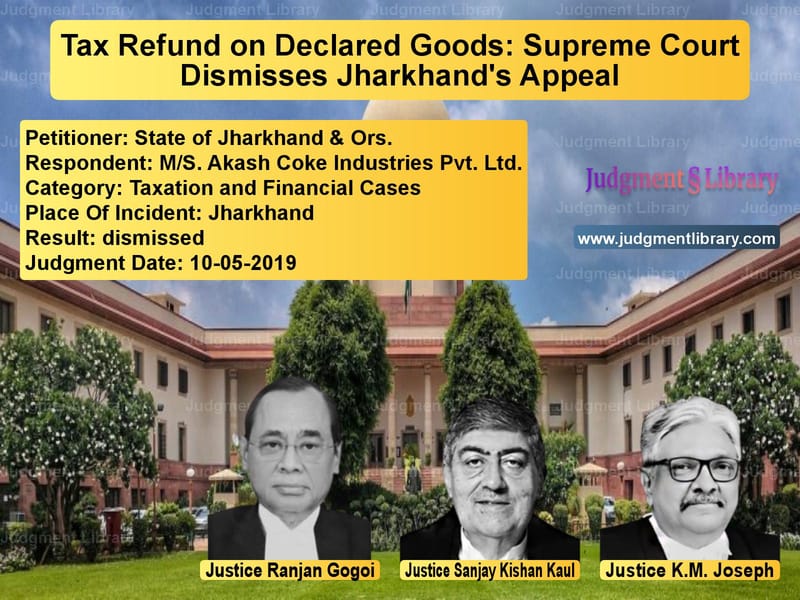

Tax Refund on Declared Goods: Supreme Court Dismisses Jharkhand’s Appeal

The Supreme Court of India, in the case of State of Jharkhand & Ors. vs. M/S. Akash Coke Industries Pvt. Ltd., delivered a significant ruling on the refund of sales tax paid on declared goods under the Central Sales Tax Act, 1956. The Court upheld the High Court’s order directing the State to reimburse sales tax paid on intra-state purchases of coal that was later processed into coke and sold through inter-state trade.

This ruling reinforces the principle of tax reimbursement under Section 15(b) of the CST Act when declared goods are subject to both intra-state and inter-state sales taxation.

Background of the Case

The respondent, M/S. Akash Coke Industries Pvt. Ltd., is engaged in the purchase of coal within the State of Jharkhand, converting it into coke, and selling the final product through inter-state trade. The key taxation details of the case include:

- Coal Purchase: The respondent paid a State Sales Tax of ₹17,89,412 on intra-state purchases of coal.

- Coke Sale: The processed coke was sold in inter-state transactions, attracting a Central Sales Tax (CST) of ₹63,80,573.

- Refund Claim: The respondent applied for a refund of the sales tax paid on coal under Section 15(b) of the CST Act, which allows reimbursement when declared goods are taxed in inter-state trade.

The refund application was denied by the State, leading to a legal dispute. The High Court ruled in favor of the respondent, directing the State to reimburse the tax with statutory interest.

Legal Issues Considered

The Supreme Court examined the following legal questions:

- Whether coal and coke can be considered the same commodity under Section 15(b) of the CST Act.

- Whether the respondent is entitled to a tax refund when the final product (coke) is different from the input material (coal).

- Whether the High Court erred in granting relief to the respondent.

Arguments by the Appellant (State of Jharkhand)

The State contended:

- The goods sold in inter-state trade were coke, whereas the tax was paid on the purchase of coal.

- Since coal and coke are different products, the refund provision under Section 15(b) of the CST Act does not apply.

- The High Court misinterpreted the law by treating coal and coke as the same goods.

Arguments by the Respondent (M/S. Akash Coke Industries Pvt. Ltd.)

The respondent argued:

- Coal and coke are both declared goods under Section 14 of the CST Act, and thus, they should be treated similarly for tax refund purposes.

- The refund claim was legally justified as the raw material was taxed under state sales tax, and the final product was taxed under CST.

- The State had already determined the refund amount but arbitrarily refused to issue the payment.

Supreme Court’s Key Observations

The Supreme Court reviewed the relevant provisions and made the following observations:

1. Applicability of Section 15(b) of the CST Act

- The Court confirmed that coal and coke are declared goods under Section 14 of the CST Act.

- It ruled that Section 15(b) applies when declared goods are subject to tax at both the state and inter-state levels.

2. Refund Eligibility Under Taxation Laws

- The Supreme Court observed that the CST Act mandates reimbursement to prevent double taxation on declared goods.

- It rejected the State’s contention that coke and coal should be treated as different commodities for refund purposes.

3. Dismissal of the State’s Appeal

- The Court found that the State failed to challenge the refund calculations at the appropriate stages of litigation.

- It ruled that the High Court’s order was justified, as the refund denial was arbitrary and against statutory provisions.

Final Judgment

The Supreme Court ruled:

- The respondent was entitled to a refund under Section 15(b) of the CST Act.

- The appeal filed by the State of Jharkhand was dismissed.

- The refund amount must be reimbursed to the respondent with statutory interest.

Implications of the Judgment

This ruling has major implications for taxation laws and commercial transactions:

1. Strengthening Taxpayer Rights

- The judgment reaffirms the right of businesses to claim tax refunds under the CST Act.

- It prevents arbitrary denials of refunds by state authorities.

2. Clarity on Tax Treatment of Declared Goods

- The decision clarifies that declared goods are subject to uniform tax treatment.

- It establishes that refunds cannot be denied simply because the goods undergo processing.

3. Limiting Unjustified Taxation

- The ruling ensures that states cannot impose multiple layers of taxation on the same goods.

- Businesses engaged in the sale of declared goods can now rely on this judgment to secure rightful refunds.

Conclusion

The Supreme Court’s ruling in State of Jharkhand & Ors. vs. M/S. Akash Coke Industries Pvt. Ltd. reinforces taxpayer rights by upholding statutory refund provisions under the CST Act. This landmark decision ensures that businesses dealing in declared goods do not face unjustified taxation and establishes a clear precedent for future tax disputes involving intra-state and inter-state sales.

Petitioner Name: State of Jharkhand & Ors..Respondent Name: M/S. Akash Coke Industries Pvt. Ltd..Judgment By: Justice Ranjan Gogoi, Justice Sanjay Kishan Kaul, Justice K.M. Joseph.Place Of Incident: Jharkhand.Judgment Date: 10-05-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: State of Jharkhand & vs MS. Akash Coke Indu Supreme Court of India Judgment Dated 10-05-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Tax Refund Disputes

See all petitions in Banking Regulations

See all petitions in Customs and Excise

See all petitions in Judgment by Ranjan Gogoi

See all petitions in Judgment by Sanjay Kishan Kaul

See all petitions in Judgment by K.M. Joseph

See all petitions in dismissed

See all petitions in supreme court of India judgments May 2019

See all petitions in 2019 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category