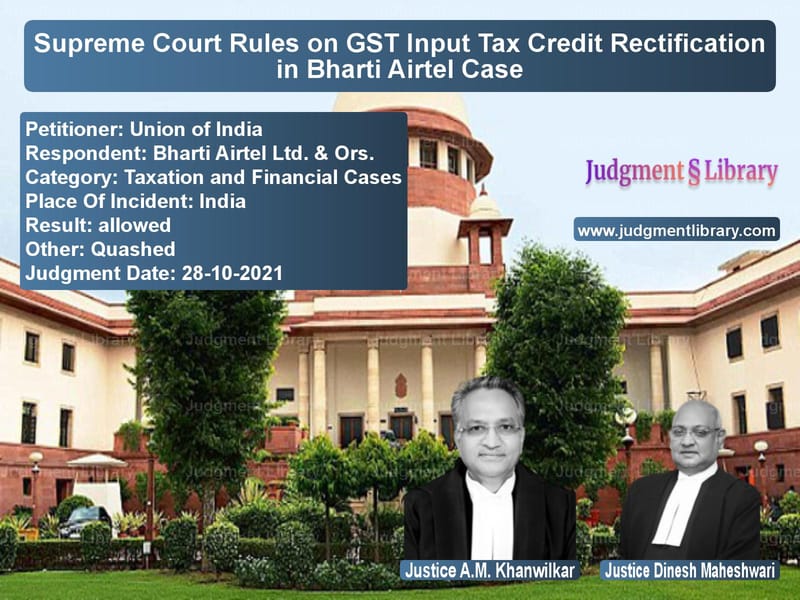

Supreme Court Rules on GST Input Tax Credit Rectification in Bharti Airtel Case

The Supreme Court of India recently delivered a significant judgment in the case of Union of India vs. Bharti Airtel Ltd. & Ors., concerning the rectification of Input Tax Credit (ITC) claims under the Goods and Services Tax (GST) regime. The ruling sets a precedent regarding the rectification of Form GSTR-3B and the application of GST laws governing self-assessment and filing procedures.

Background of the Case

The dispute originated when Bharti Airtel Ltd. filed a writ petition before the Delhi High Court challenging Circular No. 26/26/2017-GST, issued on December 29, 2017. This circular restricted the rectification of Form GSTR-3B to the month in which errors were noticed rather than the period in which they occurred. Bharti Airtel argued that this restriction caused undue financial hardship, as it was unable to utilize excess ITC for the period from July to September 2017.

Initially, the Delhi High Court ruled in favor of Bharti Airtel, allowing it to rectify the GST returns for the period when the errors occurred. However, the Union of India challenged this decision in the Supreme Court, arguing that the High Court’s ruling was inconsistent with GST laws.

Arguments of the Petitioner (Union of India)

The Union of India, represented by Additional Solicitor General N. Venkataraman, argued:

- Section 39(9) of the Central Goods and Services Tax (CGST) Act explicitly states that rectification of errors in Form GSTR-3B must be done in the return for the month in which the errors are noticed.

- The GST system is based on self-assessment, and registered taxpayers are required to maintain accurate records and determine their tax liability accordingly.

- Allowing retrospective rectification would disrupt the tax administration system, create compliance issues, and lead to a potential loss of revenue.

- The ITC mechanism was always subject to restrictions, and businesses were aware that a seamless rectification system was not available when GST was introduced in 2017.

Arguments of the Respondents (Bharti Airtel Ltd. & Others)

Senior Counsel Harish Salve, appearing for Bharti Airtel, argued:

- Bharti Airtel was entitled to rectify its Form GSTR-3B for July-September 2017 because the ITC records were not fully available at that time due to technical limitations in the GST portal.

- The delay in operationalizing Form GSTR-2A (which provides a summary of ITC) led to the miscalculation of ITC, forcing Bharti Airtel to pay an excess amount in cash instead of utilizing the available ITC.

- The government’s failure to ensure a functional GST return system should not penalize businesses that were complying in good faith.

- Allowing rectification of the actual period of error would ensure fairness and prevent unnecessary cash outflows.

Supreme Court’s Judgment

After reviewing the arguments, the Supreme Court ruled in favor of the Union of India, overturning the Delhi High Court’s decision. The Court held that:

- Self-assessment is the core principle of the GST system, and registered taxpayers are responsible for accurately reporting their ITC and tax liabilities.

- Section 39(9) of the CGST Act mandates that rectifications in GST returns should be made in the period in which errors are noticed, not the period in which they originally occurred.

- The rectification of Form GSTR-3B for past periods would disrupt the tax administration process and create cascading effects for other taxpayers.

- The absence of a real-time ITC matching system at the initial stages of GST implementation does not justify retrospective changes in returns.

Implications of the Judgment

The Supreme Court’s ruling has significant implications for businesses and tax administration in India:

- Businesses must be diligent in self-assessing ITC and tax liabilities, as retrospective rectifications will not be permitted.

- Errors in GST filings must be corrected in the subsequent period’s return rather than revising past returns.

- The judgment reinforces the importance of maintaining accurate records and reconciling ITC claims regularly.

- Taxpayers who overpaid due to miscalculated ITC may not be able to recover the excess payment directly but can only adjust it in future returns.

Conclusion

The Supreme Court’s decision in the Bharti Airtel case reaffirms the structured compliance mechanism under GST laws. It emphasizes that businesses must exercise due diligence in filing returns and cannot rely on post-facto rectifications for past periods. While this ruling ensures the stability of tax administration, it also places greater responsibility on businesses to maintain accurate financial records.

Petitioner Name: Union of India.Respondent Name: Bharti Airtel Ltd. & Ors..Judgment By: Justice A.M. Khanwilkar, Justice Dinesh Maheshwari.Place Of Incident: India.Judgment Date: 28-10-2021.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: union-of-india-vs-bharti-airtel-ltd.-&-supreme-court-of-india-judgment-dated-28-10-2021.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in GST Law

See all petitions in Tax Refund Disputes

See all petitions in Judgment by A M Khanwilkar

See all petitions in Judgment by Dinesh Maheshwari

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments October 2021

See all petitions in 2021 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category