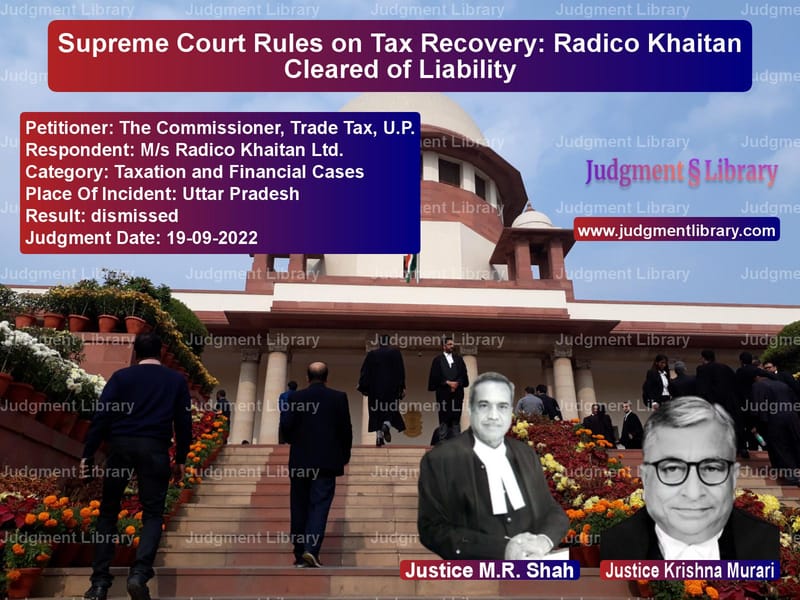

Supreme Court Rules on Tax Recovery: Radico Khaitan Cleared of Liability

The Supreme Court of India recently delivered a significant judgment in the case of The Commissioner, Trade Tax, U.P. vs. M/s Radico Khaitan Ltd., clarifying the applicability of tax recovery proceedings on a bona fide purchaser of assets from a tax-defaulting company. The Court ruled that Radico Khaitan Ltd. could not be held liable for the trade tax dues of the original assessee, M/s Shaw Scott Distillery (P) Ltd., as the sale of assets occurred before the reassessment proceedings commenced.

Background of the Case

The dispute arose when the Uttar Pradesh Trade Tax Department attempted to recover outstanding trade tax dues of M/s Shaw Scott Distillery (P) Ltd., a company in Rampur, from M/s Radico Khaitan Ltd., which had purchased certain assets of the defaulter in 1985-86.

The key facts of the case were:

- The original assessee, M/s Shaw Scott Distillery, owed trade tax amounting to Rs. 11,28,877 for the year 1980-81 and Rs. 53,89,035 for the year 1981-82.

- Radico Khaitan Ltd. purchased the plant, machinery, and goods of Shaw Scott Distillery on December 12, 1985 and January 1, 1986 for a total sum of Rs. 12,12,000.

- The Trade Tax Department issued a recovery certificate against Shaw Scott Distillery in 1990 and later endorsed the certificate against Radico Khaitan Ltd. in 1993.

- The Assessing Officer invoked Section 34 of the U.P. Trade Tax Act, declaring the asset transfers void, claiming they were made to defraud the revenue.

Legal Proceedings

Arguments by the Revenue (Appellant)

- The Revenue contended that the sale of assets to Radico Khaitan Ltd. was executed with the intent to evade tax dues.

- The recovery certificate issued against Shaw Scott Distillery was legally enforceable against the purchaser under Section 34 of the U.P. Trade Tax Act.

- The sale should be considered void since the seller was already under liability for unpaid trade tax.

Arguments by Radico Khaitan Ltd. (Respondent)

- The respondent argued that no tax proceedings were pending against Shaw Scott Distillery at the time of the purchase in 1985-86.

- The assessment proceedings had concluded in 1984 and were reopened only in 1988, meaning the purchase had taken place in good faith before any tax liability was revived.

- Radico Khaitan Ltd. was a bona fide purchaser and had no involvement in any attempt to defraud the Revenue.

Supreme Court’s Observations

A bench comprising Justice M.R. Shah and Justice Krishna Murari examined the case and made the following observations:

1. Section 34 of the U.P. Trade Tax Act Was Not Applicable

The Court noted that Section 34 applies only if a transfer of immovable property occurs during the pendency of tax proceedings and is made to defraud tax authorities. The judgment stated:

“In the present case, at the time of transfer in 1985-86, no assessment or recovery proceedings were pending.”

2. Protection for Bona Fide Purchasers

The Court ruled that the transaction between Shaw Scott Distillery and Radico Khaitan Ltd. was executed in good faith and for valuable consideration. The ruling stated:

“Nothing in Section 34 shall impair the rights of a transferee in good faith and for consideration.”

3. Timing of Tax Proceedings

The Court highlighted that:

- The asset purchase took place in 1985-86.

- The assessment proceedings were reopened in 1988.

- The recovery certificate against Shaw Scott Distillery was issued only in 1990.

- The endorsement of the recovery certificate against Radico Khaitan Ltd. was made in 1993.

Based on these facts, the Court concluded:

“Since no proceedings were pending when the sale occurred, the subsequent reopening of assessments and tax recovery attempts against the purchaser were legally untenable.”

4. Dismissal of Revenue’s Appeal

The Supreme Court dismissed the appeal and upheld the decisions of the Trade Tax Tribunal and the Allahabad High Court, which had both ruled in favor of Radico Khaitan Ltd.

Final Verdict

The Supreme Court ruled as follows:

- The appeal by the Revenue was dismissed.

- The judgment of the Trade Tax Tribunal, which set aside the endorsement of the recovery certificate against Radico Khaitan Ltd., was upheld.

- Radico Khaitan Ltd. was not liable for the tax dues of Shaw Scott Distillery.

Impact of the Judgment

This ruling has significant implications for tax recovery proceedings and the rights of bona fide purchasers:

- It reinforces that Section 34 of the U.P. Trade Tax Act cannot be applied retroactively to transactions that occurred before tax liabilities were established.

- It provides legal protection to bona fide purchasers who acquire assets in good faith.

- It restricts tax authorities from recovering dues from unrelated parties unless clear evidence of tax fraud exists.

Conclusion

The Supreme Court’s ruling in The Commissioner, Trade Tax, U.P. vs. M/s Radico Khaitan Ltd. is a landmark judgment that upholds the principle that tax liabilities cannot be arbitrarily imposed on bona fide purchasers. By ensuring that Section 34 is applied only in appropriate cases, the Court has strengthened legal safeguards for businesses engaging in asset transactions.

Petitioner Name: The Commissioner, Trade Tax, U.P..Respondent Name: M/s Radico Khaitan Ltd..Judgment By: Justice M.R. Shah, Justice Krishna Murari.Place Of Incident: Uttar Pradesh.Judgment Date: 19-09-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: the-commissioner,-tr-vs-ms-radico-khaitan-l-supreme-court-of-india-judgment-dated-19-09-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Tax Evasion Cases

See all petitions in Income Tax Disputes

See all petitions in Banking Regulations

See all petitions in Judgment by Mukeshkumar Rasikbhai Shah

See all petitions in Judgment by Krishna Murari

See all petitions in dismissed

See all petitions in supreme court of India judgments September 2022

See all petitions in 2022 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category