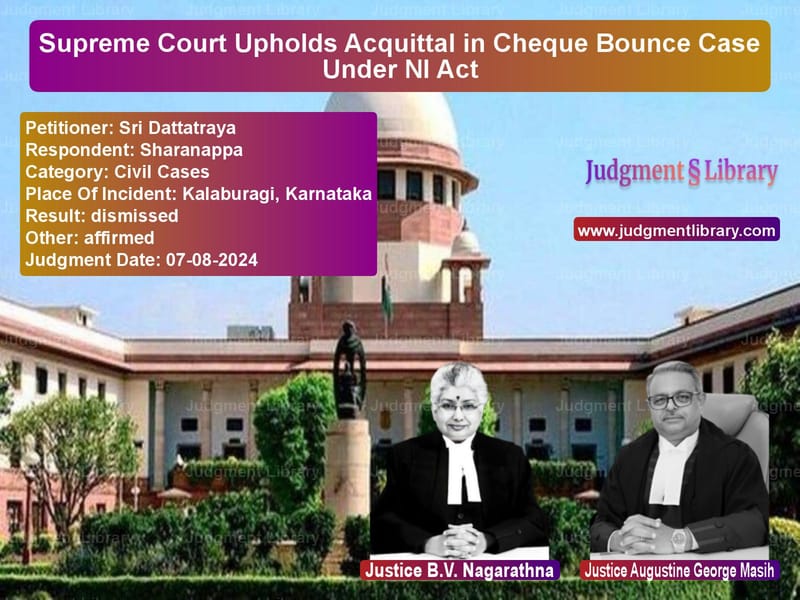

Supreme Court Upholds Acquittal in Cheque Bounce Case Under NI Act

The Supreme Court of India recently upheld the acquittal of Sharanappa in a cheque bounce case under Section 138 of the Negotiable Instruments Act, 1881 (NI Act). The case, which originated in Karnataka, revolved around the dishonor of a cheque allegedly issued by the respondent to the appellant, Sri Dattatraya. The judgment reaffirmed the principles governing the presumption of liability under the NI Act and highlighted the importance of rebuttal evidence in cheque dishonor cases.

Background of the Case

The case dates back to 2013 when the appellant, Sri Dattatraya, claimed that the respondent, Sharanappa, borrowed Rs. 2,00,000 from him for personal and family expenses. In return, the respondent issued a cheque, which was drawn on Bank of India, as a guarantee for repayment.

When the appellant presented the cheque for encashment on October 22, 2013, it was returned unpaid due to insufficient funds, as per the bank memo dated October 24, 2013. The appellant issued a legal notice demanding payment within the stipulated period, but the respondent denied liability, arguing that the cheque was issued for security purposes to a third party, Mallikarjun, and had been misused.

Trial Court Proceedings

The appellant filed a complaint before the Judicial Magistrate First Class (JMFC) at Gulbarga under Section 138 of the NI Act. The trial court examined the appellant as PW-1 and the respondent as DW-1. The respondent contended that:

- The cheque was issued to Mallikarjun in 2012 as security for a different transaction.

- Mallikarjun never returned the cheque and instead left the village.

- The appellant failed to prove that a loan transaction took place.

- The agreement purportedly evidencing the loan was not signed by the respondent on the terms but only on the stamp paper.

- The appellant did not declare the alleged loan in his income tax returns, undermining his claim.

The trial court found that the appellant failed to establish a legally enforceable debt and acquitted the respondent.

High Court Proceedings

Aggrieved by the acquittal, the appellant moved the Karnataka High Court, which upheld the trial court’s verdict, reasoning that:

- The appellant’s statements were inconsistent regarding when the cheque was issued.

- The presumption under Section 139 of the NI Act is rebuttable, and the respondent successfully cast doubt on the existence of a legal debt.

- The financial capacity of the appellant to lend Rs. 2,00,000 was not proven.

- The agreement submitted by the appellant lacked authenticity, as the respondent’s signature was only on the stamp paper and not on the loan terms.

Supreme Court’s Observations

The Supreme Court, while dismissing the appeal, made the following key observations:

- Rebuttable Presumption: Under Section 139 of the NI Act, there is a presumption that a cheque is issued for a legally enforceable debt. However, this presumption is rebuttable by the accused.

- Burden of Proof: The accused is not required to prove his defense beyond a reasonable doubt but only by a preponderance of probabilities.

- Failure to Prove Loan Transaction: The appellant failed to establish when and how the loan was advanced.

- Inconsistent Statements: The appellant’s contradictions regarding the purpose of the cheque weakened his case.

- Income Tax Records: The absence of the loan amount in the appellant’s tax filings cast doubt on the legitimacy of the transaction.

Final Judgment

On August 7, 2024, the Supreme Court ruled:

- The appeal was dismissed, and the acquittal of the respondent was upheld.

- The findings of the High Court were affirmed, concluding that the appellant failed to prove a legally enforceable debt.

- The court emphasized that presumption under Section 139 of the NI Act does not relieve the complainant from proving the debt’s legitimacy.

Implications of the Judgment

The ruling sets a significant precedent in cheque dishonor cases:

- Clarifies the Burden of Proof: The decision reinforces that the accused can rebut the presumption under Section 139 with minimal evidence.

- Financial Transactions Require Proper Documentation: Loan transactions should be backed by legally valid agreements.

- Inconsistent Testimony Can Undermine a Case: Courts will scrutinize contradictions in the complainant’s statements.

- Income Tax Filings Can Be Crucial: Failure to report loan transactions in tax returns can weaken claims in financial disputes.

Comparison with Other Precedents

The Supreme Court has previously ruled on similar cases where the presumption under Section 139 was rebutted:

- Rangappa vs. Sri Mohan (2010): The Court held that while there is a presumption under Section 139, the accused can rebut it through circumstantial evidence.

- Kumar Exports vs. Sharma Carpets (2009): The Court clarified that the burden shifts to the accused only after the complainant establishes a prima facie case.

- Basalingappa vs. Mudibasappa (2019): The Court reiterated that financial capacity is a crucial factor in determining the validity of a loan claim.

Conclusion

The Supreme Court’s decision in Sri Dattatraya vs. Sharanappa is a landmark ruling emphasizing the need for complainants to prove legally enforceable debts beyond just presenting a cheque. By reinforcing the rebuttable nature of the presumption under Section 139 of the NI Act, the judgment protects individuals from wrongful financial claims while ensuring that genuine transactions are backed by substantial evidence.

Petitioner Name: Sri Dattatraya.Respondent Name: Sharanappa.Judgment By: Justice B.V. Nagarathna, Justice Augustine George Masih.Place Of Incident: Kalaburagi, Karnataka.Judgment Date: 07-08-2024.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: sri-dattatraya-vs-sharanappa-supreme-court-of-india-judgment-dated-07-08-2024.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Cheque Dishonour Cases

See all petitions in Contract Disputes

See all petitions in Debt Recovery

See all petitions in Public Interest Litigation

See all petitions in Judgment by B.V. Nagarathna

See all petitions in Judgment by Augustine George Masih

See all petitions in dismissed

See all petitions in affirmed

See all petitions in supreme court of India judgments August 2024

See all petitions in 2024 judgments

See all posts in Civil Cases Category

See all allowed petitions in Civil Cases Category

See all Dismissed petitions in Civil Cases Category

See all partially allowed petitions in Civil Cases Category