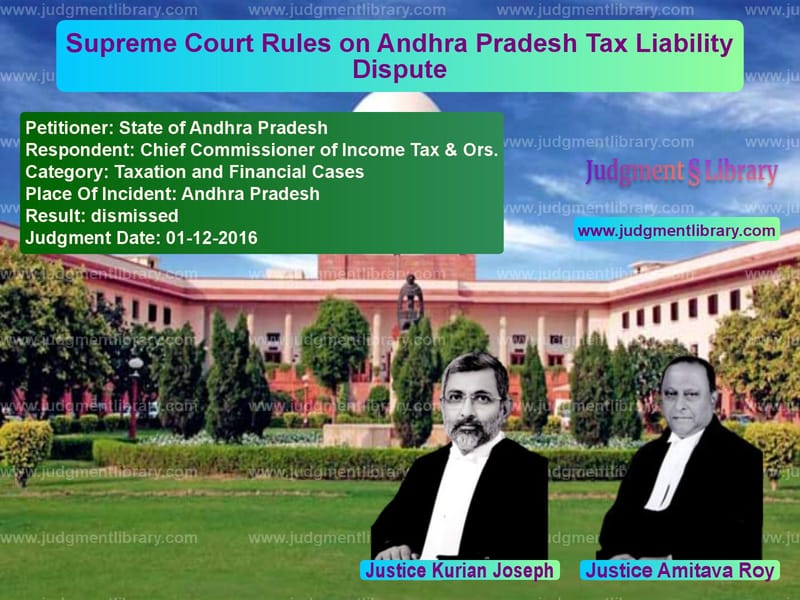

Supreme Court Rules on Andhra Pradesh Tax Liability Dispute

The Supreme Court of India, in its judgment delivered on December 1, 2016, in the case of State of Andhra Pradesh vs. Chief Commissioner of Income Tax & Ors., addressed a significant tax liability dispute involving the Andhra Pradesh government and the Income Tax Department. The issue revolved around the sale proceeds of alcohol stocks attached by the tax authorities and the question of whether the state government was liable to re-deposit the amount pending the resolution of the case.

Background of the Case

The dispute arose over the sale proceeds of beer, foreign liquor (FL), and Indian-made foreign liquor (IMFL) stocks that had been attached by the Income Tax Department. The Andhra Pradesh Beverages Corporation Limited (APBCL), a government-run entity, had sold these stocks, leading to a legal battle over the ownership of the proceeds and the corresponding tax liability.

The Income Tax Department sought to secure the revenue generated from these sales, prompting the High Court of Andhra Pradesh and Telangana to pass an interim order requiring the state government to re-deposit the amount received from APBCL into a separate account until the resolution of the case.

Key Legal Issues Considered

- Whether the Andhra Pradesh government was liable to re-deposit the sale proceeds pending final judgment.

- Whether the Income Tax Department had a legitimate claim over the amount.

- Whether coercive recovery actions could be taken before the final resolution of the writ petitions.

High Court’s Interim Order

The High Court directed that:

- The Andhra Pradesh government must re-deposit the proceeds from APBCL’s sale of the attached liquor stocks.

- The amount of ₹489.07 crores (less a tax deduction at source of ₹4.81 crores) should remain in a separate account.

- This would ensure that, upon final resolution of the writ petitions, the amount could be disbursed to the rightful claimant.

Petitioner’s (State of Andhra Pradesh) Arguments

- The High Court’s order placed an undue financial burden on the state government.

- Since the writ petitions were still pending, the re-deposit requirement was premature.

- The state government should not be required to make any payments until a final determination was reached.

- The order caused financial constraints that impacted the state’s ability to govern effectively.

Respondent’s (Chief Commissioner of Income Tax) Arguments

- The sale of the attached stocks generated substantial revenue that belonged to the rightful tax authorities.

- Failure to re-deposit the amount would impact tax collection and create a precedent for avoiding tax obligations.

- The High Court’s interim order was necessary to ensure that the proceeds were not diverted before the final judgment.

- The re-deposit requirement was a precautionary measure, not a final determination of liability.

Supreme Court’s Judgment

The Supreme Court, comprising Justice Kurian Joseph and Justice Amitava Roy, ruled as follows:

- The writ petitions were still pending before the High Court, and the Supreme Court deemed it unnecessary to address the disputed contentions at this stage.

- The re-deposit requirement was primarily directed at the State of Andhra Pradesh, and the state must comply with the High Court’s order.

- The Supreme Court requested the High Court to expedite the resolution of the writ petitions, preferably before the summer vacation.

- If the writ petitions were dismissed, the state government would be required to deposit the amount within one month, subject to interest as fixed by the High Court.

- Until the High Court resolved the writ petitions, no coercive recovery actions could be taken against the state government.

- All contentions regarding the legitimacy of the tax claim were kept open for adjudication.

Key Legal Takeaways

- Interim Financial Obligations: The ruling affirmed that pending litigation does not exempt a party from fulfilling interim financial obligations.

- Judicial Oversight of Tax Disputes: Courts have the authority to ensure that disputed funds remain secured until final resolution.

- State Government Liability: The judgment clarified that state governments are not immune from financial accountability in tax-related matters.

- Protection Against Premature Recovery: The ruling protected the state government from immediate coercive recovery actions, ensuring due process was followed.

Conclusion

The Supreme Court’s judgment in State of Andhra Pradesh vs. Chief Commissioner of Income Tax serves as an important precedent for government financial liability in tax disputes. While upholding the High Court’s interim order, the ruling emphasized judicial restraint in enforcing premature recoveries. The case highlights the judiciary’s role in balancing financial obligations with due process in tax-related matters.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: State of Andhra Prad vs Chief Commissioner o Supreme Court of India Judgment Dated 01-12-2016.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Tax Refund Disputes

See all petitions in Judgment by Kurian Joseph

See all petitions in Judgment by Amitava Roy

See all petitions in dismissed

See all petitions in supreme court of India judgments December 2016

See all petitions in 2016 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category