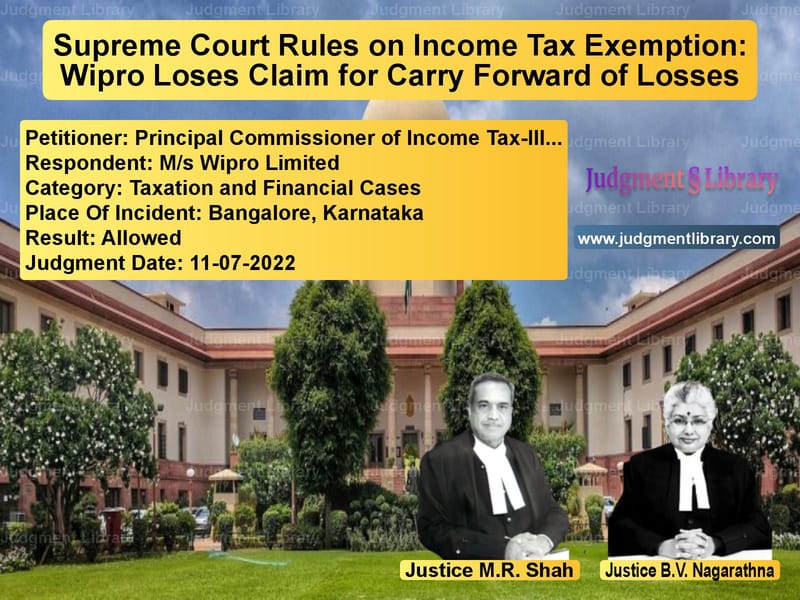

Supreme Court Rules on Income Tax Exemption: Wipro Loses Claim for Carry Forward of Losses

The Supreme Court of India, in the case of Principal Commissioner of Income Tax-III, Bangalore vs. M/s Wipro Limited, ruled in favor of the Income Tax Department, denying Wipro Limited’s claim to carry forward losses under Section 72 of the Income Tax Act, 1961. The Court held that Wipro failed to comply with the mandatory twin conditions under Section 10B(8) for opting out of the tax exemption, making the company ineligible for claiming losses.

This decision establishes the strict interpretation of tax exemption provisions and reinforces the requirement for timely compliance with tax laws.

Background of the Case

Wipro Limited, a 100% export-oriented unit (EOU), filed its income tax return on October 31, 2001, for the assessment year 2001-02, declaring a loss of Rs. 15.47 crore and claiming exemption under Section 10B of the Income Tax Act. Along with the return, the company submitted a note stating that since it was a 100% EOU, it was not carrying forward any losses.

On October 24, 2002, nearly a year later, Wipro filed a declaration before the Assessing Officer (AO) stating that it wished to opt out of the exemption under Section 10B and instead claim a carry forward of losses under Section 72. It subsequently filed a revised return on December 23, 2002, dropping the exemption claim and opting to carry forward losses.

The AO rejected the withdrawal of exemption, citing that the declaration was filed after the due date of filing the return (October 31, 2001), thus violating Section 10B(8). Consequently, Wipro’s claim to carry forward losses was denied.

Key Legal Issues

- Was Wipro eligible to opt out of the Section 10B exemption after the due date of filing the original return?

- Did Wipro’s delayed filing of the declaration impact its right to carry forward losses under Section 72?

- Was the requirement under Section 10B(8) of filing a declaration before the due date mandatory or procedural?

Arguments Presented

Petitioner’s (Income Tax Department) Arguments:

- Section 10B(8) explicitly states that an assessee must file a declaration opting out of the exemption before the due date of filing the return.

- Wipro failed to meet this requirement by submitting its declaration nearly a year later, invalidating its claim to carry forward losses.

- Allowing such retrospective changes would nullify the purpose of tax exemptions and cause revenue losses.

- The High Court erred in considering the time limit under Section 10B(8) as directory rather than mandatory.

Respondent’s (Wipro Limited) Arguments:

- The requirement under Section 10B(8) is procedural and should not affect the substantive right to opt out of the exemption.

- Since the declaration was filed before the assessment proceedings were completed, it should be considered valid.

- The objective of the provision is to allow businesses to decide whether they want the exemption, and minor procedural delays should not invalidate substantive tax benefits.

- Past judgments, such as the Delhi High Court ruling in Moser Baer India Ltd., treated similar procedural requirements as directory rather than mandatory.

Supreme Court’s Observations and Ruling

The Supreme Court ruled in favor of the Income Tax Department and held:

- Section 10B(8) of the IT Act contains twin conditions: (1) filing a declaration opting out of the exemption, and (2) filing it before the due date of return under Section 139(1).

- Both conditions are mandatory, and failure to comply with the due date requirement invalidates the declaration.

- Tax exemption laws must be strictly interpreted, and procedural requirements cannot be relaxed at the taxpayer’s convenience.

- The High Court erred in treating the deadline for filing the declaration as directory.

- Since Wipro did not file the declaration before October 31, 2001, it was not entitled to carry forward losses under Section 72.

The Supreme Court stated:

“For claiming the benefit under Section 10B(8), the twin conditions of furnishing a declaration before the Assessing Officer and filing it before the due date of filing the original return are mandatory. Non-compliance renders the claim invalid.”

The Court overruled the Karnataka High Court’s judgment, restoring the original assessment order that denied Wipro’s claim.

Key Takeaways from the Judgment

- Taxpayers must strictly comply with procedural requirements when opting out of exemptions.

- Filing a revised return does not cure non-compliance with statutory deadlines.

- Courts will not treat mandatory deadlines as directory in tax matters.

- Taxpayers cannot retrospectively alter their tax positions after the due date.

Impact of the Judgment

- This ruling reinforces the principle that procedural deadlines in tax exemptions are crucial and cannot be ignored.

- It sets a precedent that businesses cannot retroactively modify tax positions after the due date.

- Tax authorities are likely to apply stricter scrutiny to claims of exemption withdrawals and loss carry forwards.

- Companies must ensure compliance with statutory deadlines to avoid adverse tax consequences.

Conclusion

The Supreme Court’s ruling in this case highlights the importance of strict compliance with tax provisions. By holding that the deadline under Section 10B(8) is mandatory, the Court has reinforced the need for businesses to adhere to legal procedures when opting out of tax exemptions. This decision serves as a cautionary precedent for companies seeking to modify their tax filings post facto, ensuring greater accountability and compliance with tax laws.

Petitioner Name: Principal Commissioner of Income Tax-III, Bangalore.Respondent Name: M/s Wipro Limited.Judgment By: Justice M.R. Shah, Justice B.V. Nagarathna.Place Of Incident: Bangalore, Karnataka.Judgment Date: 11-07-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: principal-commission-vs-ms-wipro-limited-supreme-court-of-india-judgment-dated-11-07-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Evasion Cases

See all petitions in Tax Refund Disputes

See all petitions in Judgment by Mukeshkumar Rasikbhai Shah

See all petitions in Judgment by B.V. Nagarathna

See all petitions in allowed

See all petitions in supreme court of India judgments July 2022

See all petitions in 2022 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category