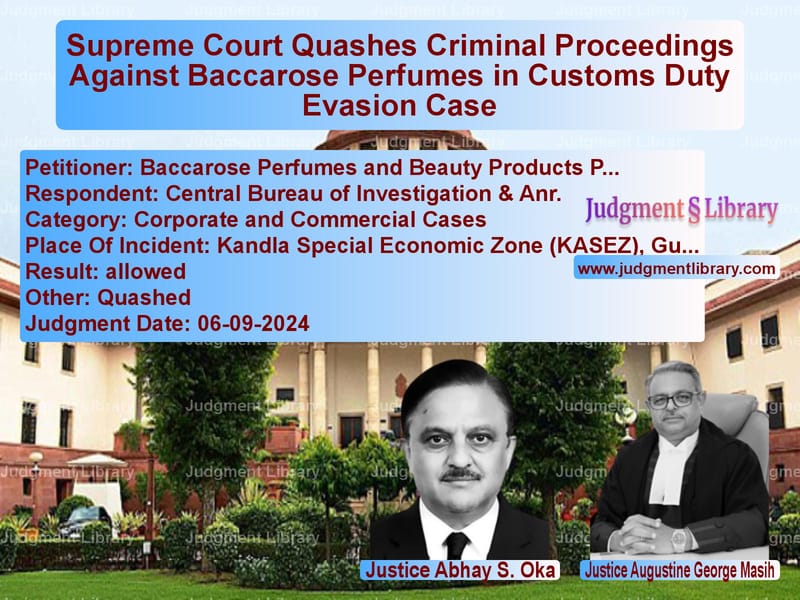

Supreme Court Quashes Criminal Proceedings Against Baccarose Perfumes in Customs Duty Evasion Case

The case of Baccarose Perfumes and Beauty Products Pvt. Ltd. vs. Central Bureau of Investigation & Anr. revolved around allegations of customs duty evasion by the appellant company. The Supreme Court, in its judgment dated September 6, 2024, quashed the criminal proceedings initiated against the company, holding that the case was an abuse of legal process.

This ruling provides clarity on the applicability of the Customs Tariff Act, 1975, the Central Excise Act, 1944, and the powers of the Settlement Commission in granting immunity in cases of alleged duty evasion.

Background of the Case

The appellant, Baccarose Perfumes and Beauty Products Pvt. Ltd., is a company engaged in the manufacturing and export of cosmetics. It operates a unit within the Kandla Special Economic Zone (KASEZ).

The Central Bureau of Investigation (CBI) alleged that the appellant company:

- Conspired with officials of the KASEZ and customs department to underpay Countervailing Duty (CVD) on goods cleared from KASEZ into the Domestic Tariff Area (DTA).

- Paid CVD based on the invoice value instead of the Maximum Retail Price (MRP), causing an alleged loss of ₹8 crore to the government.

Legal Proceedings

Initial Investigation and Show Cause Notices

- In August 2004, customs authorities intercepted goods from the appellant’s KASEZ unit, alleging non-compliance with the Standards of Weights and Measures Act, 1976.

- Show cause notices were issued between November 2004 and February 2005, demanding unpaid duties under the Customs Act, 1962 and the Central Excise Act, 1944.

CBI FIR and Criminal Proceedings

- On April 4, 2005, the CBI registered an FIR (RC-6(A)/2005-GNR) under:

- Section 120B IPC (Criminal Conspiracy)

- Section 420 IPC (Cheating)

- Section 13(1)(d) of the Prevention of Corruption Act, 1988

- Customs authorities issued demand notices for unpaid CVD.

Settlement Commission’s Findings

- The appellant sought relief under the Settlement Commission, which granted immunity on August 21, 2007.

- The Commission ruled that the company’s goods were not subject to MRP-based CVD and that duties were properly assessed based on invoice value.

- It directed a refund of ₹1.39 crore out of ₹1.51 crore already paid by the appellant.

CBI’s Closure Report and Special Judge’s Rejection

- CBI submitted a closure report on March 5, 2008, concluding no case was made out.

- However, the Special Judge rejected the closure report on June 1, 2010 and ordered the filing of a criminal case.

- The appellant filed discharge applications, arguing that:

- It had been granted immunity by the Settlement Commission.

- No wrongful loss was caused to the government.

- Proceeding with the case would amount to double jeopardy.

High Court’s Dismissal of Discharge Petition

- The Gujarat High Court rejected the appellant’s discharge petition on September 15, 2023.

- The High Court ruled that criminal liability was independent of settlement proceedings.

Appeal Before the Supreme Court

The appellant approached the Supreme Court, arguing:

- Criminal prosecution was unsustainable as the Settlement Commission had granted immunity.

- The company had no fiscal liability as the assessment orders were set aside.

- The CBI’s case lacked merit since the customs authorities themselves had accepted the appellant’s compliance.

Supreme Court’s Observations

The Supreme Court bench, comprising Justices Abhay S. Oka and Augustine George Masih, examined the legal framework governing settlement and immunity.

1. Effect of Settlement Commission’s Immunity

- The Court ruled that once the Settlement Commission grants immunity, criminal prosecution for the same allegations cannot continue.

- It cited Hira Lal Hari Lal Bhagwati v. CBI (2003), where the Supreme Court held that a settlement under tax laws bars subsequent criminal cases.

2. No Fiscal Liability, No Criminal Case

- The Court found that customs authorities had determined that no additional duty was payable.

- Since there was no fiscal liability, the criminal case lacked foundation.

3. Abuse of Process

- The Court ruled that pursuing the case despite the immunity amounted to harassment and an abuse of process.

- It emphasized that when the government itself had issued refunds, it could not simultaneously claim financial loss.

4. No Public Servant Involved

- The Court rejected charges under the Prevention of Corruption Act since no government official had been sanctioned for prosecution.

Important Excerpts from the Judgment

“Once the Settlement Commission has granted immunity, continuation of criminal proceedings would be inconsistent with the legislative intent.”

“Fiscal laws are designed to ensure compliance, and when compliance is achieved, criminal liability does not arise.”

Final Judgment

The Supreme Court ruled:

- The appeal was allowed, and the Gujarat High Court’s decision was set aside.

- The criminal proceedings against the appellant were quashed.

- Pending applications were disposed of.

Implications of the Judgment

This ruling has significant legal implications:

- Reinforcement of Settlement Commission’s Authority: Once immunity is granted, prosecution cannot continue.

- Prevention of Harassment: Protects companies from undue criminal prosecution after compliance.

- Clarification of Customs Laws: Establishes that invoice value-based CVD assessments are legally valid.

The Supreme Court’s decision ensures that settlement mechanisms remain effective and prevents unnecessary criminal litigation when fiscal compliance is achieved.

Petitioner Name: Baccarose Perfumes and Beauty Products Pvt. Ltd..Respondent Name: Central Bureau of Investigation & Anr..Judgment By: Justice Abhay S. Oka, Justice Augustine George Masih.Place Of Incident: Kandla Special Economic Zone (KASEZ), Gujarat.Judgment Date: 06-09-2024.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: baccarose-perfumes-a-vs-central-bureau-of-in-supreme-court-of-india-judgment-dated-06-09-2024.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Company Law

See all petitions in Corporate Compliance

See all petitions in unfair trade practices

See all petitions in Judgment by Abhay S. Oka

See all petitions in Judgment by Augustine George Masih

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments September 2024

See all petitions in 2024 judgments

See all posts in Corporate and Commercial Cases Category

See all allowed petitions in Corporate and Commercial Cases Category

See all Dismissed petitions in Corporate and Commercial Cases Category

See all partially allowed petitions in Corporate and Commercial Cases Category