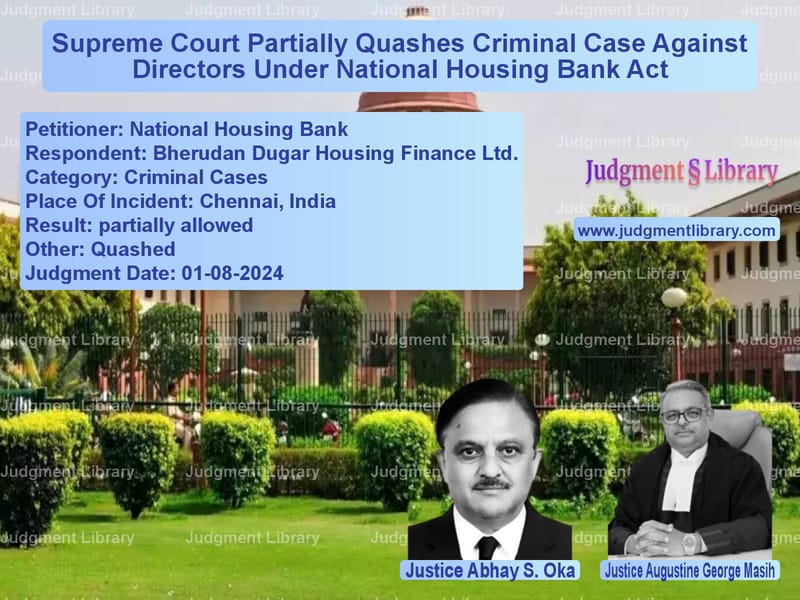

Supreme Court Partially Quashes Criminal Case Against Directors Under National Housing Bank Act

In an important ruling, the Supreme Court of India partially quashed criminal proceedings against certain directors of Bherudan Dugar Housing Finance Ltd. in a case initiated by the National Housing Bank. The case revolved around allegations of violating Section 29A of the National Housing Bank Act, 1987, which deals with offenses committed by companies in the housing finance sector.

Background of the Case

The National Housing Bank filed a complaint under Section 200 of the Code of Criminal Procedure, 1973, alleging that Bherudan Dugar Housing Finance Ltd. had violated provisions of the National Housing Bank Act, 1987. The case was based on alleged violations of Section 29A, which relates to the regulatory framework governing housing finance companies.

The complaint named multiple accused:

- Accused No. 1: The company itself, Bherudan Dugar Housing Finance Ltd.

- Accused No. 2: The Managing Director of the company.

- Accused Nos. 3-7: The other directors of the company.

The Magistrate took cognizance of the case and proceeded against all accused under Section 29A, read with Section 50 and punishable under Section 49(2A) of the National Housing Bank Act. This section prescribes a minimum sentence of one year, which may extend to five years.

The accused challenged the proceedings before the High Court, which quashed the complaint in its entirety, ruling that the allegations did not meet the legal requirements under Section 50 of the National Housing Bank Act.

Petitioner’s Argument (National Housing Bank)

The National Housing Bank, represented by its counsel, argued that:

- The complaint contained sufficient averments to establish a violation of Section 29A of the National Housing Bank Act.

- The Managing Director (Accused No. 2) was in charge of and responsible for the conduct of the company’s business, making him liable.

- The other directors (Accused Nos. 3-7) were also responsible for the company’s affairs and should be prosecuted.

- The High Court erred in quashing the complaint, as it failed to recognize the vicarious liability imposed by Section 50 of the Act.

Respondent’s Argument (Bherudan Dugar Housing Finance Ltd. and Directors)

The accused, through their counsel, contended that:

- The complaint did not specifically state that Accused Nos. 3-7 were in charge of or responsible for the conduct of the company’s business.

- The language of Section 50 of the National Housing Bank Act is similar to Section 141 of the Negotiable Instruments Act, 1881, which requires specific averments in the complaint.

- The High Court was correct in quashing the complaint against all accused as it lacked the necessary details.

Supreme Court’s Observations

The Supreme Court analyzed Section 50 of the National Housing Bank Act, which states:

“Where an offense has been committed by a company, every person who, at the time the offense was committed, was in charge of, and was responsible to, the company for the conduct of the business of the company, as well as the company, shall be deemed to be guilty of the offense and shall be liable to be proceeded against and punished accordingly.”

Read also: https://judgmentlibrary.com/supreme-court-acquits-man-in-wifes-murder-case-due-to-lack-of-evidence/

The Court noted that:

- The language of Section 50 is similar to Section 141 of the Negotiable Instruments Act, which has been interpreted to require specific averments against each accused.

- The complaint did not explicitly state that Accused Nos. 3-7 were responsible for the conduct of the company’s business at the time of the alleged offense.

- Without such averments, vicarious liability could not be imposed on them.

However, the Court found that the Managing Director (Accused No. 2) was clearly responsible for the company’s operations. The complaint explicitly stated that he was in charge of and responsible for the business, making him liable under Section 50.

Key Judgment Excerpts

The Court cited its earlier ruling in S.M.S. Pharmaceuticals Ltd. v. Neeta Bhalla, stating:

“It is necessary to specifically aver in a complaint under Section 141 that at the time the offense was committed, the person accused was in charge of, and responsible for, the conduct of business of the company. Without this averment, the requirements of Section 141 cannot be said to be satisfied.”

Applying this principle to the present case, the Court ruled:

“In the absence of the averments as contemplated by sub-section (1) of Section 50 of the 1987 Act in the complaint, the Trial Court could not have taken cognizance of the offense against the third to seventh accused. However, the second accused being the Managing Director would be in charge of the company and responsible to the company for its business.”

Final Judgment

The Supreme Court partially allowed the appeal:

- The complaint was quashed against Accused Nos. 3-7 (the directors) due to insufficient allegations.

- The proceedings would continue against Accused No. 1 (the company) and Accused No. 2 (the Managing Director).

The Court directed that the case proceed in the Judicial Magistrate’s court against the remaining accused.

Conclusion

This judgment clarifies the legal position on vicarious liability under the National Housing Bank Act, aligning it with interpretations of similar provisions in other financial statutes. It reinforces the need for precise allegations in complaints and ensures that only those truly responsible for a company’s conduct face prosecution.

By quashing the case against directors who were not specifically alleged to be in charge of the company’s business, the Supreme Court upheld the principle that criminal liability should not be imposed without clear and explicit allegations.

Petitioner Name: National Housing Bank.Respondent Name: Bherudan Dugar Housing Finance Ltd..Judgment By: Justice Abhay S. Oka, Justice Augustine George Masih.Place Of Incident: Chennai, India.Judgment Date: 01-08-2024.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: national-housing-ban-vs-bherudan-dugar-housi-supreme-court-of-india-judgment-dated-01-08-2024.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Fraud and Forgery

See all petitions in Corporate Compliance

See all petitions in Banking Regulations

See all petitions in Judgment by Abhay S. Oka

See all petitions in Judgment by Augustine George Masih

See all petitions in partially allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments August 2024

See all petitions in 2024 judgments

See all posts in Criminal Cases Category

See all allowed petitions in Criminal Cases Category

See all Dismissed petitions in Criminal Cases Category

See all partially allowed petitions in Criminal Cases Category