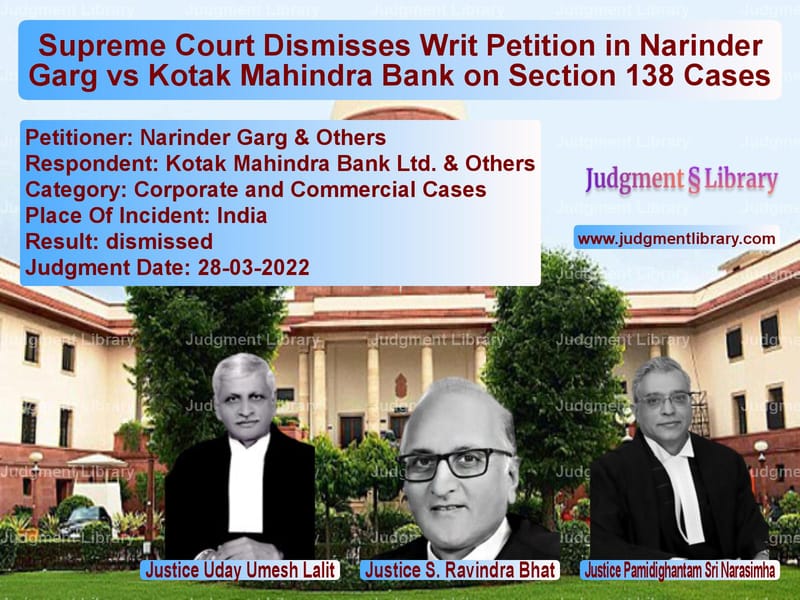

Supreme Court Dismisses Writ Petition in Narinder Garg vs Kotak Mahindra Bank on Section 138 Cases

The Supreme Court of India, in its judgment dated March 28, 2022, ruled on the case of Narinder Garg & Others vs Kotak Mahindra Bank Ltd. & Others. The case concerned the quashing of criminal complaints filed under Section 138 of the Negotiable Instruments Act, 1881, against corporate debtors and their directors after the approval of a resolution plan under the Insolvency and Bankruptcy Code, 2016 (IBC). The Supreme Court dismissed the writ petition, citing the P. Mohanraj & Others v. Shah Brothers Ispat Private Limited ruling.

Background of the Case

The petitioners, led by Narinder Garg, had approached the Supreme Court seeking relief in the form of a Writ of Mandamus to quash criminal complaints related to bounced cheques. The petitioners argued that once the resolution plan had been accepted by the Committee of Creditors (CoC) and approved by the National Company Law Tribunal (NCLT), all past liabilities, including criminal proceedings under Section 138, should be extinguished.

Reliefs Sought by the Petitioners

The petitioners sought the following reliefs:

- Quashing of criminal complaints under Section 138 against the petitioner company and its directors, arguing that the resolution plan had been accepted.

- Alternatively, the quashing of criminal complaints initiated after the moratorium order dated November 13, 2018, issued by the NCLT, as these complaints should not have proceeded during the moratorium.

Respondent’s Arguments (Kotak Mahindra Bank & Others)

The respondents countered the petitioner’s claims, stating:

- The resolution plan did not automatically extinguish the liability of natural persons like company directors.

- The Supreme Court had already addressed this issue in P. Mohanraj & Others v. Shah Brothers Ispat Private Limited (2021) 6 SCC 258, ruling that the moratorium under Section 14 of the IBC applies only to the corporate debtor, not to individuals liable under Section 141 of the Negotiable Instruments Act.

- Liabilities under Section 138 continue even after the acceptance of the resolution plan.

Supreme Court’s Observations

The Supreme Court, comprising Justices Uday Umesh Lalit, S. Ravindra Bhat, and Pamidighantam Sri Narasimha, analyzed the arguments presented and ruled:

“In P. Mohanraj & Others v. Shah Brothers Ispat Private Limited, (2021) 6 SCC 258, a Bench of three-Judges of this Court considered the matter whether a corporate entity in respect of which moratorium had become effective could be proceeded against in terms of Sections 138 and 141 of the Negotiable Instruments Act, 1881.”

The Court clarified:

“The moratorium provisions contained in Section 14 of the Insolvency and Bankruptcy Code, 2016 would apply only to the corporate debtor and that the natural persons mentioned in Section 141 of the Act would continue to be statutorily liable under the provisions of the Act.”

Final Verdict

The Supreme Court dismissed the writ petition, stating:

“The decision rendered in P. Mohanraj is quite clear on the point and, as such, no interference in this petition is called for. This writ petition is, therefore, dismissed.”

Implications of the Judgment

This ruling has significant legal consequences:

- The IBC moratorium does not protect company directors from personal liability under Section 138 of the Negotiable Instruments Act.

- Once a resolution plan is approved, it does not automatically extinguish pending cheque bounce cases against individuals.

- Financial institutions and creditors can still proceed against directors of companies in cases of dishonored cheques.

- The Court reaffirmed the principles laid down in P. Mohanraj & Others, ensuring consistency in legal interpretation.

Conclusion

The Supreme Court’s decision in Narinder Garg vs. Kotak Mahindra Bank clarifies that individuals cannot escape liability for bounced cheques simply because a company has undergone insolvency resolution. This ruling upholds the intent of the Negotiable Instruments Act and ensures that creditors retain legal recourse against individuals responsible for financial transactions.

Petitioner Name: Narinder Garg & Others.Respondent Name: Kotak Mahindra Bank Ltd. & Others.Judgment By: Justice Uday Umesh Lalit, Justice S. Ravindra Bhat, Justice Pamidighantam Sri Narasimha.Place Of Incident: India.Judgment Date: 28-03-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: narinder-garg-&-othe-vs-kotak-mahindra-bank-supreme-court-of-india-judgment-dated-28-03-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Bankruptcy and Insolvency

See all petitions in Corporate Compliance

See all petitions in unfair trade practices

See all petitions in Judgment by Uday Umesh Lalit

See all petitions in Judgment by S Ravindra Bhat

See all petitions in Judgment by P.S. Narasimha

See all petitions in dismissed

See all petitions in supreme court of India judgments March 2022

See all petitions in 2022 judgments

See all posts in Corporate and Commercial Cases Category

See all allowed petitions in Corporate and Commercial Cases Category

See all Dismissed petitions in Corporate and Commercial Cases Category

See all partially allowed petitions in Corporate and Commercial Cases Category