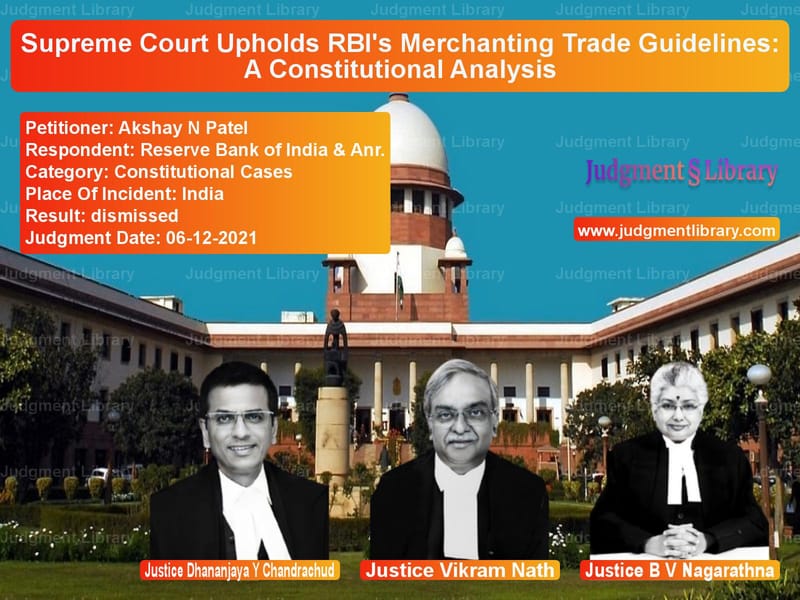

Supreme Court Upholds RBI’s Merchanting Trade Guidelines: A Constitutional Analysis

The Supreme Court, in the case of Akshay N Patel vs. Reserve Bank of India & Anr., examined the constitutional validity of Clause 2(iii) of the Revised Guidelines on Merchanting Trade Transactions (MTT) issued by the Reserve Bank of India (RBI) on January 23, 2020. The petitioner challenged the prohibition on MTT in goods banned under India’s Foreign Trade Policy (FTP), arguing that it violated his fundamental rights under Articles 14, 19(1)(g), and 21 of the Constitution.

Background of the Case

The petitioner, Akshay N Patel, is a businessman involved in manufacturing and trading pharmaceuticals, herbal skincare products, and personal protective equipment (PPE). During the COVID-19 pandemic, Patel sought to facilitate a merchanting trade transaction by purchasing PPE from a Chinese supplier and selling it to a U.S. buyer. However, the RBI rejected the transaction, citing Clause 2(iii) of its 2020 MTT Guidelines, which mandated compliance with India’s prevailing Foreign Trade Policy (FTP) at the time of shipment.

What is Merchanting Trade?

Merchanting trade transactions (MTT) involve the purchase of goods from one foreign country and their subsequent sale to another foreign country without the goods entering the domestic customs territory. These transactions are essential in global trade, particularly for businesses engaged in intermediary trading.

The RBI regulates MTT through its guidelines, ensuring that such transactions comply with India’s overall economic policies, foreign exchange management regulations, and trade restrictions.

Key Issue in the Case

The petitioner challenged Clause 2(iii) on the following grounds:

- The restriction was absolute and violated Article 14 (Right to Equality), Article 19(1)(g) (Right to Trade), and Article 21 (Right to Life and Livelihood).

- Since MTT transactions do not involve goods entering Indian territory, they do not impact India’s domestic stock of PPE products.

- The RBI should have independently assessed whether MTTs in restricted goods should be permitted, rather than automatically linking them to the FTP.

- Less restrictive measures, such as allowing case-by-case exemptions, could have been adopted instead of a blanket ban.

Arguments by the Petitioner

The petitioner contended that:

- The RBI’s restriction disproportionately affected his business, preventing him from engaging in lawful international trade.

- The restriction was arbitrary as it failed to consider that MTTs do not deplete India’s domestic supply of essential goods.

- The restriction lacked a rational nexus to its stated objective, as the goods were never intended for use within India.

- Economic restrictions must be reasonable and subject to judicial review.

Arguments by the RBI

The RBI and the Government of India defended the restriction, stating that:

- The measure was in alignment with India’s national interest during the COVID-19 pandemic.

- MTT transactions impact foreign exchange reserves and are therefore within RBI’s regulatory purview.

- The prohibition was consistent with RBI’s long-standing policies linking MTT regulations with India’s FTP.

- Judicial interference in monetary policy decisions should be minimal, as economic regulations require expert assessment.

Supreme Court’s Analysis

Legitimacy of the Restriction

The Court examined whether the RBI’s restriction served a legitimate state interest and found that ensuring sufficient PPE stocks in India during a global pandemic was a reasonable regulatory goal.

Proportionality Test

The Court applied the proportionality test to determine whether the RBI’s restriction was a reasonable limitation on fundamental rights.

- Legitimate Aim: The Court ruled that the restriction was designed to safeguard India’s foreign exchange stability and domestic supply chains in an emergency.

- Suitability: The restriction was deemed suitable, as it aligned with India’s broader trade policy.

- Necessity: The Court found that the restriction was necessary to prevent the misuse of India’s trade channels for hoarding essential goods in foreign markets.

- Minimal Intrusion: The Court determined that the restriction did not completely prohibit all forms of trade but only restricted MTT in specific goods, making it minimally intrusive.

Judicial Deference to Economic Policy

The Supreme Court emphasized that the RBI, as India’s central banking authority, has the expertise to regulate foreign exchange transactions. Courts should defer to such regulatory decisions unless they are manifestly arbitrary or unconstitutional.

“Economic policies formulated by specialized regulatory bodies must be given due deference, and judicial intervention should be minimal unless there is a clear case of arbitrariness.”

Final Judgment

The Supreme Court upheld the RBI’s restriction and dismissed the appeal. The key takeaways from the judgment include:

- The RBI’s power to regulate foreign exchange transactions was upheld.

- The Court reaffirmed the minimal intervention principle in economic matters.

- The restriction was deemed a reasonable limitation on business rights under Article 19(1)(g).

- The policy was proportionate and aligned with India’s broader economic and public health objectives.

Implications of the Judgment

- The ruling reinforces the principle of economic sovereignty in trade regulations.

- It sets a precedent that judicial intervention in monetary policy decisions should be limited.

- It clarifies that trade restrictions linked to national policy objectives will be considered constitutionally valid unless proven arbitrary.

- The decision strengthens the RBI’s regulatory control over foreign exchange transactions.

Conclusion

This judgment underscores the judiciary’s deference to regulatory authorities in economic policymaking. By upholding the RBI’s power to impose trade restrictions, the Court has reaffirmed the principle that economic regulations must align with national interests and are subject to only limited judicial review.

Petitioner Name: Akshay N Patel.Respondent Name: Reserve Bank of India & Anr..Judgment By: Justice Dhananjaya Y Chandrachud, Justice Vikram Nath, Justice B V Nagarathna.Place Of Incident: India.Judgment Date: 06-12-2021.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: akshay-n-patel-vs-reserve-bank-of-indi-supreme-court-of-india-judgment-dated-06-12-2021.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Constitution Interpretation

See all petitions in Legislative Powers

See all petitions in Public Interest Litigation

See all petitions in Judgment by Dhananjaya Y Chandrachud

See all petitions in Judgment by Vikram Nath

See all petitions in Judgment by B.V. Nagarathna

See all petitions in dismissed

See all petitions in supreme court of India judgments December 2021

See all petitions in 2021 judgments

See all posts in Constitutional Cases Category

See all allowed petitions in Constitutional Cases Category

See all Dismissed petitions in Constitutional Cases Category

See all partially allowed petitions in Constitutional Cases Category