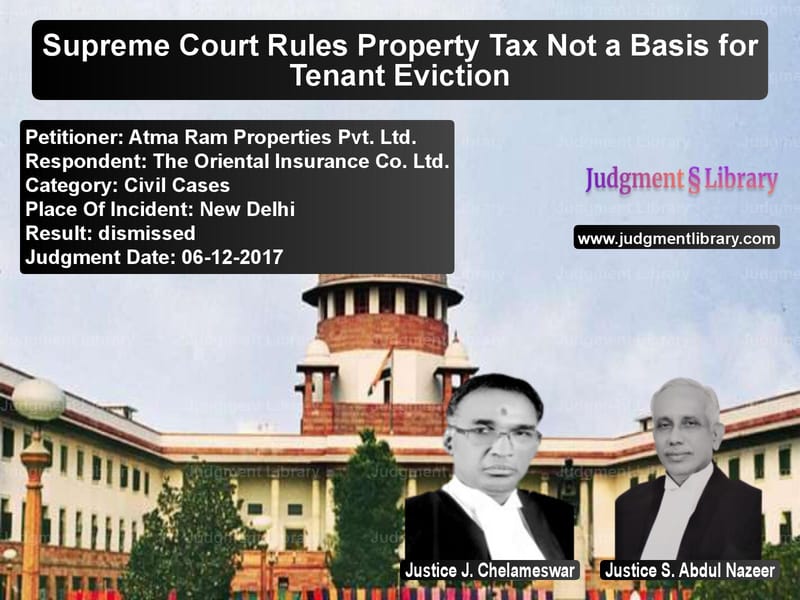

Supreme Court Rules Property Tax Not a Basis for Tenant Eviction

The Supreme Court of India, in the case of Atma Ram Properties Pvt. Ltd. vs. The Oriental Insurance Co. Ltd., delivered an important ruling concerning property tax recoverable from tenants and whether it can be treated as part of rent for eviction proceedings. The case dealt with the interplay between the New Delhi Municipal Council Act, 1994 (NDMC Act) and the Delhi Rent Control Act, 1958 (Rent Act).

The Court held that landlords cannot use unpaid property tax as a ground for eviction, reinforcing the tenant’s protection under the Rent Act. This decision sets a significant precedent in rental disputes and provides clarity on a landlord’s ability to recover municipal taxes from tenants.

Background of the Case

The dispute arose over a commercial property in Connaught Place, New Delhi. The appellant, Atma Ram Properties Pvt. Ltd., was the landlord, while Oriental Insurance Co. Ltd. was the tenant. The legal battle centered on:

- Whether property tax recoverable from a tenant under Section 67(3) of the NDMC Act can be treated as part of rent.

- Whether unpaid property tax could be used to terminate the tenancy and evict the tenant under the Transfer of Property Act, 1882.

- Whether the Rent Act’s protection is lost if the combined rent and property tax exceed Rs. 3,500 per month.

Petitioner’s (Landlord) Arguments

The appellant, Atma Ram Properties Pvt. Ltd., argued that:

- Following the 2009 amendment to the NDMC Act, property tax was calculated based on the Unit Area System, significantly increasing the tax liability.

- The total property tax payable for the rented premises amounted to Rs. 80,392.50 per month, far exceeding the base rent of Rs. 1,438 per month.

- Under Section 67(3) of the NDMC Act, the property tax paid by the landlord is recoverable as “arrears of rent.”

- Since the total amount (rent + recoverable tax) exceeded Rs. 3,500 per month, the tenancy lost protection under the Rent Act.

- The tenant failed to pay its share of property tax despite multiple notices, justifying termination of the lease and eviction.

Respondent’s (Tenant) Arguments

Oriental Insurance Co. Ltd. countered that:

- The contractual rent of the property was Rs. 1,586 per month, keeping the tenancy under Rent Act protection.

- The NDMC Act only allows recovery of tax from tenants, but does not make it a ground for eviction.

- The Rent Act specifically prohibits landlords from recovering taxes as rent, per Section 7(2).

- Any changes in municipal tax laws cannot override the special protections provided by the Rent Act.

- The suit for eviction was barred by Section 50 of the Rent Act, which prevents landlords from evicting tenants except under the grounds listed in the Act.

Supreme Court’s Observations

The Supreme Court, in a judgment delivered by Justice J. Chelameswar and Justice S. Abdul Nazeer, made the following critical observations:

“The Rent Act is a beneficial and restrictive law, providing protection to tenants against arbitrary evictions by landlords.”

Other key points from the ruling include:

- The Rent Act has a non-obstante clause (Section 14) that supersedes any contrary provisions in other laws, including the NDMC Act.

- The NDMC Act does not override the Rent Act in eviction matters.

- The purpose of allowing landlords to recover property tax from tenants under Section 67(3) of the NDMC Act is to prevent undue financial burden on landlords, but it does not provide a basis for eviction.

- Using property tax as a component of rent to push the rental amount over Rs. 3,500 per month is not legally permissible.

- The High Court correctly held that the suit for eviction was not maintainable.

Final Verdict

The Supreme Court:

- Dismissed the landlord’s appeal.

- Ruled that unpaid property tax cannot be treated as rent for the purpose of eviction.

- Affirmed that tenants remain protected under the Rent Act if the contractual rent is below Rs. 3,500 per month.

- Directed that landlords can still recover property tax through civil suits but not as a ground for eviction.

Impact of the Judgment

This ruling has significant implications for landlord-tenant disputes:

- Prevents landlords from using property tax as an eviction tool, ensuring fair protection for tenants.

- Clarifies the scope of the NDMC Act, affirming that it does not override the Rent Act.

- Strengthens tenant rights by reaffirming the special protection under the Rent Act.

- Sets a precedent for similar cases involving municipal taxes and rent control laws.

This landmark judgment reinforces the principles of rental protection in India, ensuring that tenants cannot be arbitrarily evicted based on recoverable taxes.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Atma Ram Properties vs The Oriental Insuran Supreme Court of India Judgment Dated 06-12-2017.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Landlord-Tenant Disputes

See all petitions in Property Disputes

See all petitions in Specific Performance

See all petitions in Judgment by J. Chelameswar

See all petitions in Judgment by S. Abdul Nazeer

See all petitions in dismissed

See all petitions in supreme court of India judgments December 2017

See all petitions in 2017 judgments

See all posts in Civil Cases Category

See all allowed petitions in Civil Cases Category

See all Dismissed petitions in Civil Cases Category

See all partially allowed petitions in Civil Cases Category