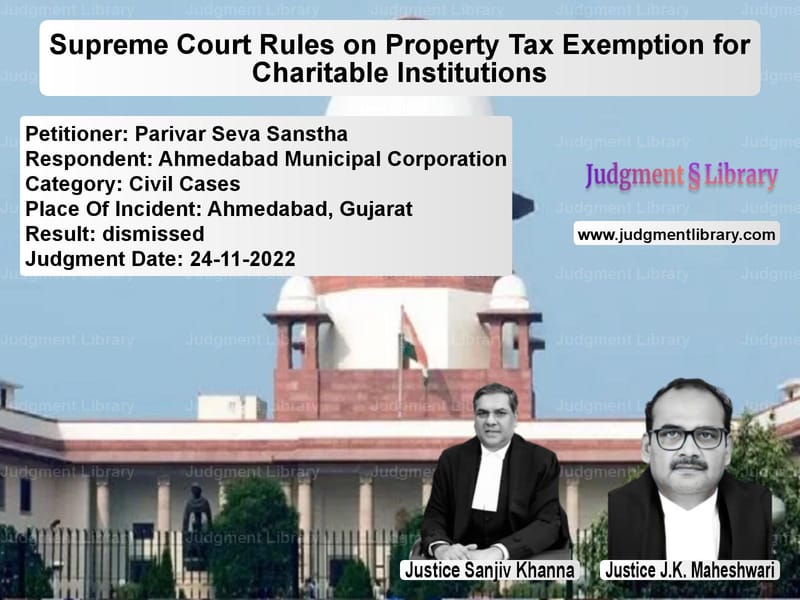

Supreme Court Rules on Property Tax Exemption for Charitable Institutions

The Supreme Court of India recently delivered an important judgment in the case of Parivar Seva Sanstha vs. Ahmedabad Municipal Corporation, which revolved around the question of whether charitable institutions operating under the Gujarat Provincial Municipal Corporations Act, 1949, could claim property tax exemptions when taxes were levied under the carpet area method.

This ruling sets a precedent in municipal taxation, determining that property tax exemptions granted under Section 132(1)(b) of the Gujarat Provincial Municipal Corporations (GPMC) Act apply only to assessments based on the rateable value method and not when the tax is computed using the carpet area method.

Background of the Case

The appeals were filed by two charitable trusts, Parivar Seva Sanstha and Bai Gulab Hargovandas Jagjivandasni Dikarina Will Trust, against the Ahmedabad Municipal Corporation. The trusts challenged the Corporation’s decision to levy general tax on their properties despite their charitable status.

Under the provisions of the GPMC Act, the Corporation has the authority to levy property tax under two systems:

- Rateable Value Method (Section 129): Tax is calculated based on the rateable value of buildings and lands.

- Carpet Area Method (Section 141AA): Tax is determined based on the carpet area of the property, with applicable rates per square meter.

The trusts claimed an exemption under Section 132(1)(b), which provides relief for buildings used for public worship or charitable purposes. However, the Corporation argued that the exemption only applied when tax was assessed under the rateable value system and not under the carpet area method.

Arguments by the Parties

Appellants (Charitable Trusts)

- Claimed that their buildings were being used solely for public charitable purposes and were thus entitled to tax exemptions under Section 132(1)(b) of the GPMC Act.

- Argued that denying exemptions based on the method of taxation was arbitrary and violated Article 14 of the Constitution of India.

- Contended that the carpet area method should not nullify their right to tax exemptions, as the legislative intent behind Section 132(1)(b) was to support charitable activities.

Respondent (Ahmedabad Municipal Corporation)

- Maintained that Section 132(1)(b) was explicitly linked to taxation under the rateable value method and did not extend to properties assessed under the carpet area method.

- Argued that Section 141AA, which introduced the carpet area method, did not incorporate any provision for exemptions under Section 132(1)(b).

- Submitted that once the Corporation opted for the carpet area method, the previous tax exemption provisions ceased to apply.

Observations by the Supreme Court

The Supreme Court conducted a detailed analysis of the legislative framework governing municipal taxation. Key observations included:

- The structure of the GPMC Act indicates a clear distinction between the two methods of taxation.

- Section 132(1)(b) applies specifically when tax is levied on a rateable value basis, whereas the carpet area method is governed by a separate set of provisions (Sections 141AA-141F).

- The legislature did not incorporate an explicit exemption clause under Section 141AA for properties used for charitable purposes.

- Applying Section 132(1)(b) to the carpet area method would require judicial legislation, which is beyond the Court’s role.

The Court quoted:

“The legislative scheme makes it crystal clear that the exemption under clause (b) to sub-section (1) of Section 132 applies only when property tax is computed under Section 129 read with Section 132. It does not apply to cases where the tax is levied using the carpet area method.”

Final Verdict

The Supreme Court dismissed the appeals and ruled as follows:

- The charitable trusts were not entitled to an exemption under Section 132(1)(b) when property tax was assessed under the carpet area method.

- The Ahmedabad Municipal Corporation’s decision to impose general tax on the properties of the trusts was upheld.

- The legislative intent was to create a distinction between tax assessments under rateable value and carpet area methods, and exemptions must be expressly provided in the law.

Impact of the Ruling

This ruling has significant implications for property tax exemptions in municipal governance. Key takeaways include:

- Clarification on Tax Exemptions: Charitable institutions seeking tax relief must verify whether the exemption applies under the taxation method adopted by the local authority.

- Judicial Restraint: The judgment reaffirms that courts cannot extend exemptions not explicitly provided in the law.

- Potential Policy Changes: State legislatures may need to amend taxation laws if they wish to extend exemptions under the carpet area method.

Conclusion

The Supreme Court’s decision establishes a clear distinction between tax assessment methods and their respective exemptions. While charitable institutions remain eligible for tax relief under the rateable value system, they cannot claim the same under the carpet area method unless explicitly provided for by law.

This ruling underscores the importance of statutory interpretation and ensures that municipal taxation remains consistent with legislative intent.

Petitioner Name: Parivar Seva Sanstha.Respondent Name: Ahmedabad Municipal Corporation.Judgment By: Justice Sanjiv Khanna, Justice J.K. Maheshwari.Place Of Incident: Ahmedabad, Gujarat.Judgment Date: 24-11-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: parivar-seva-sanstha-vs-ahmedabad-municipal-supreme-court-of-india-judgment-dated-24-11-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Property Disputes

See all petitions in Tax Refund Disputes

See all petitions in Damages and Compensation

See all petitions in Judgment by Sanjiv Khanna

See all petitions in Judgment by J.K. Maheshwari

See all petitions in dismissed

See all petitions in supreme court of India judgments November 2022

See all petitions in 2022 judgments

See all posts in Civil Cases Category

See all allowed petitions in Civil Cases Category

See all Dismissed petitions in Civil Cases Category

See all partially allowed petitions in Civil Cases Category