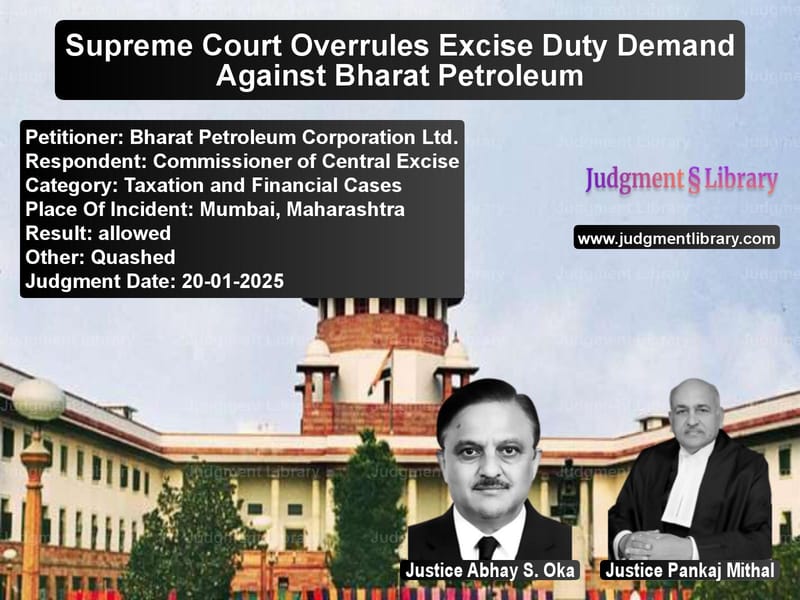

Supreme Court Overrules Excise Duty Demand Against Bharat Petroleum

The case of Bharat Petroleum Corporation Ltd. vs. Commissioner of Central Excise revolves around the determination of excise duty on petroleum products sold under a government-mandated agreement between Oil Marketing Companies (OMCs). The Supreme Court was called upon to decide whether the excise department’s method of calculating duty based on the price of petroleum products sold to dealers instead of inter-OMC transactions was legally justified.

This ruling is significant as it clarifies the legal position on transaction value under the Central Excise Act, 1944 and provides relief to the petroleum sector by ensuring that excise duty is levied correctly.

Background of the Case

Bharat Petroleum Corporation Ltd. (BPCL) and other OMCs, including Indian Oil Corporation Ltd. (IOCL) and Hindustan Petroleum Corporation Ltd. (HPCL), entered into a Multilateral Product Sale-Purchase Agreement (MOU) in 2002. This agreement mandated that petroleum products be sold between OMCs at the Import Parity Price (IPP) to ensure the seamless distribution of petroleum across India.

Chronology of Events

- June 30, 2000: The Central Board of Excise & Customs issued a circular defining ‘transaction value’ under Section 4(3)(d) of the Central Excise Act, 1944.

- April 1, 2002: The Administered Pricing Mechanism (APM) for petroleum products was abolished, and the MOU came into effect.

- 2002-2005: The excise department issued multiple show-cause notices alleging that excise duty should be calculated based on the price at which petroleum products were sold to dealers rather than the lower IPP used for inter-OMC sales.

- 2007: The Commissioner of Central Excise, Nashik, confirmed a demand of ₹119.11 crore against BPCL.

- 2014: The Customs, Excise & Service Tax Appellate Tribunal (CESTAT) upheld the excise duty demand.

- 2025: The Supreme Court set aside the demand, ruling that the correct valuation method had been applied.

Petitioner’s Arguments

BPCL, represented by senior counsel, contended that:

- The ‘transaction value’ under Section 4 of the Central Excise Act should be the actual price paid in inter-OMC sales, not the dealer sale price.

- The MOU was executed under the direction of the Ministry of Petroleum and Natural Gas to ensure smooth petroleum distribution.

- The excise department had accepted the IPP as the correct valuation method in earlier cases, leading to contradictory rulings.

- The demand was time-barred as the department invoked an extended period of limitation under Section 11A(1) of the Excise Act without valid grounds.

Respondents’ Arguments

The Commissioner of Central Excise countered that:

- The MOU was not disclosed to the department, constituting suppression of facts.

- The price used for sales to dealers reflected the actual market value and should be used for excise calculation.

- The extended period of limitation was correctly applied due to BPCL’s non-disclosure.

Supreme Court’s Analysis

Key Observations

- “For a valid excise duty demand, transaction value must reflect the actual price paid between independent buyers and sellers.”

- “The price in the MOU was the sole consideration for sales between OMCs, and the department’s reliance on dealer prices was incorrect.”

- “There was no suppression of facts, as the MOU was a well-documented government initiative.”

- “The department’s invocation of the extended limitation period was unjustified.”

Legality of the MOU Pricing

The Court found that:

- The MOU was executed with the government’s approval and ensured fair pricing in inter-OMC sales.

- Excise duty should be calculated based on the IPP agreed in the MOU.

- The OMCs were not related parties, and their transactions were at arm’s length.

Final Judgment

The Supreme Court ruled in favor of BPCL and held that:

- The excise duty demand of ₹119.11 crore was quashed.

- The extended period of limitation was not applicable.

- The valuation method adopted by BPCL under the MOU was correct and legally valid.

Implications of the Judgment

This ruling has significant implications for tax and corporate law:

- Prevents arbitrary excise duty calculations by tax authorities.

- Upholds the integrity of government-mandated agreements in the petroleum sector.

- Clarifies transaction value principles under the Excise Act.

- Protects businesses from retrospective tax demands.

Conclusion

The Supreme Court’s decision ensures that excise duty is levied fairly in petroleum sector transactions. By upholding BPCL’s valuation method, the ruling reinforces business stability and legal certainty for government-mandated pricing agreements.

Petitioner Name: Bharat Petroleum Corporation Ltd..Respondent Name: Commissioner of Central Excise.Judgment By: Justice Abhay S. Oka, Justice Pankaj Mithal.Place Of Incident: Mumbai, Maharashtra.Judgment Date: 20-01-2025.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: bharat-petroleum-cor-vs-commissioner-of-cent-supreme-court-of-india-judgment-dated-20-01-2025.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Customs and Excise

See all petitions in Tax Evasion Cases

See all petitions in Banking Regulations

See all petitions in Judgment by Abhay S. Oka

See all petitions in Judgment by Pankaj Mithal

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments January 2025

See all petitions in 2025 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category