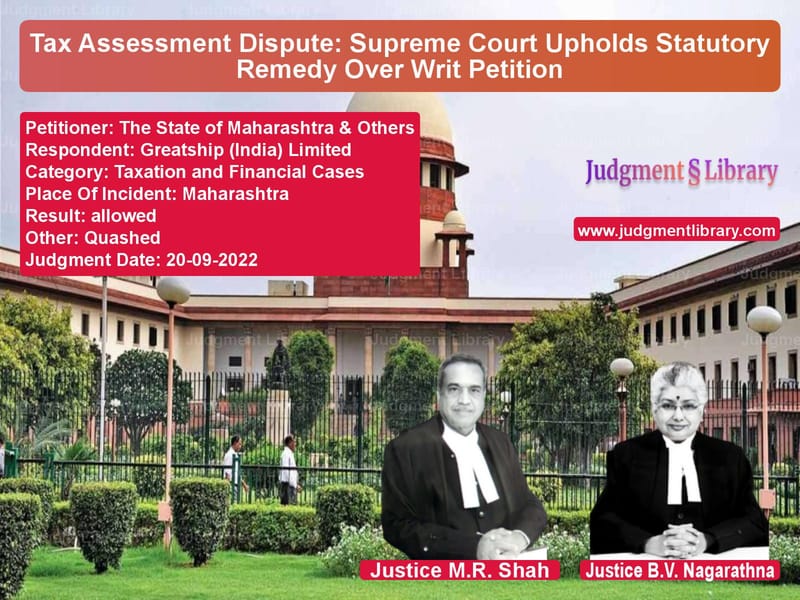

Tax Assessment Dispute: Supreme Court Upholds Statutory Remedy Over Writ Petition

Tax disputes between businesses and revenue authorities are common, often leading to prolonged legal battles. In the case of The State of Maharashtra & Others v. Greatship (India) Limited, the Supreme Court of India dealt with a fundamental question: Can a taxpayer bypass the statutory remedy of appeal and approach the High Court directly under Article 226 of the Constitution? The Court reaffirmed that statutory remedies must be exhausted before invoking the writ jurisdiction.

Background of the Case

The dispute arose when Greatship (India) Limited, the respondent, was subjected to proceedings under the Maharashtra Value Added Tax Act, 2002 (MVAT Act) and the Central Sales Tax Act, 1956 (CST Act). The Assessing Officer issued a notice of assessment on February 1, 2018, requiring the company to produce documents and justify its tax liability under Section 23 of the MVAT Act.

Contentions of the Respondent (Greatship India Limited)

The respondent argued that:

- It had submitted all required documents and responded to the show cause notice on May 3, 2018.

- A personal hearing was scheduled for March 16, 2020, but was canceled as the Assessing Officer was unavailable.

- Multiple attempts were made via telephone on March 17, 18, and 19, 2020, but the hearing did not materialize.

- On March 20, 2020, the respondent submitted another letter requesting a hearing and reiterating that all documents had been provided.

- The assessment order determining tax liability, interest, and penalty was allegedly passed on March 20, 2020, but, according to the respondent, was only issued in July 2020—beyond the limitation period.

Legal Action by the Respondent

Instead of filing an appeal before the first appellate authority, the respondent directly approached the Bombay High Court under Article 226 of the Constitution, contending that:

- The assessment order was time-barred as it was issued beyond the limitation period.

- No proper hearing was granted before the order was passed.

- The demand notice issued based on the assessment order was illegal.

High Court’s Judgment

The Bombay High Court entertained the writ petition and ruled in favor of Greatship (India) Limited. It quashed the assessment order and the demand notice, holding that the assessment was completed beyond the prescribed time frame.

Read also: https://judgmentlibrary.com/supreme-court-rules-on-tax-recovery-radico-khaitan-cleared-of-liability/

Appeal Before the Supreme Court

The State of Maharashtra and tax authorities challenged the Bombay High Court’s decision before the Supreme Court, arguing that:

- The High Court erred in entertaining the writ petition instead of directing the respondent to avail of statutory remedies.

- The MVAT Act and CST Act provide a clear appeal mechanism that must be exhausted before approaching the High Court.

- There were factual disputes regarding whether the assessment order was passed within the limitation period.

Supreme Court’s Observations

The Supreme Court, comprising Justices M.R. Shah and B.V. Nagarathna, examined the case and made the following key observations:

1. High Court Should Not Have Entertained the Writ Petition

The Supreme Court held that the High Court should not have entertained the writ petition when an alternate statutory remedy was available. The judgment stated:

“The High Court has seriously erred in entertaining the writ petition under Article 226 of the Constitution of India against the assessment order, bypassing the statutory remedies.”

2. Availability of an Appeal Mechanism

The Court emphasized that the MVAT Act and CST Act provide an appeal mechanism to challenge tax assessments. It cited previous rulings that consistently discouraged bypassing statutory remedies:

“When there is an alternate remedy available, judicial prudence demands that the Court refrains from exercising its jurisdiction under constitutional provisions.”

3. Precedents Supporting Statutory Remedies

The Court referred to various precedents where it had discouraged direct writ petitions in tax matters:

- Titaghur Paper Mills Co. Ltd. v. State of Orissa (1983) – The Court held that taxpayers must follow statutory procedures instead of directly approaching the High Court.

- Punjab National Bank v. O.C. Krishnan (2001) – The ruling emphasized that specialized tribunals and appellate bodies should be the first recourse in tax disputes.

- United Bank of India v. Satyawati Tondon (2010) – The Court reiterated that alternative statutory remedies should be exhausted before invoking writ jurisdiction.

Final Judgment

The Supreme Court allowed the appeal, set aside the Bombay High Court’s judgment, and dismissed the writ petition. The respondent was directed to file an appeal before the first appellate authority within four weeks.

The Court further directed:

“If such a remedy is availed within a period of four weeks, the appellate authority shall decide and dispose of the same on its own merits in accordance with law without raising any question of limitation.”

Key Takeaways from the Judgment

This ruling reinforces several fundamental principles in tax law:

1. Statutory Remedies Must Be Exhausted

Taxpayers cannot bypass the appeal process and directly approach the High Court unless there are exceptional circumstances, such as a violation of fundamental rights or a lack of an effective remedy.

2. Disputed Facts Should Be Resolved by Lower Authorities

The Court highlighted that factual disputes, such as whether the assessment order was issued within the limitation period, should be adjudicated by the relevant tax authorities rather than by the High Court.

Read also: https://judgmentlibrary.com/supreme-court-rules-on-priority-of-government-dues-in-insolvency-cases/

3. Judicial Prudence in Entertaining Writ Petitions

The ruling serves as a caution to High Courts against entertaining tax-related writ petitions when statutory remedies are available. The Court reaffirmed its position that direct intervention should be rare and reserved for extraordinary cases.

Conclusion

The Supreme Court’s decision in The State of Maharashtra & Others v. Greatship (India) Limited reaffirms the doctrine of exhaustion of statutory remedies. It emphasizes that tax disputes should follow the legally prescribed appeal mechanisms before being escalated to constitutional courts. This ruling provides clarity to taxpayers and revenue authorities alike, ensuring that procedural discipline is maintained in tax litigation.

Petitioner Name: The State of Maharashtra & Others.Respondent Name: Greatship (India) Limited.Judgment By: Justice M.R. Shah, Justice B.V. Nagarathna.Place Of Incident: Maharashtra.Judgment Date: 20-09-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: the-state-of-maharas-vs-greatship-(india)-li-supreme-court-of-india-judgment-dated-20-09-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Refund Disputes

See all petitions in Judgment by Mukeshkumar Rasikbhai Shah

See all petitions in Judgment by B.V. Nagarathna

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments September 2022

See all petitions in 2022 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category