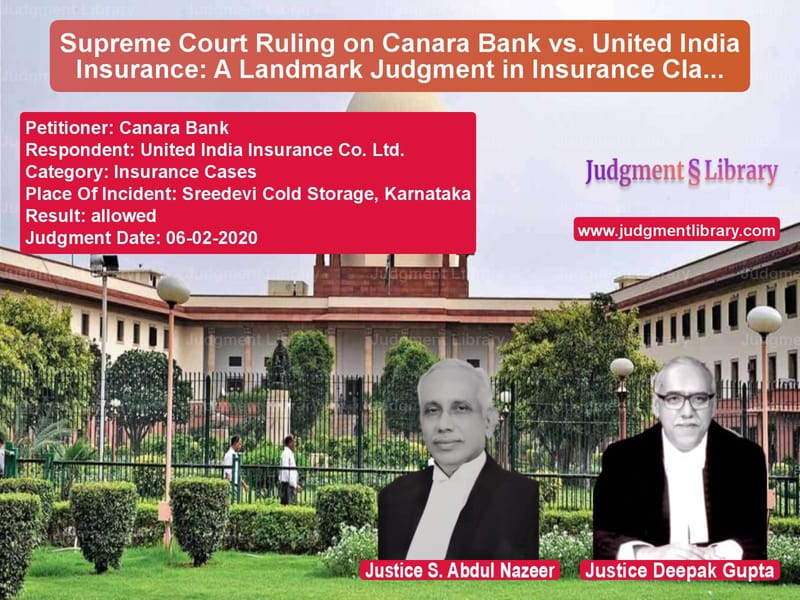

Supreme Court Ruling on Canara Bank vs. United India Insurance: A Landmark Judgment in Insurance Claims

The Supreme Court recently delivered a crucial judgment in the case of Canara Bank vs. United India Insurance Co. Ltd., addressing significant issues related to insurance claims, contractual obligations, and consumer rights. This ruling has implications for financial institutions, insurance companies, and individuals relying on insurance for risk coverage.

The case revolved around a fire incident at Sreedevi Cold Storage, where farmers had stored their agricultural produce. Canara Bank had provided loans to these farmers, with their stored produce serving as collateral. However, after a fire destroyed the stored goods, the insurance claim was rejected by United India Insurance on the grounds that the fire was not accidental and that the farmers had no legal standing to claim compensation. The dispute escalated to consumer forums, eventually reaching the Supreme Court.

Background of the Case

The farmers had stored Byadgi Chilli and other crops at the cold storage facility. They had also taken loans from Canara Bank, which were secured against these stored goods. The cold storage facility had an insurance policy with United India Insurance, covering both the building and the stored goods.

On the night of January 13-14, 2014, a fire broke out, destroying the entire storage facility and its contents. The insurance company rejected the claim, arguing that the fire was not accidental and that the farmers were not direct parties to the insurance contract.

Key Legal Issues Raised

- Whether the fire was accidental or deliberate arson.

- Whether the farmers were consumers under the Consumer Protection Act.

- Whether the insurance company was liable to compensate the farmers despite the policy being in the name of the cold storage facility.

- The validity of the tripartite agreement among the farmers, Canara Bank, and the cold storage facility.

Supreme Court’s Observations

The Supreme Court analyzed forensic evidence and reports from multiple agencies to determine the cause of the fire. The Court ruled that the fire was indeed accidental and was caused by an electrical short circuit. The insurance company’s claims of arson were dismissed.

On the issue of consumer rights, the Court held that the farmers were beneficiaries of the insurance policy and were, therefore, covered under the Consumer Protection Act. The policy explicitly covered stored goods, and the farmers had a financial interest in them.

The Court also emphasized that the tripartite agreement between the farmers, Canara Bank, and the cold storage facility clearly outlined the responsibility of the cold storage to ensure the goods, making the farmers rightful claimants.

Supreme Court’s Decision

The Supreme Court upheld the decisions of the State and National Consumer Disputes Redressal Commissions, ruling that:

- The insurance company was liable to pay for the losses incurred by the farmers.

- The farmers were considered consumers and had the right to seek redress under the Consumer Protection Act.

- The claim amount would be calculated based on the warehouse receipts issued at the time of storage.

- Interest at 12% per annum would be payable from the date of the fire until the final settlement.

Implications of the Judgment

This landmark ruling reinforces the rights of consumers and beneficiaries under insurance policies. It establishes that insurance companies cannot evade liability by relying on technicalities when policies are clearly meant to cover specific risks.

For financial institutions like Canara Bank, the ruling highlights the importance of clear agreements ensuring that insured goods are adequately covered. It also underscores the necessity for insurers to honor valid claims, even if claimants are indirect beneficiaries.

Conclusion

The Supreme Court’s judgment in this case sets a crucial precedent for future disputes involving insurance claims, contractual obligations, and consumer rights. It reinforces that beneficiaries of insurance policies have a legitimate claim, even if they are not direct signatories. This ruling ensures greater accountability in the insurance sector and provides clarity on how insurance contracts should be interpreted to protect the rights of insured parties and their beneficiaries.

Petitioner Name: Canara Bank.Respondent Name: United India Insurance Co. Ltd..Judgment By: Justice S. Abdul Nazeer, Justice Deepak Gupta.Place Of Incident: Sreedevi Cold Storage, Karnataka.Judgment Date: 06-02-2020.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Canara Bank vs United India Insuran Supreme Court of India Judgment Dated 06-02-2020.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Commercial Insurance Disputes

See all petitions in Insurance Settlements

See all petitions in Third-Party Insurance

See all petitions in Other Insurance Cases

See all petitions in Judgment by S. Abdul Nazeer

See all petitions in Judgment by Deepak Gupta

See all petitions in allowed

See all petitions in supreme court of India judgments February 2020

See all petitions in 2020 judgments

See all posts in Insurance Cases Category

See all allowed petitions in Insurance Cases Category

See all Dismissed petitions in Insurance Cases Category

See all partially allowed petitions in Insurance Cases Category