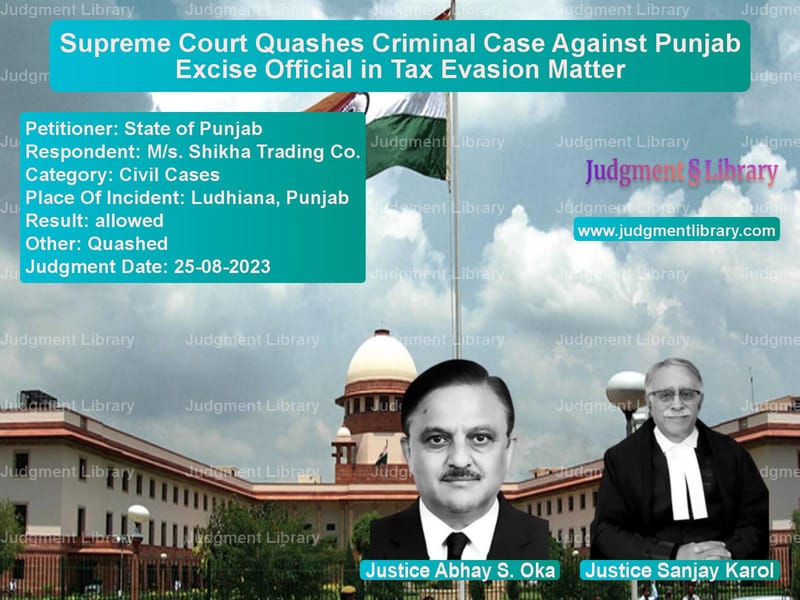

Supreme Court Quashes Criminal Case Against Punjab Excise Official in Tax Evasion Matter

The Supreme Court of India recently delivered a significant judgment in State of Punjab vs. M/s. Shikha Trading Co., quashing the criminal investigation initiated against a Punjab Excise officer. The judgment, delivered by Abhay S. Oka and Sanjay Karol, emphasized that courts must exercise restraint before ordering criminal proceedings against government officials without adequate evidence.

The ruling highlights the necessity of following due process before initiating criminal investigations against government officials, particularly in tax-related matters. It also underscores the impact of judicial remarks on officers’ morale and their ability to function impartially in their duties.

Background of the Case

The case arose from a dispute involving M/s. Shikha Trading Co. (STC), which challenged the alleged illegal sealing of its premises by officers of the Punjab Excise and Taxation Department on September 13, 2010. The company filed a writ petition before the Punjab and Haryana High Court, seeking relief against the sealing and alleging misconduct by an excise officer.

Chronology of Events

- September 13, 2010: STC’s premises were allegedly sealed by the Punjab Excise and Taxation Department.

- September 27, 2010: The High Court directed the department to de-seal the premises.

- October 21, 2010: An order regarding the de-sealing was allegedly backdated.

- December 8, 2010: The High Court ordered criminal proceedings against Assistant Excise and Taxation Commissioner (AETC) Rishi Pal Singh for allegedly submitting a false affidavit.

- August 25, 2023: The Supreme Court quashed the High Court’s order, ruling that the officer was not given an opportunity to defend himself.

Petitioner’s Arguments

The State of Punjab, represented by Senior Counsel, contended:

- The High Court passed adverse remarks against AETC Rishi Pal Singh without giving him a chance to respond.

- The allegations regarding backdating of orders were based on assumptions rather than factual evidence.

- Variations in ink, handwriting, and language in the dispatch register were normal due to multiple clerical staff making entries.

- The High Court failed to consider the burden such remarks place on honest officers trying to enforce tax laws.

Respondent’s Arguments

M/s. Shikha Trading Co., represented by legal counsel, countered:

- The sealing of its premises was illegal and arbitrary.

- The affidavit submitted by the AETC contained incorrect statements regarding the sequence of events.

- The dispatch register contained irregularities that suggested tampering.

- The High Court was justified in directing a criminal investigation to uphold accountability in the taxation system.

Supreme Court’s Analysis

The Supreme Court examined whether the High Court was justified in ordering a criminal investigation against a government officer based on the evidence available.

1. No Evidence of Misconduct

The Court ruled that the High Court’s observations were based on assumptions rather than factual evidence.

“The register records multiple entries in different hands, scripts, and languages. This does not by itself indicate tampering.”

2. Adverse Remarks Against Government Officers

The Court emphasized that adverse remarks against public officials should be made with caution.

“Adverse remarks should not be passed lightly, as they can jeopardize an officer’s career and morale.”

3. Failure to Give the Officer a Fair Hearing

The Supreme Court held that the AETC was not made a party to the case and was denied the opportunity to explain his actions.

“Before passing adverse orders, courts must ensure that the affected party has had an opportunity to defend themselves.”

4. Standard for Criminal Proceedings Against Officers

The Court reaffirmed the legal standard that criminal investigations should not be initiated without solid evidence.

“A criminal investigation should not be ordered against a government officer based on conjecture and surmise.”

Final Verdict

The Supreme Court ruled:

- The order directing criminal proceedings against AETC Rishi Pal Singh was quashed.

- The FIR and all related proceedings were closed immediately.

- The High Court’s remarks against the officer were expunged from the record.

- The ruling reaffirmed that criminal law should not be misused to harass honest government officials.

This judgment highlights the need to protect public officials from arbitrary criminal proceedings while ensuring accountability in tax administration.

Petitioner Name: State of Punjab.Respondent Name: M/s. Shikha Trading Co..Judgment By: Justice Abhay S. Oka, Justice Sanjay Karol.Place Of Incident: Ludhiana, Punjab.Judgment Date: 25-08-2023.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: state-of-punjab-vs-ms.-shikha-trading-supreme-court-of-india-judgment-dated-25-08-2023.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Fraud and Forgery

See all petitions in Judgment by Abhay S. Oka

See all petitions in Judgment by Sanjay Karol

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments August 2023

See all petitions in 2023 judgments

See all posts in Civil Cases Category

See all allowed petitions in Civil Cases Category

See all Dismissed petitions in Civil Cases Category

See all partially allowed petitions in Civil Cases Category