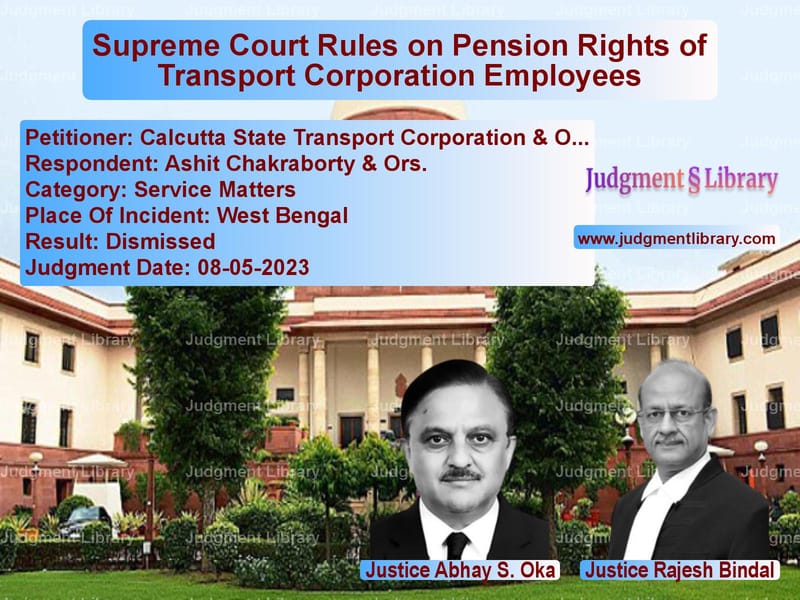

Supreme Court Rules on Pension Rights of Transport Corporation Employees

The case of Calcutta State Transport Corporation & Ors. v. Ashit Chakraborty & Ors. deals with a critical issue concerning pension entitlements of employees under the Calcutta State Transport Corporation Employees’ Service (Death-cum-Retirement Benefits) Regulations, 1990. The Supreme Court was called upon to decide whether an employee who had opted for the pension scheme but continued to have contributions deducted towards the Contributory Provident Fund (CPF) scheme could be denied pension benefits upon retirement.

The judgment is significant as it clarifies the rights of employees in cases where employers fail to properly implement pension schemes, ensuring that employees do not suffer due to administrative lapses.

Background of the Case

The respondent, Ashit Chakraborty, was appointed as a Conductor in the Calcutta State Transport Corporation (CSTC) on July 6, 1981. At the time of his appointment, the Contributory Provident Fund (CPF) scheme was in force. In 1991, CSTC introduced a pension scheme under the 1990 Regulations, effective retrospectively from April 1, 1984. Employees were given a six-month window to opt for the pension scheme.

Read also: https://judgmentlibrary.com/supreme-court-upholds-ibcs-workmen-dues-provision-in-liquidation-cases/

The key facts of the case are:

- The respondent opted for the pension scheme in 1991.

- Despite this, deductions towards the CPF scheme continued from his salary.

- On July 21, 2017, he opted for voluntary retirement, which was accepted, and he retired on July 31, 2017.

- Upon retirement, he was paid CPF contributions (Rs. 13,28,495), gratuity (Rs. 7,44,265), VRS compensation (Rs. 2,58,012), and leave salary (Rs. 2,409).

- He was not granted a pension, prompting him to file a representation on May 8, 2018.

- After receiving no response, he filed a writ petition before the High Court.

Petitioner’s Arguments

The appellants, Calcutta State Transport Corporation, represented by their counsel, argued:

- Although the respondent initially opted for the pension scheme, his continued deductions towards CPF indicated an implied acceptance of the CPF scheme.

- Since the respondent never objected to CPF deductions, he had effectively waived his right to pension.

- Allowing pension benefits would set a precedent where many similarly situated employees could raise similar claims.

Respondent’s Arguments

The respondent, Ashit Chakraborty, countered:

- He had exercised his option for pension within the required timeframe, fulfilling the legal requirement.

- It was the duty of CSTC to ensure correct deductions were made and not his responsibility to verify salary breakdowns.

- He accepted the CPF payout in good faith, assuming it was part of his retirement benefits, and only later realized he had been wrongfully excluded from the pension scheme.

- The High Court’s decision to allow pension while requiring the return of excess CPF amounts with interest was equitable and fair.

Supreme Court Judgment

The case was heard by Justice Abhay S. Oka and Justice Rajesh Bindal. The Supreme Court upheld the High Court’s decision, affirming that the respondent was entitled to pension benefits.

1. Employee’s Right to Pension

The Court ruled that the respondent had a legal right to receive a pension as he had opted for the pension scheme in 1991:

“It is not in dispute that the respondent no.1 had exercised his right to receive pension under the 1990 Regulations in the year 1991. Thereafter, it was the duty of the Corporation to have given effect to the same.”

2. Employer’s Duty in Salary Deductions

The Court rejected the argument that continued CPF deductions constituted a waiver of pension rights:

“Merely because there were some wrong deductions from his salary and he was treated as a member of the CPF Scheme, cannot be permitted to be raised as a ground to defeat his rightful claim.”

3. Refund of Excess Payments

The Court upheld the High Court’s directive that the respondent must refund the employer’s share of the CPF contributions along with excess gratuity, but with interest:

“The amount, which was not due to the respondent no.1, has been directed to be refunded to the appellant Corporation along with interest and same interest is required to be paid to him on release of arrears of pension.”

4. Precedent for Future Cases

The Court dismissed the Corporation’s argument that other employees might raise similar claims:

“The argument that there are number of similarly situated employees who will also stake their claims, will not deter this Court in granting the relief to the respondent, which is legitimately due to him.”

Final Verdict

The Supreme Court ruled:

- The respondent is entitled to pension under the 1990 Regulations.

- He must refund the employer’s share of CPF and excess gratuity, with interest.

- The Corporation must start paying the respondent’s pension within two weeks of receiving the refunded amount.

- Arrear pension from August 2017 to July 2018 must be paid in three equal installments, with interest at 6% per annum.

Conclusion

This judgment ensures that employees who validly opt for pension schemes cannot be deprived of their rightful benefits due to administrative lapses. The ruling affirms that pension is a vested right and reinforces the responsibility of employers to correctly implement employee benefits.

Petitioner Name: Calcutta State Transport Corporation & Ors..Respondent Name: Ashit Chakraborty & Ors..Judgment By: Justice Abhay S. Oka, Justice Rajesh Bindal.Place Of Incident: West Bengal.Judgment Date: 08-05-2023.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: calcutta-state-trans-vs-ashit-chakraborty-&-supreme-court-of-india-judgment-dated-08-05-2023.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Pension and Gratuity

See all petitions in Public Sector Employees

See all petitions in Employment Disputes

See all petitions in Judgment by Abhay S. Oka

See all petitions in Judgment by Rajesh Bindal

See all petitions in dismissed

See all petitions in supreme court of India judgments May 2023

See all petitions in 2023 judgments

See all posts in Service Matters Category

See all allowed petitions in Service Matters Category

See all Dismissed petitions in Service Matters Category

See all partially allowed petitions in Service Matters Category