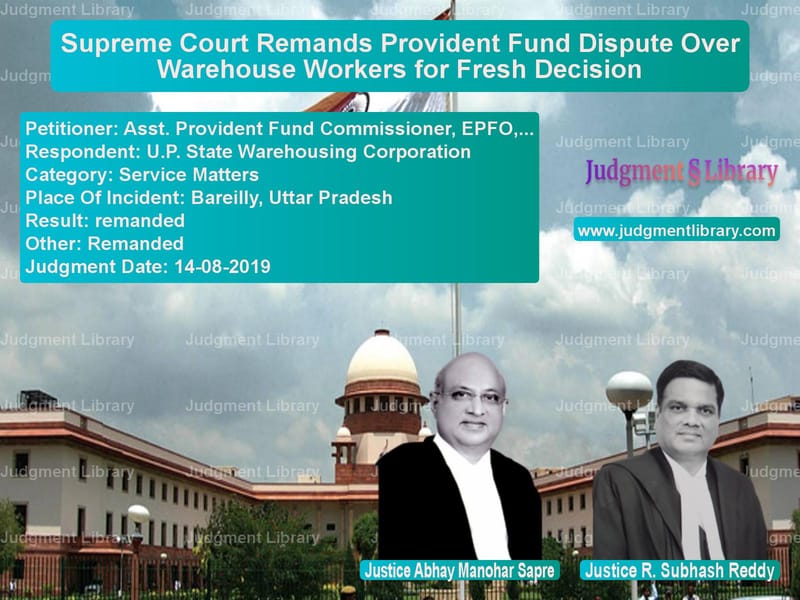

Supreme Court Remands Provident Fund Dispute Over Warehouse Workers for Fresh Decision

The case of Asst. Provident Fund Commissioner, EPFO, Bareilly v. U.P. State Warehousing Corporation revolves around the applicability of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 to workers engaged in loading and unloading operations at warehouses. The Supreme Court was called upon to determine whether these workers could be considered employees under the Act, thereby making the Warehousing Corporation liable for their provident fund contributions.

The Supreme Court set aside the Allahabad High Court’s ruling and remanded the case for fresh consideration, emphasizing that the High Court had failed to examine the legal definition of ‘employee’ under Section 2(f) of the Provident Fund Act.

Background of the Case

The dispute arose between the U.P. State Warehousing Corporation and the Employees’ Provident Fund Organization (EPFO) regarding the status of workers engaged in warehouse operations. The key developments in the case were:

- The Corporation engages contractors to handle loading and unloading of stock at its godowns.

- Workers performing these tasks formed a union and sought provident fund benefits.

- The EPFO issued a notice under Section 7A of the Act, directing the Corporation to contribute towards the workers’ provident fund.

- The Corporation contested the notice, claiming that the workers were engaged through contractors and were not its direct employees.

- After assessment, the EPFO ruled in favor of the workers and directed the Corporation to pay provident fund contributions.

- The Corporation challenged this decision before the Allahabad High Court, which ruled in its favor.

The Provident Fund authorities, feeling aggrieved, filed an appeal before the Supreme Court.

Arguments by the Appellant (EPFO)

The EPFO, represented by the Assistant Provident Fund Commissioner, argued:

- The workers engaged in loading and unloading were performing duties essential to the Corporation’s business, making them eligible for provident fund benefits.

- Under Section 2(f) of the Provident Fund Act, employees hired through contractors but engaged in the principal employer’s work are deemed employees.

- The Corporation could not evade statutory obligations by outsourcing core functions.

Arguments by the Respondent (U.P. State Warehousing Corporation)

The Corporation countered by stating:

- The workers were employed by independent contractors, not directly by the Corporation.

- The Labor Court had already ruled that there was no direct employer-employee relationship.

- The Allahabad High Court’s earlier decision in 2013 had quashed a similar claim.

Key Observations by the Supreme Court

The Supreme Court found that the High Court had failed to apply the proper legal test under Section 2(f) of the Provident Fund Act. The Court made the following observations:

- Employer-Employee Relationship: The case should have been analyzed in light of the Act’s definition of ‘employee’ rather than relying on findings from the Industrial Disputes Act.

- Relevance of Section 2(f): The High Court failed to consider whether the workers were engaged ‘in connection with’ the Corporation’s business.

- Independent Determination Required: The High Court should have independently examined the matter rather than relying on previous labor court decisions.

Supreme Court’s Judgment

The Supreme Court ruled:

“The case is remanded to the High Court for deciding afresh on merits, keeping in view the definition of ‘employee’ as per Section 2(f) of the Act and determining the legality of the proceedings under Section 7A.”

The Court directed:

- The Allahabad High Court must conduct a fresh hearing and decide the case in light of the Provident Fund Act.

- The case should be expedited to ensure timely resolution.

Implications of the Judgment

This ruling has significant implications for employment law and social security benefits:

- Clarifies Applicability of Provident Fund: Employers must ensure compliance with social security laws even when engaging contractors.

- Legal Definition of Employee Prevails: Industrial law rulings do not override statutory definitions under social security laws.

- Employers Cannot Evade Liability: Principal employers remain responsible for social security contributions of workers engaged in their business.

Conclusion

The Supreme Court’s decision in Asst. Provident Fund Commissioner v. U.P. State Warehousing Corporation reinforces the importance of statutory compliance in social security matters. By remanding the case, the ruling ensures that the status of contract workers is determined according to the Provident Fund Act rather than unrelated labor law precedents.

This decision sets a precedent for cases involving indirect employment and employer obligations under social security laws.

Petitioner Name: Asst. Provident Fund Commissioner, EPFO, Bareilly.Respondent Name: U.P. State Warehousing Corporation.Judgment By: Justice Abhay Manohar Sapre, Justice R. Subhash Reddy.Place Of Incident: Bareilly, Uttar Pradesh.Judgment Date: 14-08-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Asst. Provident Fund vs U.P. State Warehousi Supreme Court of India Judgment Dated 14-08-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Public Sector Employees

See all petitions in Employment Disputes

See all petitions in Disciplinary Proceedings

See all petitions in Judgment by Abhay Manohar Sapre

See all petitions in Judgment by R. Subhash Reddy

See all petitions in Remanded

See all petitions in Remanded

See all petitions in supreme court of India judgments August 2019

See all petitions in 2019 judgments

See all posts in Service Matters Category

See all allowed petitions in Service Matters Category

See all Dismissed petitions in Service Matters Category

See all partially allowed petitions in Service Matters Category