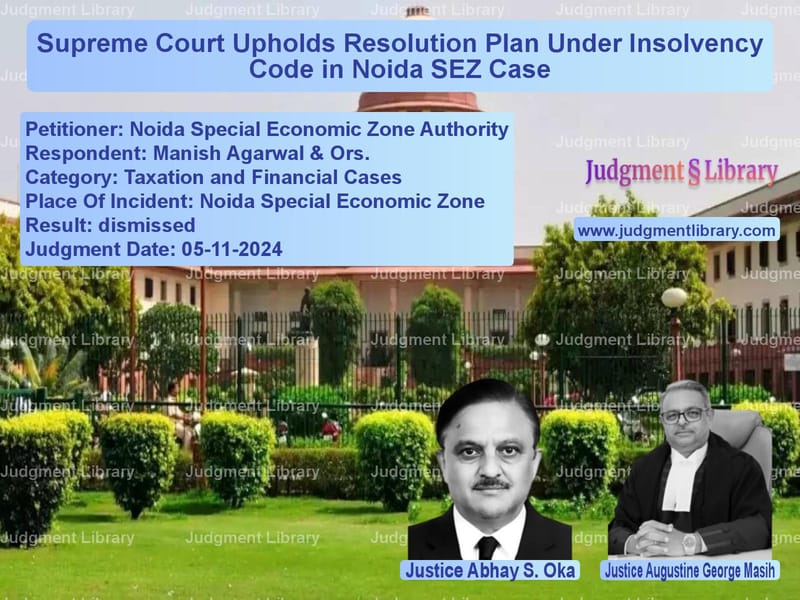

Supreme Court Upholds Resolution Plan Under Insolvency Code in Noida SEZ Case

The Supreme Court of India recently ruled on a significant case involving the Noida Special Economic Zone Authority (NSEZ) and the approval of a resolution plan under the Insolvency and Bankruptcy Code (IBC), 2016. The case, Noida Special Economic Zone Authority vs. Manish Agarwal & Ors., revolved around the financial rights of an operational creditor in insolvency proceedings.

Background of the Case

The dispute arose when Shree Bhoomika International Limited, the Corporate Debtor, defaulted on lease payments for a plot of land in NSEZ. The Noida Special Economic Zone Authority (the Appellant) initiated corporate insolvency resolution proceedings under IBC, claiming arrears of over INR 6.29 crores.

The resolution process led to the approval of a resolution plan that assigned only INR 50 lakhs to the Appellant, significantly less than its admitted claim. The Appellant challenged this decision before the National Company Law Appellate Tribunal (NCLAT), which upheld the resolution plan. The matter then reached the Supreme Court.

Key Legal Issues

- Whether the NSEZ Authority, as an operational creditor, could demand full payment of its admitted claim.

- Whether the resolution plan violated the principles of the IBC.

- Whether the resolution applicant could claim exemptions from NSEZ fees and penalties.

- Whether the valuation process for the Corporate Debtor was conducted fairly.

Petitioner’s Arguments

- The Appellant argued that it was deprived of its rightful claim and should be prioritized in payments.

- The valuation of the Corporate Debtor was flawed as no physical inspection of assets was carried out.

- The resolution plan unfairly provided exemptions to the resolution applicant, undermining the authority of NSEZ.

- The plan should be set aside as it led to an unjust enrichment of the resolution applicant at the cost of public funds.

Respondent’s Arguments

- The resolution plan was approved as per the commercial wisdom of the Committee of Creditors.

- Under IBC, financial creditors have greater rights in decision-making than operational creditors.

- The valuation was conducted by certified professionals, and its methodology was consistent with IBC regulations.

- The exemptions granted under the resolution plan were necessary for ensuring the viability of the resolution applicant.

Supreme Court’s Analysis

1. Rights of Operational Creditors Under IBC

The Court reaffirmed that operational creditors do not have the same rights as financial creditors in insolvency proceedings. It held:

“The commercial wisdom of the Committee of Creditors cannot be interfered with by the courts unless there is a clear violation of IBC provisions.”

2. Fairness of the Resolution Plan

The Court found no evidence of arbitrariness or discrimination in the resolution plan. It ruled:

“The resolution plan must be evaluated based on the feasibility and viability of its implementation, rather than the individual interests of operational creditors.”

3. Validity of the Valuation Process

The Supreme Court held that the valuation process was conducted as per IBC guidelines. It stated:

“The determination of liquidation value is based on expert assessment and does not require physical inspection in every case.”

4. Exemptions for the Resolution Applicant

The Court found that the exemptions granted were justified to ensure a successful resolution. It observed:

“Exemptions under the resolution plan must be viewed in light of the overarching goal of corporate resolution rather than liquidation.”

Final Judgment

- The Supreme Court dismissed the appeal and upheld the NCLAT ruling.

- The resolution plan remained valid and enforceable.

- The decision clarified that operational creditors cannot demand full recovery under IBC.

Implications of the Judgment

- Strengthening IBC Implementation: The ruling reinforces the priority of financial creditors in insolvency cases.

- Clarity on Valuation Standards: Establishes that valuation does not always require physical verification.

- Finality of Resolution Plans: Prevents undue litigation by operational creditors against approved plans.

- Corporate Resolution Over Liquidation: Ensures that resolution applicants receive necessary exemptions for business viability.

This ruling is a crucial precedent for insolvency proceedings in India, balancing creditor interests while ensuring effective corporate resolutions.

Petitioner Name: Noida Special Economic Zone Authority.Respondent Name: Manish Agarwal & Ors..Judgment By: Justice Abhay S. Oka, Justice Augustine George Masih.Place Of Incident: Noida Special Economic Zone.Judgment Date: 05-11-2024.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: noida-special-econom-vs-manish-agarwal-&-ors-supreme-court-of-india-judgment-dated-05-11-2024.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Bankruptcy and Insolvency

See all petitions in Corporate Compliance

See all petitions in unfair trade practices

See all petitions in Judgment by Abhay S. Oka

See all petitions in Judgment by Augustine George Masih

See all petitions in dismissed

See all petitions in supreme court of India judgments November 2024

See all petitions in 2024 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category