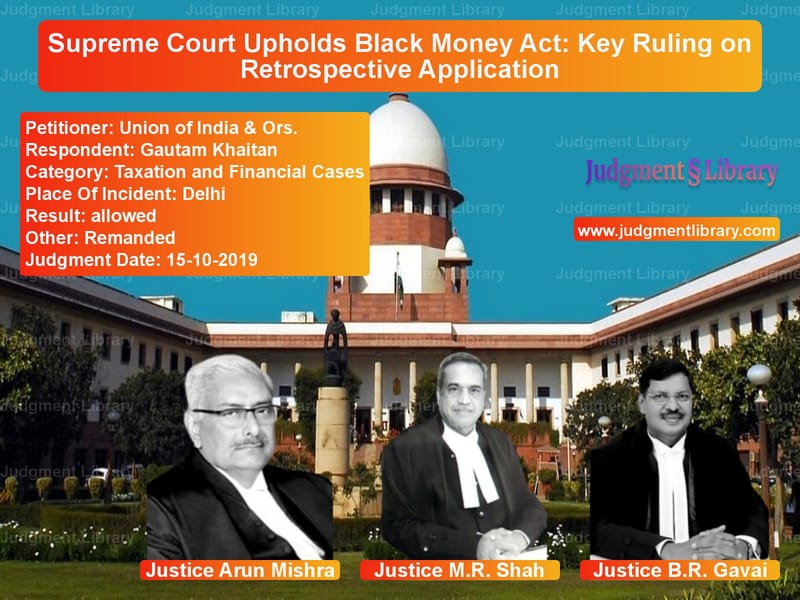

Supreme Court Upholds Black Money Act: Key Ruling on Retrospective Application

The case of Union of India & Ors. v. Gautam Khaitan involved crucial legal questions regarding the retrospective application of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (Black Money Act). The Supreme Court ruled in favor of the government, upholding the validity of the notification that brought the law into effect from July 1, 2015, instead of the originally planned April 1, 2016.

Background of the Case

The Black Money Act was enacted with the primary objective of preventing undisclosed foreign income and assets and imposing strict penalties on offenders. The respondent, Gautam Khaitan, challenged the notification that made the law effective from July 1, 2015, arguing that it had been retrospectively applied to his case.

Key Provisions of the Black Money Act

- Section 3: Imposes a 30% tax on undisclosed foreign income and assets.

- Section 59: Provides a one-time opportunity to disclose undisclosed assets and pay tax and penalties.

- Sections 50 and 51: Define penalties, including imprisonment for failure to disclose assets.

Arguments by the Union of India

The government, represented by Solicitor General Tushar Mehta, contended that:

- The Act was designed to curb black money stashed abroad and prevent tax evasion.

- The notification bringing the Act into force from July 1, 2015, was necessary to enable taxpayers to avail the disclosure scheme.

- The retrospective application did not impose new penalties but allowed for existing undisclosed assets to be taxed.

Arguments by the Respondent

The respondent, represented by Senior Advocate P.V. Kapur, argued that:

- The retrospective application of the Act was unconstitutional and created an unfair burden.

- The notification effectively altered the original provisions of the Act, which had stated it would come into effect from April 1, 2016.

- The government could not penalize individuals for assets acquired before the Act was enacted.

Supreme Court’s Observations

The Court, led by Justices Arun Mishra, M.R. Shah, and B.R. Gavai, analyzed the legislative intent and concluded:

“The scheme of the Black Money Act is to provide stringent measures for curbing the menace of black money. However, the Act also provided a one-time opportunity for individuals to declare undisclosed assets and pay the necessary tax and penalty.”

The Court held that the notification was valid and that the Act was not being applied with punitive retrospectivity. Instead, it allowed undisclosed assets to be taxed in the year they were discovered by authorities.

Judgment and Final Order

The Supreme Court ruled:

- The Delhi High Court’s interim order restraining action against Gautam Khaitan was set aside.

- The Black Money Act’s enforcement date of July 1, 2015, was upheld.

- The case was remanded to the High Court for further consideration.

Conclusion

This judgment reinforces the government’s stance on tackling black money and ensures that offenders cannot escape liability due to technicalities. It sets a crucial precedent for future cases involving the taxation of undisclosed foreign assets.

Petitioner Name: Union of India & Ors..Respondent Name: Gautam Khaitan.Judgment By: Justice Arun Mishra, Justice M.R. Shah, Justice B.R. Gavai.Place Of Incident: Delhi.Judgment Date: 15-10-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Union of India & Ors vs Gautam Khaitan Supreme Court of India Judgment Dated 15-10-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Tax Evasion Cases

See all petitions in Income Tax Disputes

See all petitions in Judgment by Arun Mishra

See all petitions in Judgment by Mukeshkumar Rasikbhai Shah

See all petitions in Judgment by B R Gavai

See all petitions in allowed

See all petitions in Remanded

See all petitions in supreme court of India judgments October 2019

See all petitions in 2019 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category