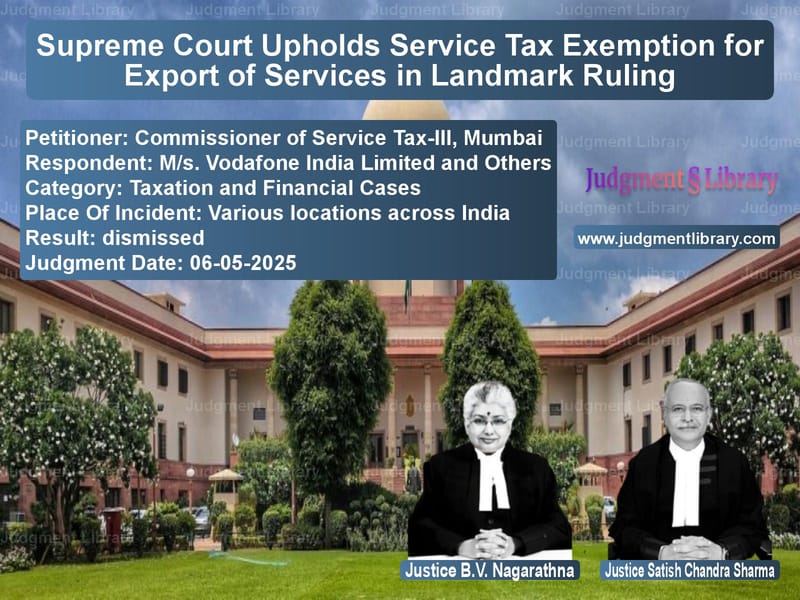

Supreme Court Upholds Service Tax Exemption for Export of Services in Landmark Ruling

In a landmark judgment that brings significant clarity to India’s service tax regime for exported services, the Supreme Court has dismissed a series of appeals filed by the Revenue Department and upheld the exemption from service tax for various services exported from India. The Court affirmed that services provided to recipients located outside India, where payment is received in convertible foreign exchange, qualify as exports and are not subject to service tax under the Export of Service Rules.

The case involved multiple appeals spanning different periods from 2003 to 2014, covering services provided by major companies including Vodafone India, Microsoft India, IBM India, Samsung India, and several others. The disputes centered around whether services such as business auxiliary services, telecommunication services, and management/maintenance services provided to overseas clients constituted exports and were therefore exempt from service tax.

The Core Legal Framework

The legal framework governing export of services evolved significantly during the period under consideration. The Export of Service Rules, 2005 categorized services into three categories. Category I related to immovable property situated outside India. Category II covered performance-based services where services were wholly or partly performed outside India. Category III, which was central to most disputes, covered remaining services and provided that such services would be treated as exported if provided to a customer located outside India, with payment received in convertible foreign exchange.

The rules underwent several amendments between 2005 and 2010. Initially, Category III services required that the service be “delivered outside India and used in business outside India” along with payment in convertible foreign exchange. However, significant changes occurred on February 27, 2010, when the requirement of “delivered outside India” or “used outside India” was omitted. From that date onward, the only requirements were that the recipient of service is located outside India and payment is received in convertible foreign exchange.

The Revenue Department’s Arguments

The Revenue Department, represented by learned Additional Solicitor General Sri Vikramjit Banerjee, mounted a substantial challenge against the exemptions claimed by the service providers. The core argument revolved around the interpretation of the expressions “delivered outside India and used outside India” and “provided from India and used outside India” in Rule 3 of the Export of Service Rules.

The Revenue Department contended that “even if the contractual customer is located outside India, if the beneficiaries of the services are located within India, then they do not fall within the scope of the exemption.” This argument was particularly relevant for services like international inbound roaming provided by telecom companies, where the ultimate users were located in India, even though the contractual relationship was with foreign telecom operators.

The Revenue Department placed heavy reliance on the Paul Merchant vs. CCE case, particularly paragraph 16 of that order, to support their interpretation. They argued that even though the expression “used outside India” was omitted on February 27, 2010, the issue of whether services were “provided within India” remained relevant for determining export status.

In response to the respondents’ arguments about the contractual nature of service tax, the Revenue Department reiterated that “the services rendered by the respondent assessee do not fall within the parameters of the proviso to sub-rule (3) of Rule 3 of the Rules and therefore, the CESTAT was not correct in granting them the benefit of the proviso.” They maintained that though the service delivered by the respondent-assessee was outside India, nevertheless, it was delivered from India and hence there could be no exemption from payment of service tax.

The Service Providers’ Defense

The respondents, represented by various learned senior counsel including Sri S.K. Bagaria, presented a comprehensive defense based on the contractual nature of service relationships and the specific language of the Export of Service Rules.

The fundamental argument advanced by the service providers was that “service tax is a contract-based levy and therefore, it is the contract which determines the relationship between a service provider and a service recipient.” They emphasized that even if certain beneficiaries may be located in India, the service provider has no contractual relationship with such beneficiaries. There is no privity of contract between the beneficiary and the service provider.

The respondents contended that “the mere fact that the beneficiary of the service is located in India would not be a determinant factor for the levy of service tax under the Rules as the service is, in fact, provided to a recipient located outside India.”

Regarding the specific legal requirements, the respondents pointed out that various preparatory activities, such as sourcing vendors, identifying customers etc. may occur in India but such activities alone would not mean that the service has not been exported to a party located overseas. They argued that “what is of significance is to whom the service is provided and where the recipient of the service is located and secondly, from whom the payment in convertible foreign exchange is received and whether, the recipient is located outside India.”

The respondents strongly supported the reasoning in the Paul Merchant case and argued that “CESTAT has rightly found that the Revenue has conflated the two categories and is subjecting category (III) services to the rigors of the performance-based services under category (II) of the Rules.”

Detailed Analysis of Specific Services

The judgment dealt with various types of services, each presenting unique characteristics in the context of export determination.

For telecommunication services, particularly international inbound roaming, the respondents argued that their contractual relationship was exclusively with foreign telecom operators, not with the individual subscribers. Vodafone India submitted that “Company is providing International Inbound Roaming Services to FTOs. In this regard, Company entered into International GSM Roaming Agreements with various FTOs to provide International Inbound Roaming services to subscribers of FTOs in India for which consideration is paid by the FTOs to Company in convertible foreign exchange.” They emphasized that there was no contract or agreement between the company and the individual subscribers.

For business auxiliary services, companies like Microsoft India, IBM India, and others argued that they were providing marketing, sales promotion, and support services to their overseas parent companies or group entities. Microsoft India contended that “Customer of Respondents for marketing and product support services is the entity in Singapore and not the person buying the software in India from the Singapore entity.”

In the case of Verizon Communications India Pvt Ltd, learned senior counsel Sri Bagaria made detailed submissions about the nature of their services. He explained that “The respondent’s contract was with Verizon US who alone had the contractual right and liability to receive the service and pay for the same.” He detailed that the respondent raised its bills on Verizon US, Verizon US paid the bills in convertible foreign exchange directly to the respondent, and the services were provided on principal-to-principal basis.

Regarding the legal requirements during different periods, Sri Bagaria made crucial submissions about the amendments to the rules. He pointed out that “the requirements of ‘delivered outside India’, ‘provided outside India’ and ‘used outside India’ have been omitted long prior to the relevant period.” During the relevant period, he argued, “the only twin requirements of Rule 3 were the following: a. the recipient of service is located outside India; and b. payment for the service is received in convertible foreign exchange.”

For the post-negative list period (from July 2012), the respondents referred to the new framework under Rule 6A of the Service Tax Rules and the Place of Provision of Service Rules, 2012. They argued that all conditions were satisfied, including that the service was not in the negative list, the place of provision was outside India, and the payment was received in convertible foreign exchange.

The respondents also strongly countered the Revenue’s attempt to characterize some services as “intermediary services” under Rule 9(c) of the Place of Provision of Service Rules. They argued that this was a new case being made for the first time at the Supreme Court level and had no factual foundation. They emphasized that “The respondent always exported its service to Verizon US on its own account and on principal-to-principal basis, raised its bills on Verizon US and received payments in convertible foreign exchange from Verizon US.”

The Supreme Court’s Analysis and Ruling

The Supreme Court bench comprising Justices B.V. Nagarathna and Satish Chandra Sharma conducted a comprehensive analysis of the legal framework and the specific facts of each case.

The Court noted that “the CESTAT in all these cases has rightly analyzed the activity and granted the relief.” The Court emphasized that “in these cases, what has been determined by the CESTAT are purely findings of facts. We do not find any perversity in the determination of the findings of facts.”

Regarding the core legal issue, the Court found that the CESTAT had correctly applied the Export of Service Rules as they stood during the relevant periods. The Court noted that for the periods after February 27, 2010, the only requirements were that the recipient of service is located outside India and payment is received in convertible foreign exchange, both of which were satisfied in these cases.

The Court also accepted the respondents’ argument about the contractual nature of service tax, noting that the service providers had contractual relationships only with the overseas entities, not with the ultimate beneficiaries in India. The privity of contract was exclusively with the overseas service recipients who made payments in convertible foreign exchange.

In its conclusive finding, the Court stated: “In the circumstances, we find that the factual determination made by the CESTAT would not call for any re-determination in these appeals. Hence, these appeals are dismissed.”

Broader Implications of the Judgment

This landmark judgment has significant implications for India’s service export industry and provides much-needed clarity on the tax treatment of exported services. By upholding the export status of various services provided to overseas clients, the Court has reinforced India’s position as a favorable destination for service exports.

The judgment affirms that the determination of export status depends on the location of the service recipient and the currency of payment, rather than the location where services are performed or where the ultimate beneficiaries are located. This principle is crucial for many IT, ITES, telecommunications, and business support service providers who serve global clients from India.

The Court’s dismissal of the Revenue’s appeals also provides relief to numerous companies facing similar disputes and establishes clear precedents for future cases involving export of services. The judgment recognizes the practical realities of global service delivery and aligns India’s service tax treatment with international principles of taxation based on consumption and destination.

For the Indian economy, this judgment supports the growth of service exports by providing tax certainty and avoiding double taxation scenarios that could arise if services provided to overseas clients were subjected to Indian service tax. It reinforces the government’s policy of promoting service exports and aligns with India’s broader economic objectives in the global services market.

The Supreme Court’s decision to uphold the factual determinations of the CESTAT also demonstrates judicial deference to specialized tribunals on technical matters involving application of tax laws to complex service arrangements. This approach promotes consistency and predictability in tax administration while respecting the expertise of specialized appellate bodies.

Petitioner Name: Commissioner of Service Tax-III, Mumbai.Respondent Name: M/s. Vodafone India Limited and Others.Judgment By: Justice B.V. Nagarathna, Justice Satish Chandra Sharma.Place Of Incident: Various locations across India.Judgment Date: 06-05-2025.Result: dismissed.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: commissioner-of-serv-vs-ms.-vodafone-india-supreme-court-of-india-judgment-dated-06-05-2025.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Judgment by B.V. Nagarathna

See all petitions in Judgment by Satish Chandra Sharma

See all petitions in dismissed

See all petitions in supreme court of India judgments May 2025

See all petitions in 2025 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category