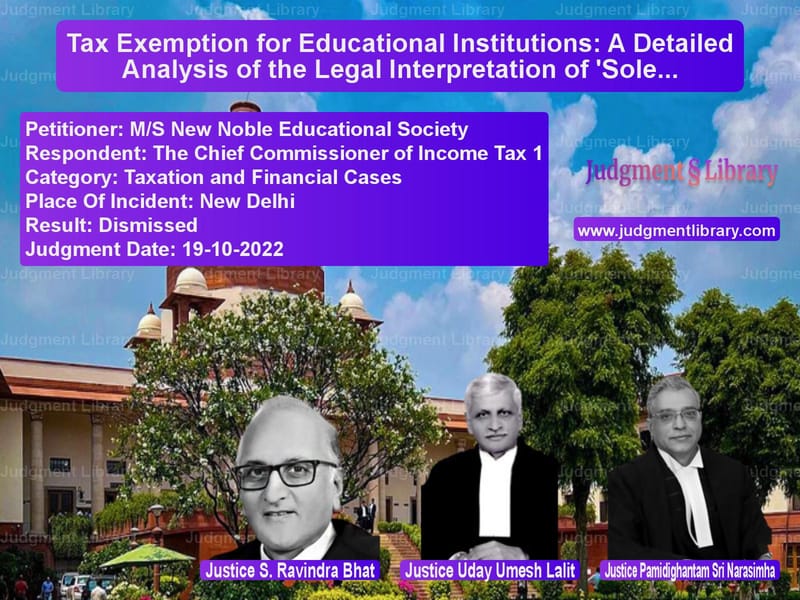

Tax Exemption for Educational Institutions: A Detailed Analysis of the Legal Interpretation of ‘Solely’ and Profit Motive

This case addresses the issue of income tax exemption under Section 10(23C)(vi) of the Income Tax Act, 1961, for educational institutions. Specifically, it focuses on the interpretation of the term ‘solely’ and whether institutions, which engage in activities beyond education, can still qualify for exemption from taxation. The appellants, various educational societies, argued that their primary objective was education and that the generation of surplus income was incidental. However, the respondents, the income tax authorities, contended that the presence of other non-educational objects in the institutions’ constitutions barred them from claiming such exemptions.

Background:

The appellants are educational societies running institutions that claimed income tax exemption under Section 10(23C)(vi) of the Income Tax Act. This section allows for exemptions for educational institutions that exist solely for educational purposes and not for profit. The issue at hand was whether the institutions, despite having some non-educational objects, could still be classified as ‘solely for educational purposes’ and therefore eligible for the tax exemption. The Andhra Pradesh High Court had previously rejected the appellants’ claim, leading to these appeals before the Supreme Court.

Appellant’s Arguments:

Ms. Prabha Swami, representing the appellants, argued that the term ‘solely’ in Section 10(23C)(vi) should not be interpreted literally. She emphasized that the institutions in question were primarily focused on education, with any additional activities being incidental and not profit-driven. Counsel referred to previous Supreme Court rulings, such as the American Hotel and Lodging Association case, to support the argument that incidental profits should not disqualify an institution from claiming exemption if its primary purpose is education. She also cited the case of Queen’s Education Society, where the Court had acknowledged that surplus generated from educational activities did not necessarily imply a profit motive.

Respondent’s Arguments:

The learned Additional Solicitor General, Mr. N. Venkataraman, for the revenue, countered that the term ‘solely’ had a clear, literal meaning and that any non-educational activities within the institutions’ objects would render them ineligible for tax exemption. He argued that the statutory language of Section 10(23C)(vi) was plain and unequivocal, and that institutions which engaged in profit-oriented activities, even incidentally, could not claim the exemption. He also pointed out that the requirement of registration under the Andhra Pradesh Charities Act was a mandatory precondition for tax exemption, as the Act provided a regulatory framework for charitable institutions.

Court’s Analysis:

The Court examined the meaning of the word ‘solely’ in the context of Section 10(23C)(vi) and previous case law. The Court noted that the term ‘solely’ refers to the primary or dominant purpose of the institution, which must be education, and not to the literal exclusion of all other objects. The Court emphasized that educational institutions are not prohibited from having incidental activities, such as running a printing press or providing hostel facilities, so long as these activities are directly related to and supportive of the institution’s primary educational purpose. The Court also clarified that the generation of surplus income from educational activities does not disqualify an institution from claiming tax exemption.

The Court further considered whether registration under state laws, such as the Andhra Pradesh Charities Act, was a prerequisite for tax exemption under the Income Tax Act. The Court agreed with the respondent’s contention that such registration was necessary for compliance with local laws, but it also acknowledged that the exemption claim under Section 10(23C) could not be denied solely due to non-registration under state laws. The Court emphasized that the primary focus should be on whether the institution was genuinely engaged in educational activities and not on ancillary matters like registration under state laws.

Judgment:

In its judgment, the Court ruled that the appellants were entitled to exemption under Section 10(23C)(vi) of the Income Tax Act, provided their primary objective was the imparting of education and not profit-making. The Court overruled previous judgments that had applied the ‘predominant object’ test, instead affirming that the correct test is whether the institution exists solely for educational purposes. The Court also clarified that incidental activities, such as running a printing press or providing hostel facilities, do not disqualify an institution from claiming the exemption, as long as they are related to the educational activities. The Court also held that while registration under state laws is necessary, it does not automatically disqualify institutions from tax exemptions if the institution genuinely operates for educational purposes.

Conclusion:

This case highlights the importance of interpreting tax exemptions for educational institutions in the context of their primary purpose—education. It reinforces that incidental activities related to education do not preclude institutions from qualifying for tax exemptions, even if they generate surplus income. The judgment also clarifies that the term ‘solely’ in tax law should be understood in terms of an institution’s primary purpose, rather than a literal interpretation. This decision provides important guidance for educational institutions seeking tax exemptions and for the authorities tasked with regulating them.

Petitioner Name: M/S New Noble Educational Society.Respondent Name: The Chief Commissioner of Income Tax 1.Judgment By: Justice S. Ravindra Bhat, Justice Uday Umesh Lalit, Justice Pamidighantam Sri Narasimha.Place Of Incident: New Delhi.Judgment Date: 19-10-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: ms-new-noble-educat-vs-the-chief-commission-supreme-court-of-india-judgment-dated-19-10-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Evasion Cases

See all petitions in Banking Regulations

See all petitions in Judgment by S Ravindra Bhat

See all petitions in Judgment by Uday Umesh Lalit

See all petitions in Judgment by P.S. Narasimha

See all petitions in dismissed

See all petitions in supreme court of India judgments October 2022

See all petitions in 2022 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category