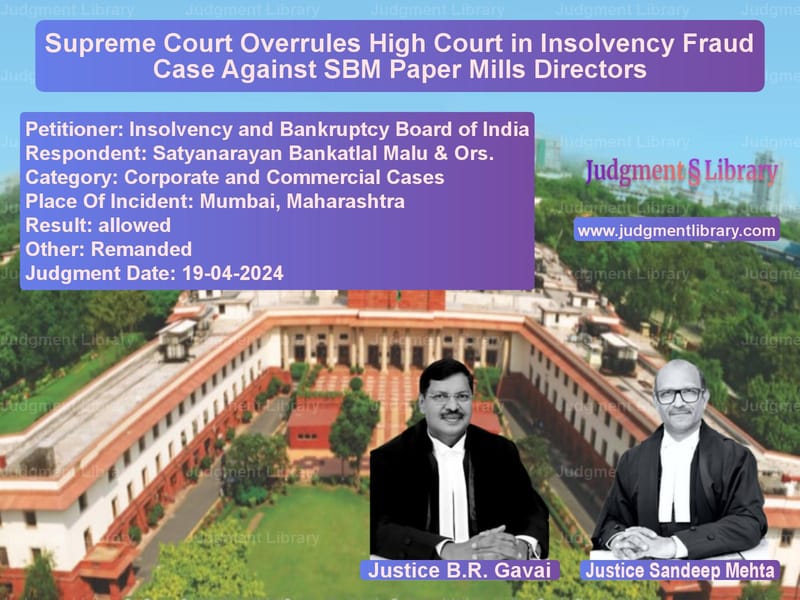

Supreme Court Overrules High Court in Insolvency Fraud Case Against SBM Paper Mills Directors

The Supreme Court of India recently delivered a significant judgment in Insolvency and Bankruptcy Board of India v. Satyanarayan Bankatlal Malu & Ors., a case that has set a precedent in corporate fraud prosecution. The appeal, filed by the Insolvency and Bankruptcy Board of India (IBBI), challenged the decision of the Bombay High Court, which had quashed the criminal proceedings against the ex-directors of SBM Paper Mills Pvt. Ltd.

The Supreme Court ruled in favor of the IBBI, holding that special courts under the Insolvency and Bankruptcy Code (IBC) retain jurisdiction to prosecute corporate offenders. This judgment clarifies the interpretation of Section 236 of the IBC, particularly its relation to the Companies Act, 2013.

Background of the Case

The dispute originated when SBM Paper Mills Pvt. Ltd. (Corporate Debtor) filed an application under Section 10 of the IBC before the National Company Law Tribunal (NCLT), Mumbai, seeking initiation of the Corporate Insolvency Resolution Process (CIRP) against itself in 2017. The petition was admitted, and the tribunal declared a moratorium under Section 14 of the IBC.

However, in 2018, the company’s ex-directors, Satyanarayan Bankatlal Malu and Ramesh Satyanarayan Malu, attempted to withdraw the insolvency petition, citing a One-Time Settlement (OTS) with Allahabad Bank, its sole financial creditor. The NCLT initially permitted withdrawal under Section 12A of the IBC. But the respondents failed to comply with the terms of the settlement, leading to further litigation.

Following multiple hearings, the NCLT found that the ex-directors had committed procedural fraud and referred the matter to the Insolvency and Bankruptcy Board of India (IBBI) for prosecution. The IBBI subsequently filed a criminal complaint under Section 236 of the IBC, alleging violations under Sections 73(a) and 235A of the IBC.

The Additional Sessions Judge, Mumbai, took cognizance of the complaint and issued summons to the accused in 2021. However, the Bombay High Court later quashed the proceedings, ruling that the special court lacked jurisdiction to try offenses under the IBC.

Arguments by the Appellant (IBBI)

- The IBBI contended that the High Court erred in quashing the proceedings on jurisdictional grounds.

- They argued that Section 236 of the IBC clearly provides for prosecution before a Special Court established under Chapter XXVIII of the Companies Act, 2013.

- They submitted that the legislative intent was to ensure stringent action against corporate fraud and misconduct.

- The IBBI emphasized that the Bombay High Court misinterpreted the 2017 amendment to the Companies Act, which altered the structure of Special Courts but did not divest them of jurisdiction over IBC offenses.

Arguments by the Respondents (Ex-Directors of SBM Paper Mills)

- The respondents argued that the prosecution was invalid as the IBC does not explicitly mention that offenses under its provisions should be tried by a Sessions Court.

- They contended that after the Companies (Amendment) Act, 2017, Special Courts could only try offenses under the Companies Act, not the IBC.

- The respondents maintained that since the IBC is a separate code, the Special Court had no jurisdiction.

- They urged the Supreme Court to uphold the High Court’s ruling and quash the complaint.

Key Observations of the Supreme Court

- The Court rejected the High Court’s interpretation of Section 236 of the IBC, clarifying that it mandates the trial of IBC offenses in Special Courts.

- It ruled that the 2017 amendment to the Companies Act did not take away the jurisdiction of Special Courts over IBC offenses.

- The Court emphasized that “The legislative intent behind Section 236 of the IBC was to create a mechanism for the speedy prosecution of corporate fraud.”

- The bench also pointed out that the IBC is a self-contained code, and its provisions must be interpreted to fulfill the statute’s purpose.

Final Judgment

The Supreme Court allowed the appeal and reinstated the criminal proceedings against the ex-directors. It held:

“The High Court erred in holding that offenses under the IBC cannot be tried by Special Courts established under Chapter XXVIII of the Companies Act. Section 236 of the IBC is clear in its mandate, and the complaint filed by the IBBI must be adjudicated by the Special Court.”

The Court remanded the case to the Special Court and directed a speedy trial.

Implications of the Judgment

- This judgment clarifies that IBC offenses must be tried by Special Courts under the Companies Act.

- It prevents misuse of legal loopholes by corporate fraudsters seeking to evade prosecution on technical grounds.

- The ruling strengthens the Insolvency and Bankruptcy Board of India’s authority in taking legal action against corporate malpractices.

- It sets a precedent for future cases involving insolvency fraud and corporate governance failures.

Conclusion

The Supreme Court’s ruling in Insolvency and Bankruptcy Board of India v. Satyanarayan Bankatlal Malu marks a crucial development in corporate law. By reaffirming the jurisdiction of Special Courts over IBC offenses, the judgment ensures that insolvency fraud cases are prosecuted effectively. This ruling strengthens the enforcement mechanisms of the IBC, discouraging attempts to manipulate insolvency proceedings for personal gain.

Petitioner Name: Insolvency and Bankruptcy Board of India.Respondent Name: Satyanarayan Bankatlal Malu & Ors..Judgment By: Justice B.R. Gavai, Justice Sandeep Mehta.Place Of Incident: Mumbai, Maharashtra.Judgment Date: 19-04-2024.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: insolvency-and-bankr-vs-satyanarayan-bankatl-supreme-court-of-india-judgment-dated-19-04-2024.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Corporate Compliance

See all petitions in Bankruptcy and Insolvency

See all petitions in unfair trade practices

See all petitions in Judgment by B R Gavai

See all petitions in Judgment by Sandeep Mehta

See all petitions in allowed

See all petitions in Remanded

See all petitions in supreme court of India judgments April 2024

See all petitions in 2024 judgments

See all posts in Corporate and Commercial Cases Category

See all allowed petitions in Corporate and Commercial Cases Category

See all Dismissed petitions in Corporate and Commercial Cases Category

See all partially allowed petitions in Corporate and Commercial Cases Category