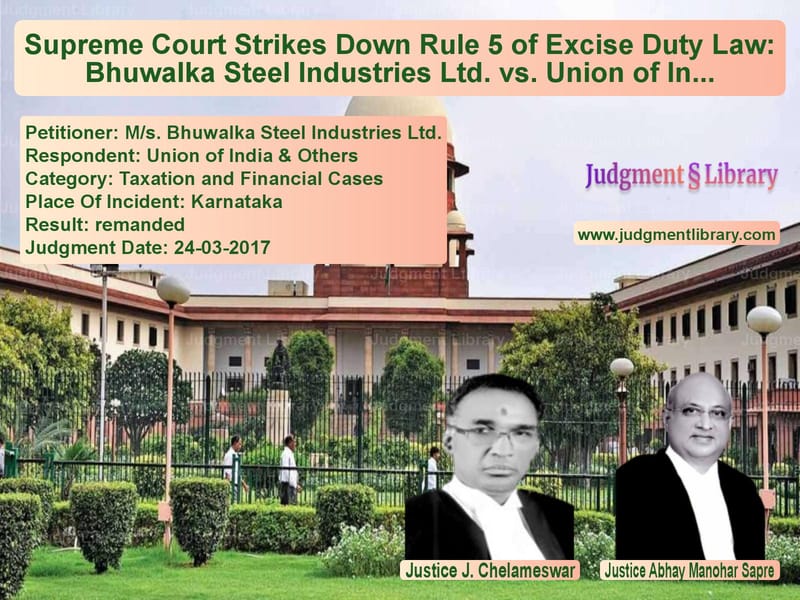

Supreme Court Strikes Down Rule 5 of Excise Duty Law: Bhuwalka Steel Industries Ltd. vs. Union of India

The Supreme Court of India, in its landmark judgment in M/s. Bhuwalka Steel Industries Ltd. & Another vs. Union of India & Others, examined the constitutional validity of Rule 5 of the Hot Re-Rolling Steel Mills Annual Capacity Determination Rules, 1997. This rule had allowed excise duty to be levied based on the annual capacity of production (ACP) rather than actual production. The appellants challenged this rule, arguing that it was unconstitutional and led to unfair taxation on manufacturers.

The Court ultimately ruled in favor of the petitioners, striking down Rule 5 as ultra vires to the parent Act and remanding the matter to the excise authorities for recalculating duty based on actual production.

Background of the Case

The dispute arose when M/s. Bhuwalka Steel Industries Ltd., along with other steel manufacturers, challenged the Central Government’s decision to impose excise duty under the provisions of the Central Excise & Salt Act, 1944. The petitioners operated hot re-rolling steel mills in Karnataka, and their products were subject to excise duty under the Hot Re-Rolling Steel Mills Annual Capacity Determination Rules, 1997.

The controversy centered around Rule 5 of these rules, which deemed that the annual capacity of production (ACP) must be equal to the actual production in the financial year 1996-97. This provision essentially imposed excise duty based on past production levels, irrespective of actual production in later years.

Key Legal Issues Considered

- Whether Rule 5 of the 1997 Rules was ultra vires to the Central Excise Act, 1944.

- Whether taxation based on ACP violated the fundamental principle that excise duty should be levied on actual production.

- Whether Rule 5 created unconstitutional classifications between different manufacturers.

- Whether the power to determine ACP through subordinate legislation was legally valid.

Petitioner’s Arguments (M/s. Bhuwalka Steel Industries Ltd.)

- Rule 5 was an arbitrary provision that imposed duty on ACP rather than actual production, violating fundamental taxation principles.

- The government had exceeded its legislative power by imposing an artificial deeming provision through subordinate rules.

- Excise duty must be levied based on goods actually manufactured, as mandated by the parent Act.

- Rule 5 effectively penalized manufacturers even when production declined due to market conditions.

- It created two classes of manufacturers—those taxed on actual production and those taxed based on an assumed production capacity, violating Article 14 of the Constitution.

Respondent’s Arguments (Union of India)

- The introduction of ACP-based excise duty was necessary to prevent tax evasion by underreporting production.

- Rule 5 was a valid exercise of the government’s power under Section 3A of the Central Excise Act, which allowed for excise duty to be levied on estimated production.

- The rule was uniformly applicable and did not create unconstitutional classifications.

- The classification was reasonable as it ensured that all hot re-rolling mills paid duty proportionate to their installed capacity.

Supreme Court’s Observations

The Supreme Court carefully examined the validity of Rule 5 and held that it was ultra vires because:

- Section 3A of the Central Excise Act permitted duty on ACP, but it did not mandate that ACP must always equal production in 1996-97.

- Rule 5 introduced a legal fiction that was beyond the powers granted by the parent legislation.

- Excise duty, by its nature, should be levied on the actual manufacture of goods, and Rule 5 contradicted this principle.

- Artificially linking ACP to past production levels ignored ground realities such as economic downturns, plant shutdowns, and fluctuations in demand.

The Court ruled:

“A deeming provision in a subordinate rule cannot override the parent legislation’s intent. Taxation must be based on actual facts, not assumed capacities.”

The judgment further emphasized:

“Taxation laws should not create artificial distinctions between similarly placed manufacturers. Rule 5 violates Article 14 of the Constitution by treating different manufacturers unequally.”

Supreme Court’s Ruling

- The Supreme Court struck down Rule 5 as unconstitutional and beyond the powers granted under the Central Excise Act.

- The Court remanded the case to the excise authorities for reassessment of duty based on actual production rather than ACP.

- The ruling reaffirmed that taxation laws must comply with the fundamental principle of fairness and equity.

Key Takeaways from the Judgment

- Subordinate legislation cannot impose a legal fiction beyond the intent of the parent Act.

- Excise duty should be levied based on actual production unless explicitly stated otherwise in the statute.

- Article 14 prohibits arbitrary taxation classifications that result in unequal treatment of manufacturers.

- Taxation laws must align with economic realities and not burden industries unfairly.

Conclusion

The Supreme Court’s ruling in M/s. Bhuwalka Steel Industries Ltd. vs. Union of India is a significant decision in taxation jurisprudence. By striking down Rule 5, the Court upheld the fundamental principle that taxation must be fair, reasonable, and based on actual transactions. The judgment ensures that manufacturers are not subjected to arbitrary taxation policies and reaffirms the principle that the government’s power to impose excise duty must be exercised within legal limits.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Ms. Bhuwalka Steel vs Union of India & Oth Supreme Court of India Judgment Dated 24-03-2017.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Customs and Excise

See all petitions in Tax Refund Disputes

See all petitions in Judgment by J. Chelameswar

See all petitions in Judgment by Abhay Manohar Sapre

See all petitions in Remanded

See all petitions in supreme court of India judgments March 2017

See all petitions in 2017 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category