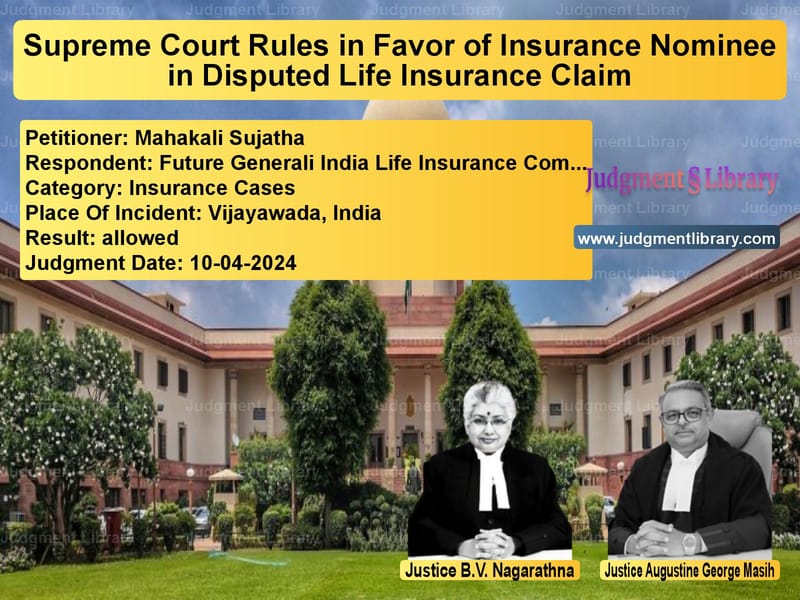

Supreme Court Rules in Favor of Insurance Nominee in Disputed Life Insurance Claim

The Supreme Court of India has delivered a landmark judgment in the case of Mahakali Sujatha vs. The Branch Manager, Future Generali India Life Insurance Company Limited & Another. This case pertains to a life insurance claim that was repudiated on grounds of alleged suppression of material facts by the insured. The judgment clarifies crucial aspects of the duty of disclosure in insurance contracts and the applicability of Section 45 of the Insurance Act, 1938.

Background of the Case

The appellant, Mahakali Sujatha, is the daughter and nominee of her deceased father, Sri Siriveri Venkateswarlu, who had taken two life insurance policies from Future Generali India Life Insurance Company Limited. The first policy was issued on May 5, 2009, for a sum assured of Rs. 4,50,000/-, and the second policy on March 22, 2010, for Rs. 4,80,000/-. The policies provided for double indemnity in case of accidental death.

On February 28, 2011, the insured met with an unfortunate train accident and lost his life. Following the death, the appellant, as the nominee, applied for the insurance claim. However, the insurance company repudiated the claim on December 31, 2011, stating that the insured had failed to disclose information about other life insurance policies he held with different insurers.

Legal Proceedings

District Consumer Forum

The appellant filed a consumer complaint (CC No. 8 of 2014) before the District Consumer Forum, Vijayawada. The District Forum ruled in favor of the complainant, finding no evidence of material suppression. It directed the insurer to pay the insured sum with interest.

State Consumer Forum

The insurance company appealed before the State Consumer Forum, which upheld the District Forum’s order on December 11, 2018. It observed that the insurer had failed to produce any conclusive evidence proving suppression of material facts.

National Consumer Disputes Redressal Commission (NCDRC)

Unhappy with the verdicts, the insurance company filed a revision petition (RP No. 1268 of 2019) before the NCDRC. The NCDRC ruled in favor of the insurer, relying on the Supreme Court’s judgment in Reliance Life Insurance Co. Ltd. vs. Rekhaben Nareshbhai Rathod (2019) 6 SCC 175, which held that suppression of material facts related to prior insurance policies could justify repudiation. The consumer complaint was dismissed.

Arguments by the Petitioner (Mahakali Sujatha)

- The insurer failed to provide documentary proof that the deceased had other insurance policies at the time of applying for the Future Generali policies.

- The allegation of suppression was based only on an affidavit filed by the insurer, without any corroborating evidence.

- The burden of proof rested on the insurer to establish that the insured had knowingly suppressed material facts.

- Section 45 of the Insurance Act bars insurers from questioning a policy after two years unless they can prove deliberate fraud.

- The insured’s answer in the proposal form was not misleading, as the insurer had not made the queries clear.

Arguments by the Respondents (Future Generali India Life Insurance)

- The insured had taken 15 other insurance policies amounting to Rs. 71,27,702/- prior to applying for the disputed policies.

- Had this information been disclosed, the insurer would not have issued the policies.

- Life insurance is based on the principle of uberrimae fidei (utmost good faith), which requires full disclosure of material facts.

- The insured’s failure to disclose prior policies was a material suppression justifying repudiation.

Supreme Court’s Judgment

After reviewing the arguments, the Supreme Court set aside the NCDRC’s ruling and reinstated the decisions of the District and State Consumer Forums.

Key Observations

- The insurer failed to produce certified documentary evidence proving that the insured held other policies.

- The mere listing of policies in an affidavit without corroboration does not meet the legal standard of proof.

- The contra proferentem rule applies—when policy language is ambiguous, it must be interpreted in favor of the insured.

- Insurance contracts must be based on fairness; an insurer cannot reject claims without conclusive proof of misrepresentation.

- The insurance company’s reliance on Reliance Life Insurance vs. Rekhaben was misplaced because, in that case, the insured had admitted prior policies, while in the present case, no such admission existed.

Final Ruling

- The NCDRC’s order dated July 22, 2019, was set aside.

- The insurer was directed to pay Rs. 7,50,000/- and Rs. 9,60,000/- under the two policies.

- Interest at 7% per annum was awarded from the date of the complaint until realization.

- Both parties were directed to bear their own costs.

Implications of the Judgment

This ruling provides clarity on the burden of proof in insurance disputes:

- Insurers must provide certified evidence when rejecting claims based on alleged misrepresentation.

- Courts will interpret ambiguous policy language in favor of policyholders.

- Section 45 of the Insurance Act protects policyholders from arbitrary repudiation.

Conclusion

The Supreme Court’s verdict in Mahakali Sujatha vs. Future Generali India Life Insurance is a crucial win for policyholders, reinforcing the need for fair practices in the insurance sector. This judgment ensures that insurance companies cannot arbitrarily repudiate claims without concrete evidence, thereby protecting consumer rights.

Petitioner Name: Mahakali Sujatha.Respondent Name: Future Generali India Life Insurance Company Limited & Another.Judgment By: Justice B.V. Nagarathna, Justice Augustine George Masih.Place Of Incident: Vijayawada, India.Judgment Date: 10-04-2024.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: mahakali-sujatha-vs-future-generali-indi-supreme-court-of-india-judgment-dated-10-04-2024.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Life Insurance Claims

See all petitions in Insurance Settlements

See all petitions in Consumer Rights

See all petitions in Judgment by B.V. Nagarathna

See all petitions in Judgment by Augustine George Masih

See all petitions in allowed

See all petitions in supreme court of India judgments April 2024

See all petitions in 2024 judgments

See all posts in Insurance Cases Category

See all allowed petitions in Insurance Cases Category

See all Dismissed petitions in Insurance Cases Category

See all partially allowed petitions in Insurance Cases Category