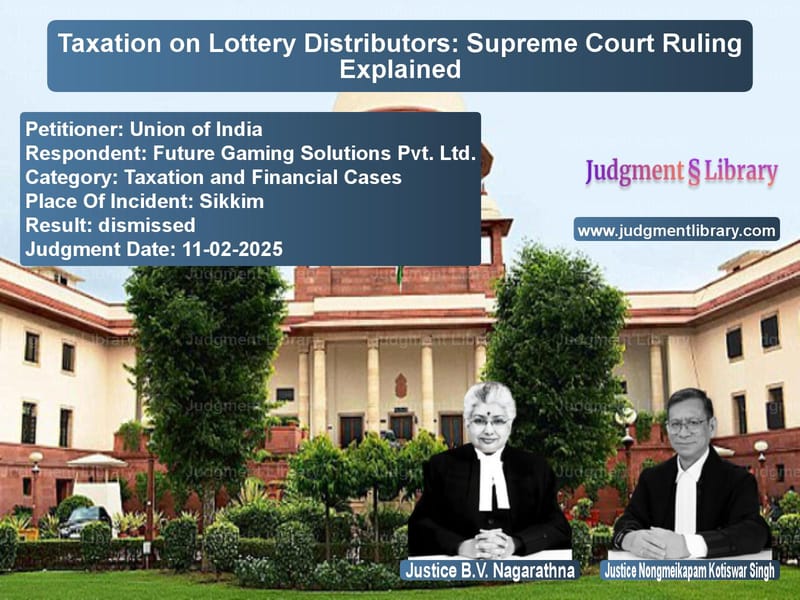

Taxation on Lottery Distributors: Supreme Court Ruling Explained

The Supreme Court recently delivered a landmark judgment in the case of Union of India & Others vs. Future Gaming Solutions Pvt. Ltd., addressing the validity of service tax levied on lottery distributors under the Finance Act, 1994. This case revolved around whether lottery distributors acted as agents of the State Government or independent entities engaged in a principal-to-principal business relationship.

The matter had a long history involving multiple amendments to the Finance Act, starting from 2010, which sought to impose service tax on activities related to lottery distribution. The core issue before the Court was whether the relationship between the lottery distributors and the State of Sikkim was one of agency or an independent purchase-and-sale transaction.

Background of the Case

The dispute arose when the Union of India attempted to impose service tax on the sale of lottery tickets by private distributors, arguing that their role was akin to an agent providing a service to the State Government. The High Court of Sikkim had ruled against the levy of service tax, holding that lottery distributors were purchasing tickets from the State and reselling them independently, making the transactions principal-to-principal in nature.

Read also: https://judgmentlibrary.com/supreme-court-overrules-excise-duty-demand-against-bharat-petroleum/

Key Amendments to the Finance Act

- 2010 Amendment: Introduced a new taxable service category for organizing or promoting lottery sales.

- 2012 Amendment: Introduced the Negative List, exempting betting, gambling, and lotteries from service tax.

- 2015 Amendment: Redefined lottery distributors as entities liable for service tax.

- 2016 Amendment: Clarified that activities related to lotteries conducted on behalf of the State Government were not considered part of the Negative List.

Arguments by the Union of India

The government contended that lottery distributors were merely agents acting on behalf of the State and facilitating the sale of lottery tickets. The Revenue argued that the nature of the agreements between the State of Sikkim and the lottery distributors indicated an agency relationship.

Key arguments included:

- The State retained control over lottery schemes, dictating the terms and conditions of sales.

- The agreements used terms like “distributor” and “agent,” implying a fiduciary relationship.

- The revenue structure indicated that the State benefitted from sales proceeds, showing control over the business.

Arguments by Lottery Distributors

On the other hand, the respondents argued that their role was independent of the State Government, operating as outright purchasers of lottery tickets who took financial risks.

Key arguments included:

- They paid a fixed sum to the State Government upfront, securing the right to sell tickets.

- They were free to appoint sub-distributors and set pricing strategies.

- There was no indemnification or reimbursement from the State in case of losses.

Supreme Court’s Decision

The Supreme Court ruled in favor of the lottery distributors, upholding the Sikkim High Court’s decision that they were engaged in a principal-to-principal transaction and not as agents of the State Government.

Key findings of the Court:

- The agreements showed that lottery distributors bore the financial risk of sales, indicating a buyer-seller relationship.

- The terminology used in agreements, such as “agent,” was not determinative of the actual relationship.

- Since distributors had full control over resale pricing and appointments of sub-agents, they were not acting on behalf of the State.

- The amendments made to the Finance Act were ineffective in altering the fundamental nature of the transactions.

Conclusion

The Supreme Court’s judgment is a significant ruling that clarifies the taxation status of lottery distributors. By holding that these entities operate on a principal-to-principal basis, the Court has exempted them from service tax liability under the Finance Act, 1994. This ruling reinforces the principle that merely labeling an entity as an “agent” does not automatically create an agency relationship.

For lottery distributors and State Governments, this judgment provides clarity on tax liabilities and contractual obligations, ensuring that business operations can proceed without ambiguity regarding service tax applicability.

Petitioner Name: Union of India.Respondent Name: Future Gaming Solutions Pvt. Ltd..Judgment By: Justice B.V. Nagarathna, Justice Nongmeikapam Kotiswar Singh.Place Of Incident: Sikkim.Judgment Date: 11-02-2025.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: union-of-india-vs-future-gaming-soluti-supreme-court-of-india-judgment-dated-11-02-2025.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Tax Evasion Cases

See all petitions in Banking Regulations

See all petitions in Income Tax Disputes

See all petitions in GST Law

See all petitions in Tax Refund Disputes

See all petitions in Judgment by B.V. Nagarathna

See all petitions in Judgment by N. Kotiswar Singh

See all petitions in dismissed

See all petitions in supreme court of India judgments February 2025

See all petitions in 2025 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category