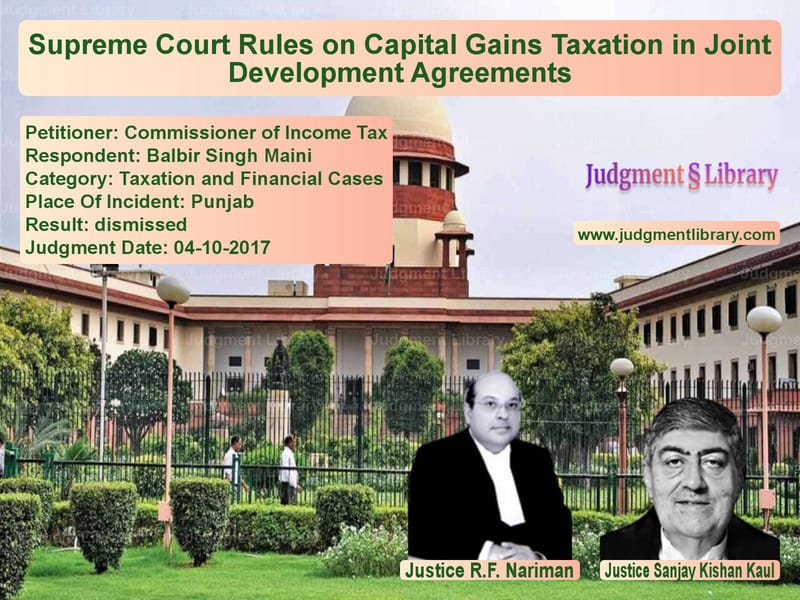

Supreme Court Rules on Capital Gains Taxation in Joint Development Agreements

The Supreme Court of India, in the case of Commissioner of Income Tax vs. Balbir Singh Maini, delivered a landmark judgment on October 4, 2017, concerning the taxation of capital gains in Joint Development Agreements (JDAs). The ruling clarified that income tax on capital gains cannot be levied when the development project has not materialized due to legal constraints, setting a significant precedent for real estate transactions.

The case revolved around a tripartite Joint Development Agreement (JDA) executed between landowners, Hash Builders Pvt. Ltd., and Tata Housing Development Company Ltd. (THDC). The agreement aimed to develop land into residential and commercial properties, with landowners receiving monetary compensation and constructed units in return. However, legal hurdles prevented the project’s completion, leading to a dispute over whether capital gains tax should be levied on the landowners.

Petitioner’s Arguments

The petitioner, Commissioner of Income Tax, contended that:

- The execution of the JDA amounted to a “transfer” under Section 2(47)(v) of the Income Tax Act, 1961, triggering capital gains tax.

- The possession of land was handed over to the developer, satisfying the conditions of Section 53A of the Transfer of Property Act, 1882.

- The landowners had received an advance payment as part of the agreement, establishing financial gain.

- Despite legal hurdles preventing project completion, the mere execution of the JDA should be deemed a taxable transfer.

Respondent’s Arguments

The respondent, Balbir Singh Maini and other landowners, argued that:

- The JDA was never executed in full due to the lack of regulatory approvals, meaning no real transfer took place.

- Possession was given only for development purposes, not for sale, negating the applicability of Section 53A of the Transfer of Property Act.

- Under Section 48 of the Income Tax Act, capital gains tax can be levied only when income is received or accrued, which had not happened.

- The developers failed to make payments beyond initial advances, reinforcing that no real income had arisen from the agreement.

Key Observations by the Court

The Supreme Court ruled in favor of the landowners, emphasizing that capital gains taxation applies only when income is realized. The bench observed:

“The effect of the amendments made to the Registration Act, 1908, and the Transfer of Property Act, 1882, is that unless a JDA is registered, it has no effect in law. Since the JDA in this case was not registered, Section 53A of the Transfer of Property Act does not apply.”

The Court further noted:

- Registration is a mandatory requirement for enforcing rights under Section 53A of the Transfer of Property Act, and the unregistered JDA had no legal standing.

- The phrase “transfer” under Section 2(47)(v) of the Income Tax Act requires actual delivery of possession with an enforceable agreement, which was absent.

- Capital gains tax cannot be levied on hypothetical income; there must be an actual accrual of financial gains.

- Under Section 45 of the Income Tax Act, tax liability arises only when the full value of consideration is received, which was not the case here.

Final Judgment

The Supreme Court ruled:

“Capital gains tax shall not be imposed on the landowners as the Joint Development Agreement did not result in an actual transfer of property due to non-registration and lack of project execution.”

The Court also held:

“A taxpayer is liable to pay tax only when real income arises. Mere execution of a JDA without execution in fact does not lead to accrual of income.”

Implications of the Judgment

This ruling has several significant implications:

- It establishes that capital gains tax cannot be levied on unregistered JDAs.

- It clarifies that taxability depends on actual income realization, not just contractual agreements.

- It protects landowners from premature tax liabilities in development projects that do not materialize.

- It ensures that taxation is based on real financial transactions rather than hypothetical gains.

- It sets a precedent for similar cases involving real estate transactions and capital gains taxation.

Conclusion

The Supreme Court’s ruling in this case reinforces the principle that tax liability must arise from actual income and not from theoretical transactions. By exempting landowners from capital gains tax in an incomplete development agreement, the Court has provided much-needed clarity for real estate taxation.

Going forward, this judgment will serve as a benchmark for taxation in joint development agreements, ensuring that landowners are not unfairly burdened with tax liabilities on transactions that have not resulted in actual financial gain.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Commissioner of Inco vs Balbir Singh Maini Supreme Court of India Judgment Dated 04-10-2017.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Evasion Cases

See all petitions in Tax Refund Disputes

See all petitions in Judgment by Rohinton Fali Nariman

See all petitions in Judgment by Sanjay Kishan Kaul

See all petitions in dismissed

See all petitions in supreme court of India judgments October 2017

See all petitions in 2017 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category