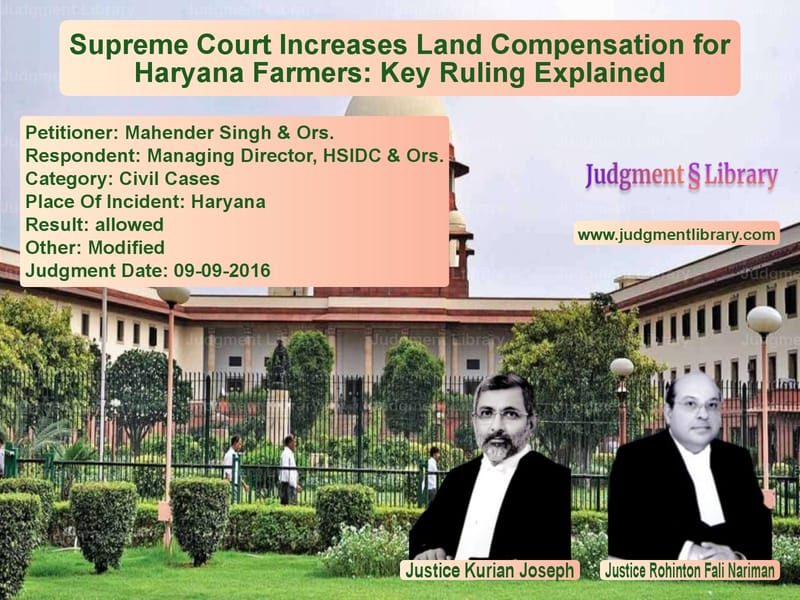

Supreme Court Increases Land Compensation for Haryana Farmers: Key Ruling Explained

The case of Mahender Singh & Ors. v. Managing Director, HSIDC & Ors. deals with the issue of fair compensation for landowners whose agricultural lands were acquired by the Haryana State Industrial and Infrastructure Development Corporation (HSIDC). The Supreme Court ruled in favor of the appellants, increasing their compensation by reducing the deduction for development charges from 40% to 30%. This ruling follows the principles established in Sachin & Ors. v. State of Haryana & Ors., reinforcing the legal precedent for calculating land compensation in Haryana.

Background of the Case

The dispute arose when HSIDC acquired agricultural land in Haryana for development projects, including industrial and infrastructural expansion. The affected landowners challenged the compensation awarded to them, arguing that the deductions made under the pretext of development charges were excessive and not in line with Supreme Court precedents.

The landowners claimed that their land, which was taken for industrial development, was undervalued and that a deduction of 40% was arbitrary and unfair. They contended that the Supreme Court had previously ruled in similar cases that development charge deductions should be capped at 30%.

Legal Issues in the Case

The primary legal issues in this case revolved around:

- Whether a 40% deduction for development charges was legally justified.

- Whether the appellants had a valid claim for higher compensation based on existing judicial precedents.

- Whether the principles laid down in Sachin & Ors. v. State of Haryana & Ors. should apply to this case.

Arguments from the Appellants (Landowners)

- The appellants argued that the 40% deduction for development charges was arbitrary and inconsistent with previous Supreme Court rulings.

- They contended that their land was similarly situated to that in Sachin & Ors., where the Court had reduced the deduction to 30%, and thus, they should be granted the same benefit.

- The appellants emphasized that HSIDC had failed to provide a justified breakdown of development costs, making the deduction unsubstantiated.

- They claimed that denying them equal treatment as provided in previous rulings would amount to discrimination.

Arguments from the Respondents (HSIDC & State of Haryana)

- The respondents argued that the deduction for development charges was necessary to account for infrastructure costs such as roads, drainage, and electricity.

- They maintained that the 40% deduction was based on government policies and previous land acquisition projects.

- They contended that not all land acquisitions should be treated identically and that the Sachin case could not be applied blindly.

- They also argued that increasing the compensation would place a financial burden on the state exchequer and disrupt ongoing industrial development.

Supreme Court’s Judgment

1. Applicability of Sachin & Ors. v. State of Haryana & Ors.

The Supreme Court examined whether the present case was comparable to Sachin and concluded that the ruling in that case applied here. The judgment stated:

“The claim for compensation is covered by the decision of this Court in Sachin & Ors. v. State of Haryana & Ors., whereby the cut in the development charges has been reduced from 40% to 30%.”

Therefore, the Court ruled that the appellants were entitled to the same reduction in deductions as provided in Sachin.

2. Reduction in Development Charge Deduction

The Court ruled that the deduction for development charges should be reduced from 40% to 30%. This decision effectively increased the compensation payable to the landowners.

3. Principle of Equal Treatment

The Court emphasized the need for uniformity in compensation awards for similar land acquisition cases. It stated:

“Landowners whose properties are acquired under similar circumstances must be compensated equitably, and any deviation from established precedent must be well justified.”

4. Limitation on Statutory Benefits

The Court noted that the appellants had delayed refiling their petition before the Supreme Court. As a result, the Court ruled that they would not be entitled to statutory benefits for the period of delay. However, the increase in compensation remained unaffected.

5. Final Ruling

The Supreme Court allowed the appeal in terms of the Sachin ruling, increasing the compensation payable to the landowners.

Impact of the Judgment

This ruling reinforces several key principles related to land acquisition compensation:

- Landowners must be compensated fairly, and arbitrary deductions must be avoided.

- The government must provide clear and justified reasons for any deductions applied to compensation.

- Precedents set by the Supreme Court must be followed to ensure uniform treatment across cases.

- Compensation determinations must account for the development potential of acquired land.

Key Takeaways from the Judgment

- Development charge deductions in land acquisition cases should be capped at 30%, as per the Sachin precedent.

- The Supreme Court ensures that landowners receive fair compensation and are not subjected to excessive deductions.

- The ruling highlights the importance of judicial consistency in land acquisition disputes.

- Delays in refiling petitions may impact statutory benefits but do not necessarily affect the final compensation awarded.

Conclusion

The Supreme Court’s ruling in Mahender Singh & Ors. v. Managing Director, HSIDC & Ors. ensures that landowners receive just compensation when their land is acquired for development. By applying the precedent from Sachin & Ors., the Court reaffirmed that deductions for development charges must be reasonable and consistent across similar cases. This decision strengthens legal protections for landowners and ensures fairness in government-led land acquisitions.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Mahender Singh & Ors vs Managing Director, H Supreme Court of India Judgment Dated 09-09-2016-1741883744416.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Property Disputes

See all petitions in Compensation Disputes

See all petitions in Landlord-Tenant Disputes

See all petitions in Judgment by Kurian Joseph

See all petitions in Judgment by Rohinton Fali Nariman

See all petitions in allowed

See all petitions in Modified

See all petitions in supreme court of India judgments September 2016

See all petitions in 2016 judgments

See all posts in Civil Cases Category

See all allowed petitions in Civil Cases Category

See all Dismissed petitions in Civil Cases Category

See all partially allowed petitions in Civil Cases Category