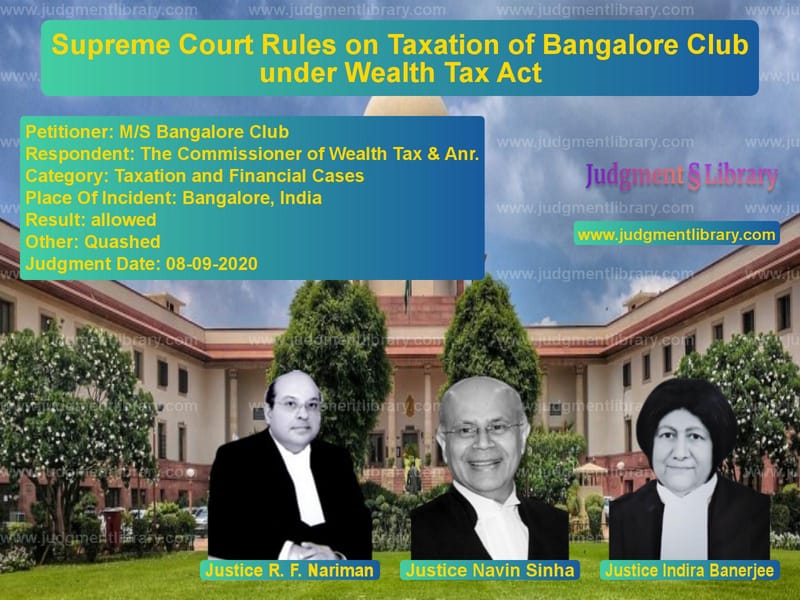

Supreme Court Rules on Taxation of Bangalore Club under Wealth Tax Act

The Supreme Court of India delivered a crucial judgment in the case of M/S Bangalore Club vs. The Commissioner of Wealth Tax & Anr., addressing whether the Bangalore Club, a social institution, could be taxed under the Wealth Tax Act. This case has been significant in determining the applicability of tax laws to clubs and associations that are not engaged in business or profit-making activities.

Background of the Case

The Bangalore Club, established in 1868 during British rule, was a social club that provided recreational and cultural facilities to its members. Despite its non-commercial nature, the tax authorities sought to bring the club under the ambit of the Wealth Tax Act.

The primary question before the court was whether the assets of the club were liable for taxation under the Wealth Tax Act, particularly in light of Section 21AA, which dealt with the taxation of an ‘Association of Persons’ (AOP) where the individual shares of members were indeterminate.

Petitioners’ Arguments

The Bangalore Club contended:

- It was a social club and not engaged in any business or profit-making activity.

- The principles of mutuality applied, meaning members contributed to the club and received benefits in return, ruling out taxation.

- The definition of ‘Association of Persons’ in tax law historically referred to entities formed with the intent to generate income or profit, which was not the case for the Bangalore Club.

- Under the club’s dissolution rule, any remaining assets were to be distributed equally among members, making the shares determinate and known, negating the applicability of Section 21AA.

Respondents’ Arguments

The tax department, represented by the Commissioner of Wealth Tax, argued:

- The club operated as an ‘Association of Persons’ and hence was liable for wealth tax.

- The membership was fluctuating, making individual shares indeterminate, thus attracting Section 21AA.

- The Bangalore Club had assets and investments generating income, making it taxable under the Wealth Tax Act.

Supreme Court’s Observations

On the Definition of ‘Association of Persons’

The Supreme Court extensively examined the meaning of an ‘Association of Persons’ in taxation laws. It held that the term traditionally referred to a collective of individuals pursuing a common objective, typically profit generation. In this case, the Bangalore Club had no business or commercial intent, as it solely functioned for the benefit of its members.

On the Principle of Mutuality

The Court reaffirmed the principle of mutuality, emphasizing that an entity cannot be taxed on income derived from its own members. Since the Bangalore Club operated on funds contributed by its members and provided facilities exclusively for them, it did not qualify as a taxable entity under the Wealth Tax Act.

On Section 21AA Applicability

The Court scrutinized Section 21AA, which imposes wealth tax on an association of persons with indeterminate shares. The Court found that since Rule 35 of the Bangalore Club’s regulations clearly specified that any surplus on dissolution would be equally distributed among members, the shares were determinate. Therefore, Section 21AA did not apply.

Final Judgment

The Supreme Court ruled in favor of the Bangalore Club, holding that:

- The club was not an ‘Association of Persons’ in the context of tax law.

- The principle of mutuality prevented it from being taxed under the Wealth Tax Act.

- Section 21AA did not apply, as the individual shares of members were determinate.

- The High Court’s ruling was incorrect, and the assessment order imposing wealth tax was set aside.

Legal Implications

This ruling sets an important precedent regarding the taxation of social clubs and associations. It clarifies that entities formed solely for the benefit of members, without a commercial or profit-making objective, cannot be brought under the Wealth Tax Act. Additionally, it reinforces the principle of mutuality, ensuring that contributions made by members to an association for collective benefits remain non-taxable.

Conclusion

The Supreme Court’s judgment in M/S Bangalore Club vs. The Commissioner of Wealth Tax & Anr. provides much-needed clarity on the taxation of social clubs and similar institutions. By ruling that the Bangalore Club is not liable for wealth tax, the Court has reaffirmed the principles of mutuality and fairness in tax laws, ensuring that social and recreational clubs are not unfairly burdened by taxes intended for commercial entities.

Petitioner Name: M/S Bangalore Club.Respondent Name: The Commissioner of Wealth Tax & Anr..Judgment By: Justice R. F. Nariman, Justice Navin Sinha, Justice Indira Banerjee.Place Of Incident: Bangalore, India.Judgment Date: 08-09-2020.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: MS Bangalore Club vs The Commissioner of Supreme Court of India Judgment Dated 08-09-2020.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Tax Evasion Cases

See all petitions in Income Tax Disputes

See all petitions in Banking Regulations

See all petitions in Judgment by Rohinton Fali Nariman

See all petitions in Judgment by Navin Sinha

See all petitions in Judgment by Indira Banerjee

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments September 2020

See all petitions in 2020 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category