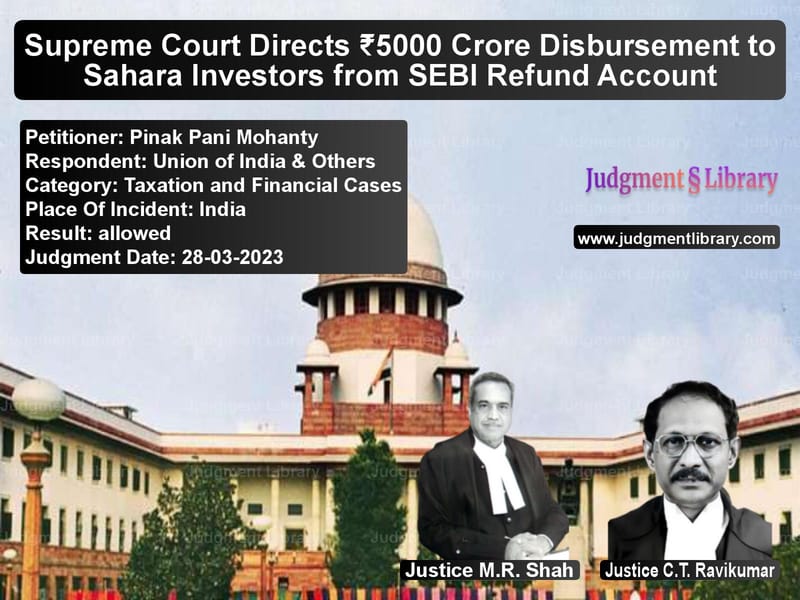

Supreme Court Directs ₹5000 Crore Disbursement to Sahara Investors from SEBI Refund Account

The Supreme Court of India recently ruled on a significant case concerning the disbursement of funds from the Sahara-SEBI Refund Account. The case, Pinak Pani Mohanty v. Union of India & Others, involved the transfer of ₹5000 crore from the unutilized funds lying in the account to repay investors who had deposited money in Sahara Group’s cooperative societies.

The judgment provides relief to numerous investors whose funds had been locked due to the legal and financial troubles surrounding the Sahara Group. The ruling ensures that these investors receive their money in a transparent manner, under the supervision of a retired Supreme Court judge.

Background of the Case

The dispute arose from complaints by depositors of Sahara Group’s cooperative societies, who claimed that their invested funds had not been returned. The Union of India, through the Ministry of Cooperation, filed an application before the Supreme Court seeking permission to utilize part of the unutilized balance in the Sahara-SEBI Refund Account to reimburse affected depositors.

According to the government, the total amount lying in the Sahara-SEBI Refund Account was ₹24,979.67 crore, which had been deposited following a Supreme Court order directing Sahara India Real Estate Corporation Limited and Sahara Housing Investment Corporation Limited to refund investors’ money. However, a large portion of these funds remained unutilized.

Petitioner’s Arguments (Union of India)

The Union of India, represented by Solicitor General Tushar Mehta, presented the following key arguments:

- A significant portion of the funds deposited in the Sahara-SEBI Refund Account originally belonged to investors of Sahara Group’s cooperative societies.

- Thousands of depositors had lodged complaints about non-repayment of their investments.

- The ₹5000 crore should be transferred to the Central Registrar of Cooperative Societies for direct disbursement to the affected depositors.

- The funds should be distributed transparently under the supervision of a retired Supreme Court judge.

- There was no legal restriction or attachment on the funds that would prevent such a transfer.

Respondent’s Arguments (Sahara Group and SEBI)

The Sahara Group and SEBI countered with the following arguments:

- The funds in the Sahara-SEBI Refund Account were meant for investors who had been misled by Sahara’s financial schemes, and their disbursement required strict regulatory oversight.

- Transferring funds from this account to the Central Registrar of Cooperative Societies might raise legal and administrative complications.

- The claim that a portion of the funds belonged to cooperative society depositors needed further verification.

Supreme Court’s Judgment

The Supreme Court bench comprising M.R. Shah and C.T. Ravikumar ruled in favor of the Union of India’s request, allowing the transfer of ₹5000 crore to the Central Registrar of Cooperative Societies.

“Out of the total amount of ₹24,979.67 crore lying in the Sahara-SEBI Refund Account, ₹5000 crore shall be transferred to the Central Registrar of Cooperative Societies, who shall disburse the same against the legitimate dues of the depositors of the Sahara Group of Cooperative Societies.”

The Court issued the following directives:

- The ₹5000 crore will be used to pay verified and genuine depositors.

- The disbursement process will be supervised by Justice R. Subhash Reddy, a retired Supreme Court judge.

- Advocate Gaurav Agarwal was appointed as Amicus Curiae to assist in the monitoring process.

- The funds will be transferred directly to depositors’ bank accounts after proper verification of identity and investment records.

- The disbursement must be completed within nine months.

- After nine months, any remaining funds will be returned to the Sahara-SEBI Refund Account.

Implications of the Judgment

The Supreme Court’s decision carries significant financial and legal implications:

For Investors:

- Thousands of depositors who invested in Sahara cooperative societies will finally receive their money.

- The judgment sets a precedent for government intervention in protecting small investors from financial fraud.

- The ruling ensures transparency and accountability in the fund disbursement process.

For Sahara Group:

- The decision is a major financial setback as it removes ₹5000 crore from the Sahara-SEBI Refund Account.

- It highlights the group’s financial mismanagement and the ongoing legal challenges it faces.

For SEBI and the Government:

- The judgment clarifies that the SEBI Refund Account cannot be indefinitely held without utilization.

- The decision empowers the government to take proactive steps in resolving investor disputes.

Conclusion

The Supreme Court’s ruling in Pinak Pani Mohanty v. Union of India & Others is a landmark judgment that prioritizes investor rights and financial transparency. By directing the transfer of ₹5000 crore for direct reimbursement to Sahara cooperative society depositors, the Court has provided much-needed relief to thousands of individuals awaiting their money.

The decision reaffirms the judiciary’s role in safeguarding investor interests while ensuring that regulatory agencies like SEBI fulfill their mandate effectively. The appointment of a retired Supreme Court judge and an Amicus Curiae further guarantees that the disbursement process will be conducted fairly and transparently.

With a strict timeline of nine months for fund distribution, the ruling aims to provide swift justice to affected investors while ensuring that any unutilized funds are returned to the Sahara-SEBI Refund Account.

Petitioner Name: Pinak Pani Mohanty.Respondent Name: Union of India & Others.Judgment By: Justice M.R. Shah, Justice C.T. Ravikumar.Place Of Incident: India.Judgment Date: 28-03-2023.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: pinak-pani-mohanty-vs-union-of-india-&-oth-supreme-court-of-india-judgment-dated-28-03-2023.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Banking Regulations

See all petitions in Tax Refund Disputes

See all petitions in Judgment by Mukeshkumar Rasikbhai Shah

See all petitions in Judgment by C.T. Ravikumar

See all petitions in allowed

See all petitions in supreme court of India judgments March 2023

See all petitions in 2023 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category