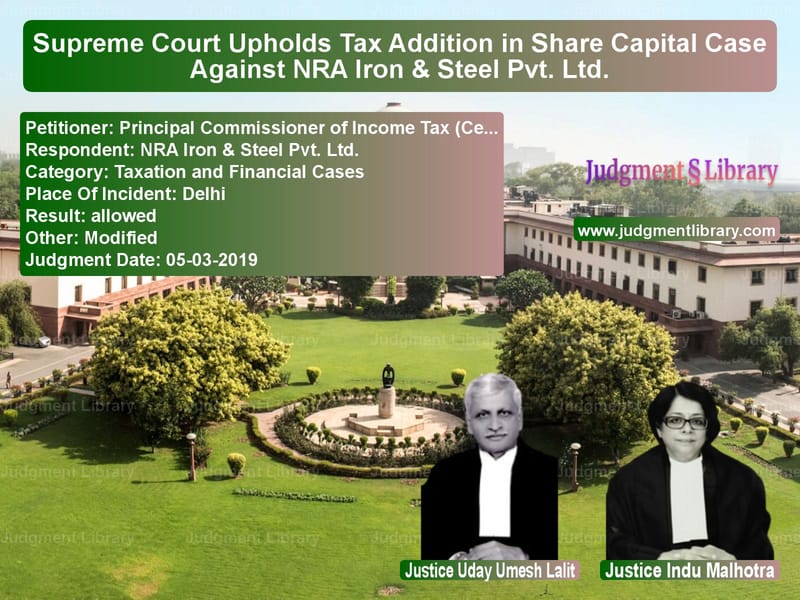

Supreme Court Upholds Tax Addition in Share Capital Case Against NRA Iron & Steel Pvt. Ltd.

The Supreme Court of India, in the case of Principal Commissioner of Income Tax (Central) – 1 vs. NRA Iron & Steel Pvt. Ltd., ruled in favor of the Income Tax Department by upholding the addition of Rs. 17.6 crores to the assessee’s income under Section 68 of the Income Tax Act. This case underscores the importance of proving the identity, creditworthiness, and genuineness of transactions when raising capital through share premium.

Background of the Case

The case pertains to the assessment year 2009-10, where NRA Iron & Steel Pvt. Ltd., the respondent-assessee, received Rs. 17.6 crores as share capital and premium from various investor companies based in Mumbai, Kolkata, and Guwahati. The company filed its income tax return on September 29, 2009, declaring an income of Rs. 7,01,870.

During the assessment proceedings, the Assessing Officer (AO) noted that the shares of the respondent company had a face value of Rs. 10 per share but were subscribed at a premium of Rs. 190 per share. This led to further scrutiny regarding the legitimacy of these transactions.

The AO issued a notice under Section 148 of the Income Tax Act, reopening the assessment on April 13, 2012, and later served a detailed questionnaire to the assessee seeking information about the source of funds.

Findings of the Assessing Officer

The AO conducted an independent inquiry to verify the identity and creditworthiness of the investor companies, as well as the genuineness of the transactions. The key findings were:

- Several investor companies were found to be non-existent at the addresses provided.

- Despite summons being issued, none of the investor companies appeared before the AO.

- The financial statements of these companies showed negligible or nil income, raising doubts about their ability to invest large sums of money.

- None of the companies provided bank statements to prove the source of funds for making such significant investments.

Based on these findings, the AO added Rs. 17.6 crores to the total taxable income of the assessee, citing failure to prove the genuineness of the share capital received.

Appeal Before the Commissioner of Income Tax (Appeals)

The assessee challenged the AO’s order before the Commissioner of Income Tax (Appeals) [CIT(A)], arguing that:

- All transactions were conducted through proper banking channels.

- They had submitted income tax returns and PAN details of the investor companies.

- Once identity was established, the burden shifted to the Income Tax Department to prove that the investments were not genuine.

The CIT(A) ruled in favor of the assessee and deleted the addition.

Income Tax Appellate Tribunal (ITAT) Decision

The Revenue appealed against the CIT(A)’s decision before the Income Tax Appellate Tribunal (ITAT), which also ruled in favor of the assessee. The ITAT held that since the assessee had provided PAN details and financial records of the investor companies, the burden of proving otherwise lay on the Revenue.

Delhi High Court’s Ruling

The Revenue further challenged the ITAT order before the Delhi High Court, which dismissed the appeal on the grounds that no substantial question of law arose. The High Court held that the ITAT and CIT(A) had correctly considered all facts and had given a reasoned decision.

Supreme Court’s Observations

The Supreme Court examined the case and laid down key principles regarding the applicability of Section 68 of the Income Tax Act:

- The assessee must prove three crucial elements to satisfy Section 68:

- Identity of the creditors/investors

- Creditworthiness of the creditors/investors

- Genuineness of the transaction

- Mere submission of PAN details and bank statements does not automatically establish creditworthiness.

- Failure of investors to appear before the AO or provide sufficient financial records raises suspicions.

- If an assessee receives a large premium on shares, they must provide a valid justification for such a valuation.

The Court emphasized:

“Merely proving the identity of the creditors does not discharge the onus of the assessee. The capacity of the creditors and genuineness of the transaction must also be demonstrated.”

Final Judgment

The Supreme Court ruled in favor of the Revenue, stating that the assessee had failed to discharge its burden of proof. The key directions were:

- The High Court, ITAT, and CIT(A) orders were set aside.

- The AO’s addition of Rs. 17.6 crores to the income of the assessee was reinstated.

- The ruling reinforced that unexplained cash credits, even in the form of share capital, can be taxed as income if the assessee fails to provide credible evidence.

Conclusion

This judgment reinforces the principle that mere documentation is insufficient to prove the legitimacy of share capital transactions. Companies must establish the authenticity of their investors and transactions to avoid tax scrutiny. The ruling serves as a warning to companies engaging in money laundering through bogus share capital and premium transactions.

Petitioner Name: Principal Commissioner of Income Tax (Central) – 1.Respondent Name: NRA Iron & Steel Pvt. Ltd..Judgment By: Justice Uday Umesh Lalit, Justice Indu Malhotra.Place Of Incident: Delhi.Judgment Date: 05-03-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Principal Commission vs NRA Iron & Steel Pvt Supreme Court of India Judgment Dated 05-03-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Evasion Cases

See all petitions in Banking Regulations

See all petitions in Judgment by Uday Umesh Lalit

See all petitions in Judgment by Indu Malhotra

See all petitions in allowed

See all petitions in Modified

See all petitions in supreme court of India judgments March 2019

See all petitions in 2019 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category