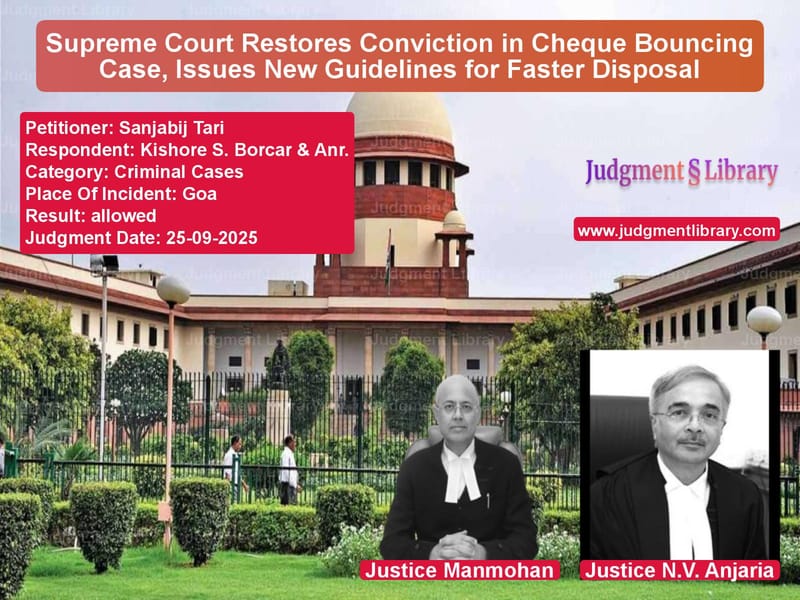

Supreme Court Restores Conviction in Cheque Bouncing Case, Issues New Guidelines for Faster Disposal

In a significant judgment that reinforces the legal sanctity of cheques as financial instruments, the Supreme Court has restored the conviction of an accused in a cheque bouncing case while issuing comprehensive guidelines to tackle the massive backlog of such cases across India. The case involved Sanjabij Tari, who had appealed against the Bombay High Court’s decision that had acquitted Kishore S. Borcar in a cheque dishonour case under Section 138 of the Negotiable Instruments Act.

The dispute originated from a cheque for Rs. 6,00,000 issued by Borcar to Tari, which was dishonored due to insufficient funds. The Trial Court and Sessions Court had concurrently convicted Borcar, but the High Court in its revisional jurisdiction acquitted him, leading to the present appeal before the Supreme Court.

Arguing for the appellant-complainant, Mr. Amarjit Singh Bedi contended that the High Court erred in upsetting the conviction based on categorical findings of fact by both lower courts. He emphasized that “there was no evidence on record to establish that the Appellant-Complainant did not have the financial means to advance a friendly loan of Rs.6,00,000/- to the Respondent No.1-Accused.” He further pointed out that the complainant had arranged money from his father, who was a cloth merchant, and had even parted with a portion of the loan amount borrowed from a financial institution.

On the other hand, Mr. Ankit Yadav, representing the accused, argued that the complainant “was being paid a salary of only Rs.2,300/- per month at the relevant point of time, which was not even adequate to take care of his family, leave alone sufficient to advance a loan of Rs.6,00,000/-.” He contended that the accused can always rely on material filed by the complainant to raise a probable defense creating doubts about the existence of a legally enforceable debt.

The Supreme Court bench comprising Justices Manmohan and N.V. Anjaria delivered a comprehensive judgment that addressed both the specific case and broader systemic issues. The court began by outlining the scope and intent of Chapter XVII of the NI Act, noting that it was introduced “to enhance the acceptability of cheques in settlement of liabilities by making the drawer liable for penalties in case of bouncing of cheques due to insufficiency of funds in the accounts.”

The court made several crucial legal observations about the presumptions under the Negotiable Instruments Act. The judges stated: “Once the execution of the cheque is admitted, the presumption under Section 118 of the NI Act that the cheque in question was drawn for consideration and the presumption under Section 139 of the NI Act that the holder of the cheque received the said cheque in discharge of a legally enforceable debt or liability arises against the accused.” This reaffirmation of legal presumptions strengthens the position of cheque holders in bouncing cases.

The court specifically addressed the argument about cash transactions above Rs. 20,000, stating: “Any breach of Section 269SS of the IT Act, 1961 is subject to a penalty only under Section 271D of the IT Act, 1961. Further neither Section 269SS nor 271D of the IT Act, 1961 state that any transaction in breach thereof will be illegal, invalid or statutorily void. Therefore, any violation of Section 269SS would not render the transaction unenforceable under Section 138 of the NI Act or rebut the presumptions under Sections 118 and 139 of the NI Act.”

The judgment expressed concern about how some courts were handling cheque bouncing cases: “This Court also takes judicial notice of the fact that some District Courts and some High Courts are not giving effect to the presumptions incorporated in Sections 118 and 139 of NI Act and are treating the proceedings under the NI Act as another civil recovery proceedings and are directing the complainant to prove the antecedent debt or liability. This Court is of the view that such an approach is not only prolonging the trial but is also contrary to the mandate of Parliament.”

Regarding the specific case, the court found that the accused had filed no documents or examined any independent witness to establish the financial incapacity of the complainant. The judges noted: “When the evidence of Appellant-Complainant (PW-1) is read in its entirety, like it should be, it cannot be said that the Appellant-Complainant had no wherewithal to advance any loan to the Respondent No.1-Accused.”

The court also emphasized the importance of the accused replying to statutory notices, observing: “The fact that the accused has failed to reply to the statutory notice under Section 138 of the NI Act leads to an inference that there is merit in the Appellant-Complainant’s version.” The judges found the accused’s defense that a signed blank cheque was issued to enable the complainant to obtain a bank loan as “unbelievable and absurd.”

Perhaps the most significant part of the judgment addresses the massive backlog of cheque bouncing cases in India. The court took judicial notice that “pendency of cheque bouncing cases under the NI Act in District Courts in major metropolitan cities of India continues to be staggeringly high. For instance, the pendency of Section 138 cases as on 01st September 2025 in Delhi District Courts is 6,50,283, Mumbai District Courts is 1,17,190 and Calcutta District Courts is 2,65,985.” The court noted that in some states, these cases constitute nearly fifty percent of the pendency in trial courts.

To address this crisis, the Supreme Court issued comprehensive guidelines. These include directions for service of summons through both traditional and electronic means, creation of dedicated online payment facilities, mandatory filing of case synopses, and establishment of dedicated dashboards to monitor pendency. The court also modified the compounding guidelines from the Damodar S. Prabhu case, reducing the costs payable at different stages of litigation to encourage early settlement.

The new compounding guidelines provide that if the accused pays the cheque amount before recording defense evidence, compounding may be allowed without any cost. If payment is made after defense evidence but before judgment, an additional 5% cost would apply. At the Sessions Court or High Court stage, the cost would be 7.5%, and before the Supreme Court, 10% of the cheque amount.

The court also clarified the nature of proceedings under Section 138, noting that they are “quasi-criminal in character” and essentially “a civil sheep in a criminal wolf’s clothing.” The judges emphasized that the objective is not retribution but ensuring payment and promoting the credibility of cheques.

In conclusion, the Supreme Court allowed the appeal, set aside the High Court’s order, and restored the judgments of the Trial Court and Sessions Court. The accused was directed to pay Rs. 7,50,000 in fifteen monthly installments of Rs. 50,000 each. The court directed all High Courts and District Courts to implement the new guidelines by November 1, 2025, marking a significant step toward decongesting the judicial system while upholding the sanctity of cheques in commercial transactions.

Petitioner Name: Sanjabij Tari.Respondent Name: Kishore S. Borcar & Anr..Judgment By: Justice Manmohan, Justice N.V. Anjaria.Place Of Incident: Goa.Judgment Date: 25-09-2025.Result: allowed.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: sanjabij-tari-vs-kishore-s.-borcar-&-supreme-court-of-india-judgment-dated-25-09-2025.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Cheque Dishonour Cases

See all petitions in Fraud and Forgery

See all petitions in Other Cases

See all petitions in Judgment by Manmohan

See all petitions in Judgment by N.V. Anjaria

See all petitions in allowed

See all petitions in supreme court of India judgments September 2025

See all petitions in 2025 judgments

See all posts in Criminal Cases Category

See all allowed petitions in Criminal Cases Category

See all Dismissed petitions in Criminal Cases Category

See all partially allowed petitions in Criminal Cases Category