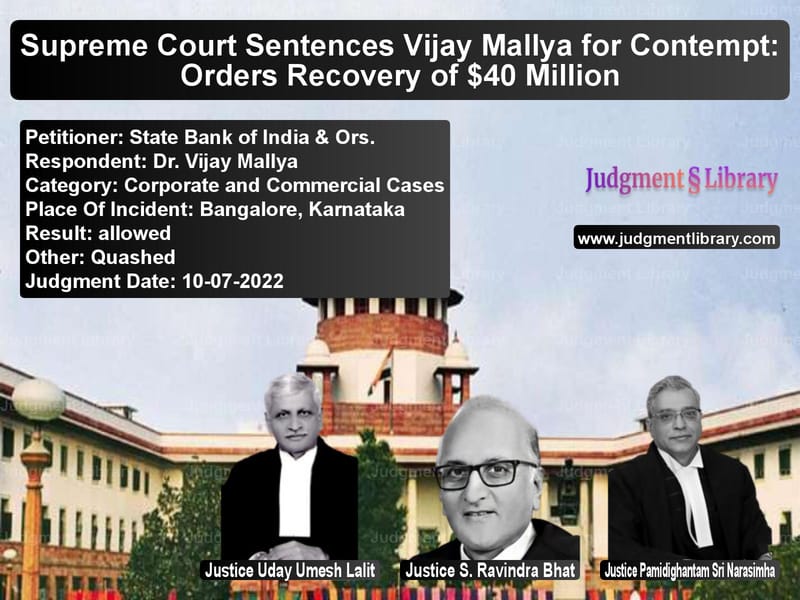

Supreme Court Sentences Vijay Mallya for Contempt: Orders Recovery of $40 Million

The case of State Bank of India & Ors. vs. Dr. Vijay Mallya is a landmark ruling on financial fraud and contempt of court. The Supreme Court, in its ruling delivered by a bench comprising Uday Umesh Lalit, S. Ravindra Bhat, and Pamidighantam Sri Narasimha, held Vijay Mallya guilty of contempt for disbursing $40 million to his children despite court orders restraining asset transfers.

The Court sentenced Mallya to four months of imprisonment and imposed a fine of Rs. 2,000, along with directives to recover the illegally transferred funds. This ruling marks a significant moment in India’s legal history, ensuring accountability for financial misconduct.

Background of the Case

Vijay Mallya, the former chairman of Kingfisher Airlines, had defaulted on bank loans exceeding Rs. 9,000 crore from Indian banks, including the State Bank of India. While default proceedings were ongoing, he received $40 million from Diageo Plc as part of a severance package on February 25, 2016.

The Karnataka High Court had earlier issued a restraint order preventing Mallya from transferring assets. However, he moved the funds to trusts controlled by his three children—Siddhartha Mallya, Leena Mallya, and Tanya Mallya—placing them beyond the reach of creditors. The banks filed contempt petitions against Mallya for violating court orders.

Legal Issues in the Case

- Did Vijay Mallya violate the Karnataka High Court’s order by transferring $40 million?

- Did he deliberately conceal financial details from the Supreme Court?

- Can contempt proceedings be used to recover misappropriated funds?

- What punishment should be imposed for contempt?

Arguments by the Petitioners (Indian Banks)

- Mallya knowingly violated court orders by diverting funds to overseas trusts controlled by his children.

- He had refused to comply with disclosure obligations regarding his financial status.

- The $40 million belonged to creditors and should have been available for loan recovery.

- His actions constituted willful disobedience of judicial authority.

Arguments by the Respondent (Vijay Mallya)

- Mallya argued that the $40 million was part of a legally executed severance agreement with Diageo Plc.

- The funds had been transferred to trusts controlled by his children, and he had no control over their usage.

- He claimed that he had been unfairly targeted despite multiple failed businesses.

- He did not intend to defraud creditors but was caught in a complex financial dispute.

Supreme Court’s Observations

- Mallya’s actions directly violated the Karnataka High Court’s restraint order.

- Transferring the funds to his children’s trusts was an attempt to shield assets from creditors.

- His failure to disclose financial details to the Supreme Court aggravated the contempt.

- The contempt jurisdiction of the Supreme Court includes powers to reverse fraudulent transfers.

The Court ruled:

“The transactions in terms of which the amount of US$40 million was disbursed to the beneficiaries are declared void and inoperative.”

Final Judgment

The Supreme Court issued the following directives:

- Mallya is sentenced to four months of imprisonment.

- He must pay a fine of Rs. 2,000 within four weeks, failing which he will serve an additional two months of imprisonment.

- The Ministry of Home Affairs must secure Mallya’s presence in India for sentence execution.

- The $40 million transferred to the trusts must be returned with 8% interest.

- If the funds are not returned, the Recovery Officer is authorized to take legal steps to seize equivalent assets.

- Indian authorities are directed to work with foreign agencies to trace and recover misappropriated assets.

Implications of the Judgment

- The ruling reinforces that court orders must be followed without exception.

- It establishes that fraudulent financial transactions can be reversed through contempt proceedings.

- The decision strengthens India’s legal standing in international financial disputes.

- It sends a strong message to corporate defaulters that contempt of court will not be tolerated.

- The order enables Indian banks to recover diverted funds from overseas trusts.

This landmark ruling upholds the principle of accountability in financial transactions and strengthens legal mechanisms for recovering misappropriated funds.

Petitioner Name: State Bank of India & Ors..Respondent Name: Dr. Vijay Mallya.Judgment By: Justice Uday Umesh Lalit, Justice S. Ravindra Bhat, Justice Pamidighantam Sri Narasimha.Place Of Incident: Bangalore, Karnataka.Judgment Date: 10-07-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: state-bank-of-india-vs-dr.-vijay-mallya-supreme-court-of-india-judgment-dated-10-07-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Fraud and Forgery

See all petitions in Bankruptcy and Insolvency

See all petitions in Judgment by Uday Umesh Lalit

See all petitions in Judgment by S Ravindra Bhat

See all petitions in Judgment by P.S. Narasimha

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments July 2022

See all petitions in 2022 judgments

See all posts in Corporate and Commercial Cases Category

See all allowed petitions in Corporate and Commercial Cases Category

See all Dismissed petitions in Corporate and Commercial Cases Category

See all partially allowed petitions in Corporate and Commercial Cases Category