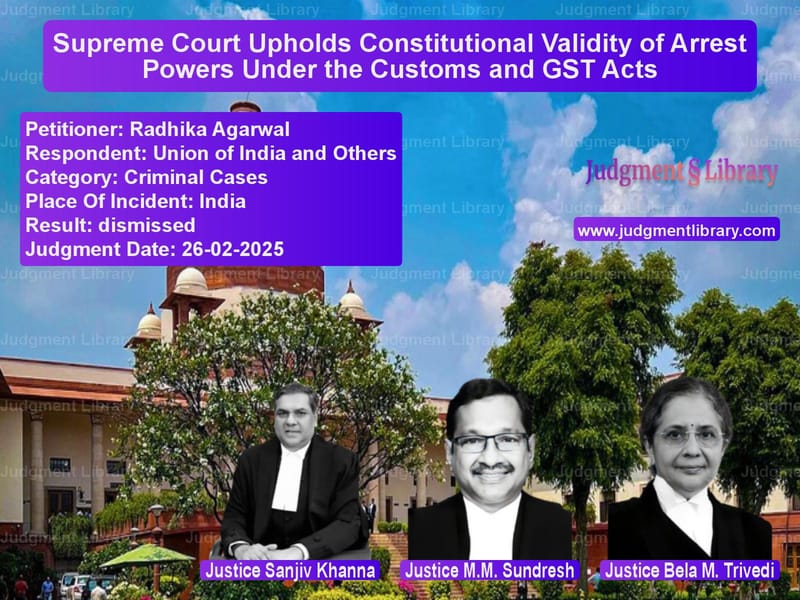

Supreme Court Upholds Constitutional Validity of Arrest Powers Under the Customs and GST Acts

The case of Radhika Agarwal vs. Union of India is a landmark judgment where the Supreme Court examined the constitutional validity of the arrest powers granted under the Customs Act, 1962 and the Goods and Services Tax (GST) Acts. The petitioners challenged these provisions, arguing that they allowed excessive executive control over individuals accused of tax evasion, thereby violating fundamental rights under Articles 21 and 22 of the Constitution.

The Supreme Court, after a detailed analysis, ruled that these provisions were legally valid but must be exercised with necessary safeguards. The judgment reinforces the idea that while the government has the authority to curb tax evasion, it must ensure that individual freedoms are not unjustly curtailed through arbitrary arrests.

Background of the Case

The case originated from multiple petitions filed by individuals and business entities contesting the broad powers conferred on officers under the Customs Act and GST Acts. The petitioners contended that these laws allowed for arrests without proper judicial oversight, violating constitutional protections.

The key legal questions raised were:

- Whether the power of arrest under the Customs and GST Acts violated fundamental rights under Articles 21 and 22.

- Whether tax-related offenses should be treated as economic offenses requiring stricter procedural safeguards.

- Whether the safeguards provided under these laws were sufficient to prevent misuse of arrest powers.

Petitioners’ Arguments

The petitioners, represented by senior advocates, presented the following key arguments:

- The power to arrest for tax-related offenses should be exercised only after a proper adjudication of liability.

- The Supreme Court in Om Prakash v. Union of India (2011) had held that certain tax-related offenses were non-cognizable and bailable, which required magistrate approval before an arrest could be made.

- The laws grant excessive discretion to tax officers, enabling them to use arrest powers arbitrarily, leading to coercion and harassment.

- The right to life and personal liberty under Article 21 of the Constitution cannot be taken away without following due process.

- There was no clear differentiation between minor infractions and serious offenses, leading to a disproportionate application of arrest powers.

Respondents’ Arguments

The Union of India, defending the provisions, put forth the following arguments:

- The amendments to the Customs Act and GST Acts after 2012 explicitly categorize specific offenses as cognizable and non-bailable.

- Legislative intent behind these provisions was to deter large-scale tax evasion and protect government revenue.

- The officers exercising these powers were bound by procedural safeguards to ensure arrests were not arbitrary.

- The Supreme Court had previously upheld similar provisions in economic offenses in the case of P. Chidambaram v. Directorate of Enforcement (2019), where it held that white-collar crimes affect national interest and require stricter measures.

Supreme Court’s Observations

The Supreme Court upheld the legislative amendments but also laid down stringent conditions for the exercise of arrest powers. The Court ruled:

“The power of arrest under tax laws cannot be used as a means of oppression. However, economic offenses differ from ordinary crimes, and thus, must be dealt with appropriately. The intent behind these provisions is deterrence, but they must be exercised with caution.”

The key takeaways from the Court’s observations were:

- The power to arrest should not be used routinely and must be exercised only when necessary for investigation.

- Arrests should be based on clear and credible material demonstrating an offense.

- The “reason to believe” that a person has committed an offense must be recorded in writing and communicated to the accused.

- Section 104(4) of the Customs Act and Section 132(5) of the GST Acts categorize offenses into bailable and non-bailable categories to ensure fairness.

- Officers must adhere to procedural safeguards, including maintaining an arrest memo and informing the accused of their rights.

Judicial Review of Arrests

The Supreme Court reaffirmed that judicial scrutiny applies to arrests under these laws:

- The legality of an arrest can be challenged through writ petitions under Article 226 or Article 32 of the Constitution.

- Court intervention is warranted if procedural safeguards are not followed.

- While courts should not interfere in routine investigations, they must prevent misuse of arrest powers.

Safeguards for Arrestees

The judgment mandated additional protections for individuals facing arrest:

- Arrestees must be informed in writing about the grounds of arrest.

- A relative or friend must be notified of the arrest.

- Medical examination must be conducted within 24 hours.

- The right to legal representation must be guaranteed.

Final Judgment

The Supreme Court ruled:

- The constitutional validity of arrest provisions under the Customs Act and GST Acts is upheld.

- The government must issue detailed guidelines to prevent misuse of arrest powers.

- Courts must ensure strict compliance with procedural safeguards.

- Arrests should not be made solely to recover tax dues unless there is intent to evade liability.

Impact of the Judgment

The ruling provides much-needed clarity on the limits of arrest powers in tax-related cases. It ensures that enforcement agencies have the tools to combat tax evasion while protecting individuals from arbitrary arrests. The judgment strikes a balance between tax compliance and constitutional rights.

Conclusion

The Supreme Court’s decision reinforces the idea that laws must be implemented with fairness and due process. While tax evasion is a serious offense, enforcement measures must be exercised within legal limits. The ruling serves as a benchmark for future cases involving economic offenses and arrest powers.

Petitioner Name: Radhika Agarwal.Respondent Name: Union of India and Others.Judgment By: Justice Sanjiv Khanna, Justice M.M. Sundresh, Justice Bela M. Trivedi.Place Of Incident: India.Judgment Date: 26-02-2025.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: radhika-agarwal-vs-union-of-india-and-o-supreme-court-of-india-judgment-dated-26-02-2025.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Money Laundering Cases

See all petitions in Fraud and Forgery

See all petitions in Tax Evasion Cases

See all petitions in Banking Regulations

See all petitions in Income Tax Disputes

See all petitions in Judgment by Sanjiv Khanna

See all petitions in Judgment by M.M. Sundresh

See all petitions in Judgment by Bela M. Trivedi

See all petitions in dismissed

See all petitions in supreme court of India judgments February 2025

See all petitions in 2025 judgments

See all posts in Criminal Cases Category

See all allowed petitions in Criminal Cases Category

See all Dismissed petitions in Criminal Cases Category

See all partially allowed petitions in Criminal Cases Category