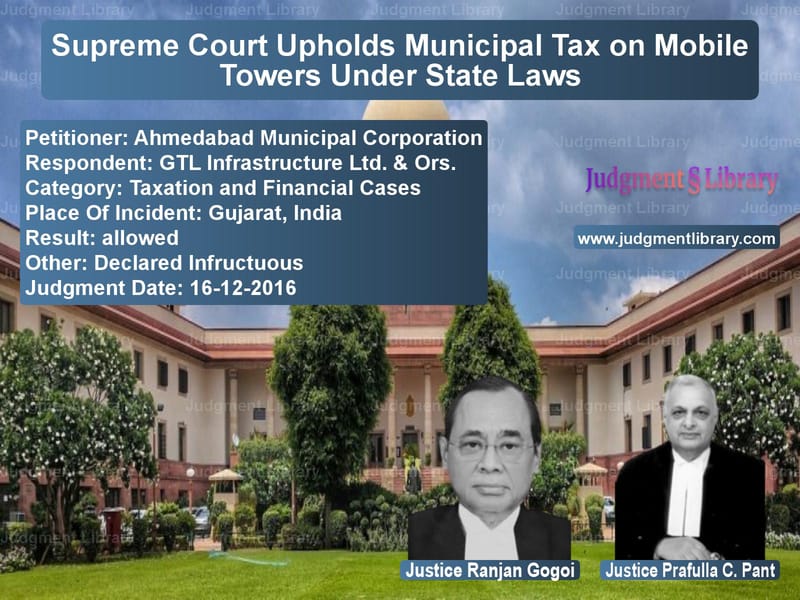

Supreme Court Upholds Municipal Tax on Mobile Towers Under State Laws

The case of Ahmedabad Municipal Corporation vs. GTL Infrastructure Ltd. & Ors. examined the validity of levying property tax on mobile towers under state municipal laws. The Supreme Court ruled in favor of municipal corporations, holding that mobile towers qualify as ‘buildings’ under state laws and are subject to property tax.

Background of the Case

Several municipal corporations, including the Ahmedabad Municipal Corporation, imposed property tax on mobile towers under state legislation such as the Gujarat Provincial Municipal Corporations Act, 1949. Mobile tower companies challenged these levies, arguing that mobile towers did not constitute ‘land’ or ‘buildings’ as defined under municipal laws. The Gujarat High Court ruled in favor of the companies, declaring Section 145A of the Gujarat Act unconstitutional.

The municipal corporations appealed to the Supreme Court, seeking clarity on their power to impose property tax on mobile towers.

Key Legal Issues

- Do mobile towers qualify as ‘buildings’ under municipal tax laws?

- Do state governments have the power to impose property tax on mobile towers under Entry 49 of List II of the Constitution?

- Can municipal corporations levy property tax on mobile towers under their taxation powers?

- Was the Gujarat High Court correct in declaring Section 145A unconstitutional?

Arguments by the Petitioners (Municipal Corporations)

- The definition of ‘building’ under the Gujarat Municipal Act was broad enough to include mobile towers.

- Under Entry 49 of List II, the state government had the power to levy taxes on lands and buildings.

- Mobile towers are permanent structures and should be taxed as buildings under municipal laws.

- Other states such as Maharashtra and Madhya Pradesh had already imposed similar taxes.

Arguments by the Respondents (Mobile Tower Operators)

- Mobile towers are not ‘buildings’ as they are not meant for human habitation.

- Telecommunication infrastructure is regulated under Entry 31 of List I (Union List), and states cannot impose tax on it.

- The Gujarat High Court correctly ruled that Section 145A was unconstitutional.

- Municipal corporations lack jurisdiction to levy property tax on mobile towers.

Supreme Court’s Judgment

The Supreme Court ruled in favor of the municipal corporations, holding that:

- Mobile towers qualify as ‘buildings’ under municipal tax laws.

- State legislatures have the power to impose taxes on lands and buildings under Entry 49 of List II.

- The levy of tax on mobile towers is not unconstitutional.

- Municipal corporations have jurisdiction to impose property tax on mobile towers.

The Court stated:

“Mobile towers are structures that are affixed to the ground or buildings and have permanence. They qualify as buildings under municipal tax laws and are subject to taxation.”

Impact of the Judgment

- Reinforces the power of municipal corporations to levy taxes on mobile towers.

- Clarifies that mobile towers qualify as ‘buildings’ under state laws.

- Ensures that telecom companies comply with local tax regulations.

- Sets a precedent for similar taxation in other states.

Analysis of the Judgment

The Supreme Court’s ruling is significant for multiple reasons:

- Judicial Recognition of Municipal Taxing Powers: The judgment upholds the taxation rights of municipal corporations, reinforcing their ability to generate revenue through property tax.

- Clarity on the Legal Definition of ‘Building’: By classifying mobile towers as buildings, the Court has ensured that all fixed structures used for commercial purposes can be taxed under municipal laws.

- Implications for the Telecom Industry: Mobile tower operators must now comply with municipal tax laws and factor property tax into their operational costs.

Future Implications

The judgment sets a strong precedent that will impact similar cases in other states. Some expected outcomes include:

- Uniform Taxation: Other states may follow Gujarat’s example and implement property tax on mobile towers.

- Increased Revenue for Municipalities: Cities will benefit financially by taxing telecom infrastructure.

- Regulatory Clarity: The ruling eliminates ambiguity over whether municipal bodies can tax mobile towers, ensuring regulatory stability.

Conclusion

The Supreme Court’s ruling confirms that mobile towers are taxable under municipal laws. The decision provides clarity on the classification of telecommunication infrastructure under property tax laws, ensuring that local bodies have the authority to impose such levies.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Ahmedabad Municipal vs GTL Infrastructure L Supreme Court of India Judgment Dated 16-12-2016.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Tax Evasion Cases

See all petitions in Judgment by Ranjan Gogoi

See all petitions in Judgment by Prafulla C. Pant

See all petitions in allowed

See all petitions in Declared Infructuous

See all petitions in supreme court of India judgments December 2016

See all petitions in 2016 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category