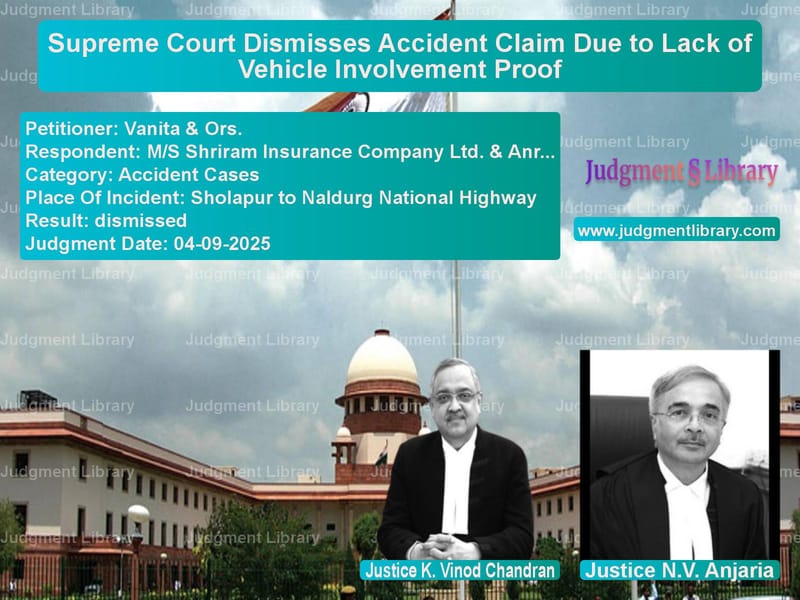

Supreme Court Dismisses Accident Claim Due to Lack of Vehicle Involvement Proof

In a significant ruling that underscores the importance of concrete evidence in motor accident claims, the Supreme Court has dismissed an appeal filed by the family of a deceased victim, upholding the High Court’s decision that the involvement of the alleged offending vehicle was not proved. The case involved a tragic accident that claimed the life of Dhanji Ram Marekar on May 27, 2012, when he was riding his motorcycle on the Sholapur to Naldurg National Highway. The appellants, comprising the widow Vanita and children of the deceased, had sought compensation of Rs. 10,00,000 from the insurance company, alleging that a Tata Magic vehicle bearing registration number MH-13-B-2719 had caused the fatal accident.

The legal journey began when the Motor Accident Claims Tribunal in Osmanabad initially ruled in favor of the claimants, awarding them compensation of Rs. 15,77,000 with 9% interest. However, this decision was challenged by the insurance company before the Bombay High Court, which reversed the Tribunal’s judgment. The High Court found that the claimants had failed to prove the involvement of the alleged Tata Magic vehicle in the accident, leading to the current appeal before the Supreme Court.

The Claimants’ Arguments

Mr. Dilip Annasahab Taur, representing the appellants, argued before the Supreme Court that the High Court’s finding regarding the non-involvement of the Tata Magic vehicle was perverse. The claimants maintained that the factum of the accident should have been accepted based on the testimony of witnesses, including Deepak Shendge. The counsel emphasized that the non-examination of witnesses named Mahesh Deshmukh and Laxman Kamble should not have been decisive in concluding the non-involvement of the offending vehicle. The appellants contended that the High Court should have considered the issue of vehicle involvement on the principle of preponderance of probabilities, a standard often applied in civil cases.

The Insurance Company’s Defense

Ms. Meenakshi Midha, appearing for the respondent insurance company, defended the High Court’s judgment by highlighting numerous circumstances that cast doubt on the claimants’ version. The insurance company had consistently denied the factum of the accident itself and specifically challenged the involvement of the Tata Magic vehicle with registration number MH-13-B-2719. In their written statement, they had denied that the vehicle was involved in the accident, that it was owned by respondent No. 1, or that it was insured with them. The insurance company had even alleged that a false offense was registered against the driver in collusion with the police.

The Supreme Court’s Analysis

The Supreme Court bench comprising Justices K. Vinod Chandran and N.V. Anjaria carefully examined the evidence and circumstances that led the High Court to doubt the involvement of the alleged vehicle. The Court noted several crucial aspects that weakened the claimants’ case. The accident occurred on May 27, 2011, but the First Information Report was lodged only on June 21, 2011 – a delay of 26 days. The brother of the deceased, Balaji, who filed the FIR, provided an explanation that the Court found “least inspiring” when he stated that he couldn’t lodge the report immediately due to grief and mental distress.

The Court observed that Balaji was not examined by the claimants, and neither were the key witnesses Mahesh Deshmukh and Laxman Kamble, who allegedly brought the deceased to the hospital. The judgment specifically noted that “Nor it is the case that the vehicle number of Tata Magic was provided to the informant Balaji at any specific point of time by either the deceased victim or the persons who brought the victim to the hospital.” This absence of contemporaneous recording of the vehicle number significantly weakened the claimants’ case.

The Court further highlighted that Deepak Lokhande (CW2), who was projected as an eye-witness, claimed to know the Tata Magic number but never provided it to the police or gave a statement under Section 161 of the Code of Criminal Procedure. The judgment pointed out that “He conceded that though he witnessed the accident and noted the registration number of the offending vehicle; he never informed the police or even gave a statement under Section 161 of the Code of Criminal Procedure, 1973.”

Read also: https://judgmentlibrary.com/supreme-court-enhances-compensation-for-100-disabled-accident-victim/

Evidentiary Gaps and Inconsistencies

The Supreme Court enumerated several critical evidentiary gaps that proved fatal to the claimants’ case. The accident occurred during summer at about 6:00 p.m. when there was sufficient daylight, making it possible to identify the vehicle and its registration number. However, none of the alleged eye-witnesses provided the vehicle number in their initial statements. The Investigating Officer was not examined by the claimants, and the inquest Panchnama was prepared only on May 28, 2011.

The Court noted with concern that “It is not comprehensible as to why the police waited for some relative to lodge the report of the incident and did not do anything for 25 days. Even eye-witnesses did not approach before 21.06.2011.” This unusual delay in reporting and investigation raised serious questions about the credibility of the claimants’ version.

The judgment emphasized that “Mere indicating the offending vehicle to be ‘Tata Magic’ was not sufficient. The identity of the offending vehicle with particular registration number was required to be proved.” This distinction between general identification of the vehicle type and specific identification with registration number proved crucial in the Court’s analysis.

Legal Principles Applied

The Supreme Court reaffirmed the settled legal position that “in a motor-accident claim petition, the initial burden to prove the factum of accident and involvement of offending vehicle lie on the claimants. It is the claimants who have to discharge this primary burden by establishing the occurrence of the accident and the involvement as well as identity of the vehicle at least on prima facie basis. Only then the onus to disprove shifts to the other side.”

The Court found that even on the principle of preponderance of probabilities, the involvement of the Tata Magic vehicle with registration number MH-13-B-2719 could not be concluded. The judgment stated that “Given the above strong evidentiary considerations, even on the principle of the preponderance of probabilities, the involvement of Tata Magic vehicle with registration number MH-13-B-2719 could not be concluded and was not established.”

Conclusion and Impact

The Supreme Court ultimately dismissed the appeal, upholding the High Court’s decision that the claimants had failed to prove the involvement of the alleged vehicle in the accident. The Court concluded that “The High Court, thus, in holding that the claimant had failed to prove the involvement of the Tata Magic in the accident or that it was owned by respondent No.1 or that the same was insured with respondent No.2 committed no error. It has to be held that the liability of payment of compensation could not be fastened on the respondent-insurance company.”

This judgment serves as an important reminder of the evidentiary standards required in motor accident claim cases. While courts often adopt a compassionate approach toward accident victims and their families, the fundamental requirement of proving the basic facts of the case, including the involvement of the alleged vehicle, remains essential. The decision reinforces that mere assertions without concrete evidence, especially regarding the identity of the offending vehicle, cannot form the basis for compensation claims against insurance companies.

The ruling also highlights the importance of prompt reporting of accidents, examination of all relevant witnesses, and proper documentation in establishing a claim. For insurance companies, this judgment provides clarity on their defense rights when the fundamental aspects of a claim, such as vehicle involvement, are not properly established by the claimants.

Petitioner Name: Vanita & Ors..Respondent Name: M/S Shriram Insurance Company Ltd. & Anr..Judgment By: Justice K. Vinod Chandran, Justice N.V. Anjaria.Place Of Incident: Sholapur to Naldurg National Highway.Judgment Date: 04-09-2025.Result: dismissed.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: vanita-&-ors.-vs-ms-shriram-insuranc-supreme-court-of-india-judgment-dated-04-09-2025.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Road Accident Cases

See all petitions in Compensation Disputes

See all petitions in Motor Vehicle Act

See all petitions in Negligence Claims

See all petitions in Insurance Settlements

See all petitions in Judgment by K. Vinod Chandran

See all petitions in Judgment by N.V. Anjaria

See all petitions in dismissed

See all petitions in supreme court of India judgments September 2025

See all petitions in 2025 judgments

See all posts in Accident Cases Category

See all allowed petitions in Accident Cases Category

See all Dismissed petitions in Accident Cases Category

See all partially allowed petitions in Accident Cases Category