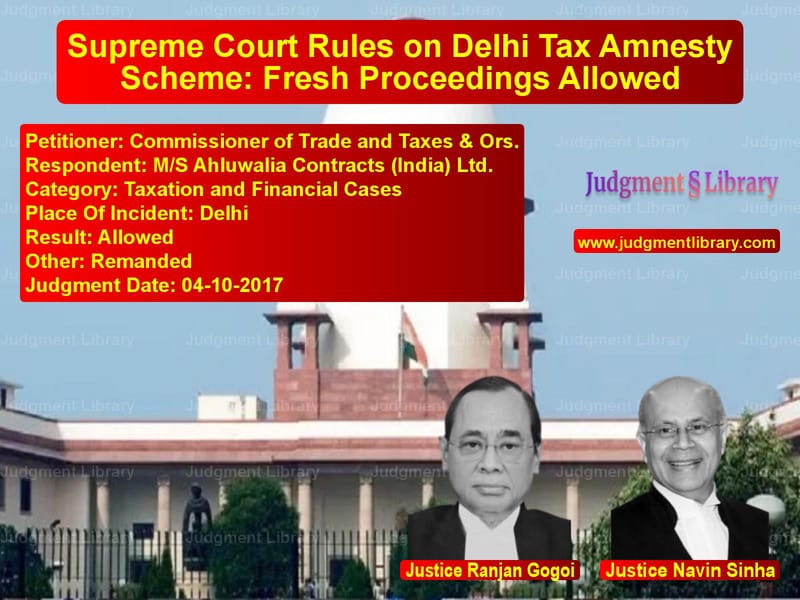

Supreme Court Rules on Delhi Tax Amnesty Scheme: Fresh Proceedings Allowed

The case of Commissioner of Trade and Taxes & Ors. vs. M/S Ahluwalia Contracts (India) Ltd. revolves around the applicability of the Delhi Tax Compliance Achievement Scheme, 2013 (Amnesty Scheme) under the Delhi Value Added Tax (DVAT) Act, 2004. The Supreme Court was called upon to determine whether the Designated Authority under the scheme had the jurisdiction to issue a show cause notice and whether the Revenue could initiate fresh proceedings after a delay.

Background of the Case

The respondent, M/S Ahluwalia Contracts (India) Ltd., filed a declaration under the Amnesty Scheme to settle tax liabilities. The Designated Authority issued an acknowledgment of discharge after the company paid the tax dues as per the scheme. However, on January 16, 2015, the Additional Commissioner (Special Zone), Department of Trade and Taxes, New Delhi, issued a show cause notice under Clause 8 of the scheme, alleging that the declaration made by the company was false.

The respondent replied on January 27, 2015, but the authority proceeded with adjudication, resulting in an order dated February 11, 2015, against which the respondent filed a writ petition before the Delhi High Court.

Legal Issues in the Case

- Whether the Additional Commissioner had the jurisdiction to issue a show cause notice under Clause 8 of the Amnesty Scheme.

- Whether the Revenue was barred from issuing a fresh notice after the expiration of the limitation period under Clause 8(3).

- Whether the High Court was correct in quashing the proceedings initiated by the Revenue.

Arguments of the Petitioners (Commissioner of Trade and Taxes & Ors.)

- The government order dated April 30, 2014, delegated the power to the Designated Authority to decide applications under the scheme.

- The power to dispose of applications necessarily included the power to reopen cases where declarations were found to be false.

- The failure of the respondent to challenge the jurisdiction of the Additional Commissioner during adjudication should preclude them from raising the issue later in a writ petition.

Arguments of the Respondent (M/S Ahluwalia Contracts (India) Ltd.)

- The power to issue show cause notices under Clause 8 was exclusively vested in the Commissioner and was not delegated to the Designated Authority.

- The Amnesty Scheme required show cause notices to be issued within one year of the declaration date, and the period had already lapsed.

- The respondent could not be penalized for the Revenue’s failure to act within the stipulated time frame.

Supreme Court’s Observations

The Supreme Court analyzed the provisions of the Amnesty Scheme, focusing on Clause 8, which empowered the Commissioner to reopen cases where false declarations were made. The Court found that:

- The Additional Commissioner was not the competent authority to issue the show cause notice, as no delegation of power under Clause 8 had been made.

- The respondent had the right to challenge jurisdiction in the writ petition despite failing to do so during adjudication.

- The High Court erred in holding that fresh proceedings were completely barred after the expiry of the limitation period.

The Court stated:

“The power to issue notices under Clause 8 is vested in the Commissioner. The absence of a timely challenge does not confer jurisdiction where none exists.”

Final Ruling

The Supreme Court issued the following directions:

- The show cause notice issued by the Additional Commissioner was quashed.

- The Revenue was permitted to issue a fresh show cause notice under Clause 8, provided it was done by the Commissioner or a properly designated authority.

- The order of the High Court barring fresh proceedings was set aside.

- The respondent was directed to cooperate with any new proceedings initiated under the scheme.

The Court ruled:

“The legislative intent of the Amnesty Scheme does not preclude the Revenue from correcting procedural errors, provided due process is followed.”

Conclusion

This judgment clarifies the scope of the Delhi Tax Compliance Achievement Scheme and upholds the principle that procedural irregularities should not obstruct substantive justice. It reinforces the need for clear delegation of authority in taxation matters while ensuring that tax evasion is not overlooked due to technical lapses.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Commissioner of Trad vs MS Ahluwalia Contra Supreme Court of India Judgment Dated 04-10-2017.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Tax Refund Disputes

See all petitions in Banking Regulations

See all petitions in Income Tax Disputes

See all petitions in Judgment by Ranjan Gogoi

See all petitions in Judgment by Navin Sinha

See all petitions in allowed

See all petitions in Remanded

See all petitions in supreme court of India judgments October 2017

See all petitions in 2017 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category