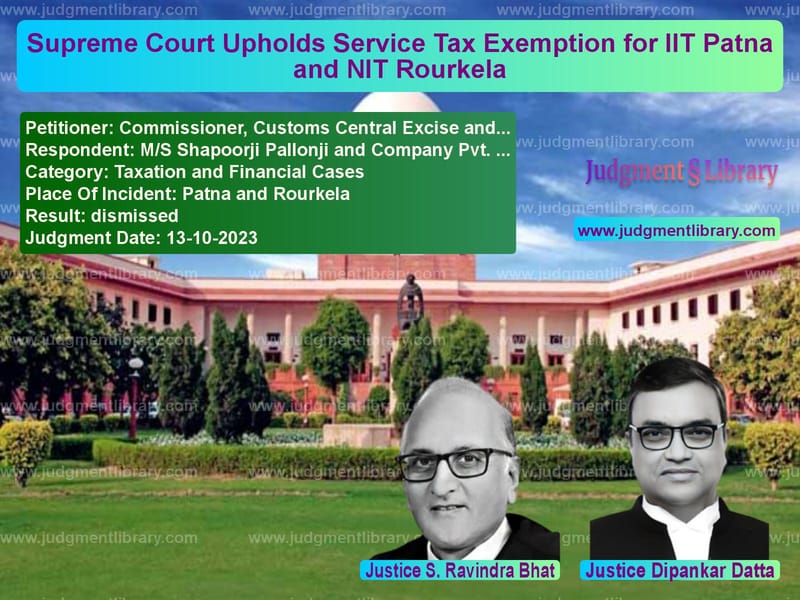

Supreme Court Upholds Service Tax Exemption for IIT Patna and NIT Rourkela

The Supreme Court of India has ruled in favor of M/S Shapoorji Pallonji and Company Pvt. Ltd. in a landmark case regarding service tax exemption for educational institutions. The case revolved around whether the Indian Institute of Technology, Patna (IIT Patna), and the National Institute of Technology, Rourkela (NIT Rourkela), qualify as ‘governmental authorities’ under the Mega Service Tax Exemption Notification, thereby making them eligible for exemption from service tax.

Background of the Case

The dispute emerged when IIT Patna and NIT Rourkela awarded contracts for construction works to Shapoorji Pallonji & Company Pvt. Ltd. (SPCL). The contracts were executed under agreements that included service tax payments. However, SPCL later sought exemption from service tax under the Mega Service Tax Exemption Notification No. 25/2012, which exempts services provided to ‘governmental authorities’ for educational purposes.

SPCL filed writ petitions before the Patna High Court and the Orissa High Court, arguing that since IIT Patna and NIT Rourkela were established by Acts of Parliament, they should be considered governmental authorities. The High Courts ruled in favor of SPCL, directing refunds of service tax paid. The Commissioner of Customs, Central Excise, and Service Tax, along with the Union of India, appealed the decision to the Supreme Court.

Legal Issues

- Whether IIT Patna and NIT Rourkela qualify as ‘governmental authorities’ under the Mega Service Tax Exemption Notification.

- Whether the High Courts correctly interpreted the statutory provisions regarding service tax exemption.

- The applicability of the 90% government equity or control requirement for determining ‘governmental authority’ status.

Arguments by the Appellants (Union of India & Commissioner of Customs)

The appellants contended:

- The exemption notification requires an entity to be set up by an Act of Parliament and have 90% or more government participation.

- The High Court erred in reading the provisions of the notification in a disjunctive manner, thereby allowing a broader interpretation.

- If the ruling is upheld, it could lead to several public institutions claiming tax exemptions, resulting in revenue losses.

- The service tax was paid under self-assessment, and a refund should not be granted without an appeal against the assessment order.

Arguments by the Respondents (SPCL & IIT Patna/NIT Rourkela)

The respondents countered:

- IIT Patna and NIT Rourkela were established by Parliamentary enactments, making them ‘governmental authorities’.

- The 90% equity participation condition applies only to non-statutory bodies and should not apply to institutions set up by Parliament.

- The institutions fall within the exemption category under the notification and thus should not be liable for service tax.

- Clause 29(h) of the Exemption Notification also supports exemption for subcontractors providing services to contractors exempted under the notification.

Supreme Court’s Observations

On Interpretation of ‘Governmental Authority’

The Supreme Court analyzed the legal definition of ‘governmental authority’ and held:

“The phrase ‘set up by an Act of Parliament’ stands independently of the 90% government control requirement. Institutions created through legislation are inherently governmental authorities.”

On Revenue Implications

The Court dismissed concerns about revenue loss, emphasizing:

“A restrictive interpretation of tax exemptions must not override the express language of a notification. Exemptions are granted for specific public welfare reasons.”

On Refund of Service Tax

The Court ruled that since the institutions were entitled to exemption, SPCL should not have paid service tax in the first place. It upheld the High Courts’ decision directing refunds.

Final Judgment

The Supreme Court upheld the High Courts’ rulings, affirming that:

- IIT Patna and NIT Rourkela are ‘governmental authorities’ under the Mega Service Tax Exemption Notification.

- Service tax paid by SPCL should be refunded.

- The exemption notification must be interpreted in favor of entities clearly covered under its provisions.

Impact of the Judgment

This ruling sets a significant precedent for tax exemptions granted to educational institutions and other statutory bodies. It reinforces that:

- Institutions established by Parliament are entitled to tax benefits.

- Contractors providing services to such institutions should not bear the burden of service tax.

- Government notifications must be interpreted in a manner consistent with their intended purpose.

Conclusion

The Supreme Court’s ruling ensures a fair application of tax exemptions for educational institutions. By upholding the exemption status of IIT Patna and NIT Rourkela, the judgment provides clarity on the legal framework governing service tax exemptions, benefiting institutions and contractors alike.

Petitioner Name: Commissioner, Customs Central Excise and Service Tax, Patna.Respondent Name: M/S Shapoorji Pallonji and Company Pvt. Ltd. & Others.Judgment By: Justice S. Ravindra Bhat, Justice Dipankar Datta.Place Of Incident: Patna and Rourkela.Judgment Date: 13-10-2023.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: commissioner,-custom-vs-ms-shapoorji-pallon-supreme-court-of-india-judgment-dated-13-10-2023.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Tax Refund Disputes

See all petitions in Corporate Compliance

See all petitions in Public Interest Litigation

See all petitions in unfair trade practices

See all petitions in Legal Malpractice

See all petitions in Judgment by S Ravindra Bhat

See all petitions in Judgment by Dipankar Datta

See all petitions in dismissed

See all petitions in supreme court of India judgments October 2023

See all petitions in 2023 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category