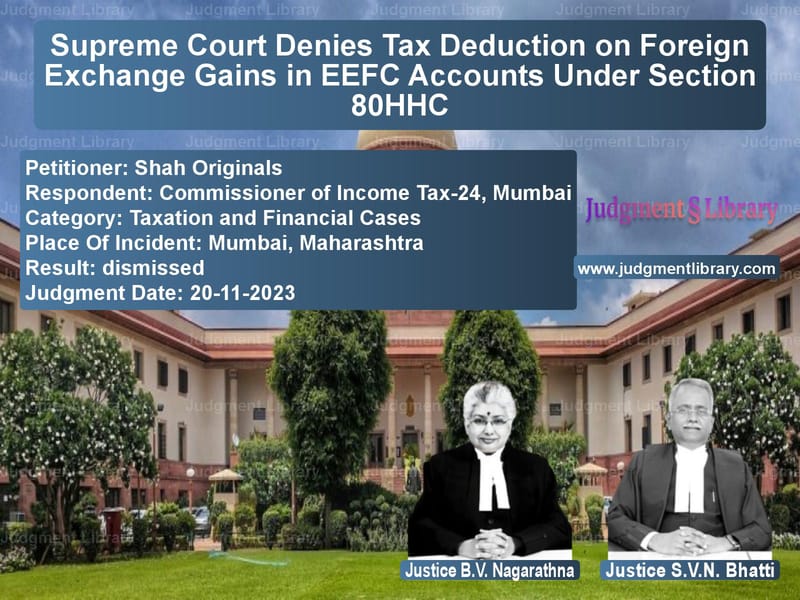

Supreme Court Denies Tax Deduction on Foreign Exchange Gains in EEFC Accounts Under Section 80HHC

The Supreme Court of India recently ruled in the case of Shah Originals v. Commissioner of Income Tax-24, Mumbai, clarifying whether gains from foreign exchange fluctuations in an Exchange Earners Foreign Currency (EEFC) account qualify for a tax deduction under Section 80HHC of the Income Tax Act. This decision has significant implications for exporters and businesses maintaining EEFC accounts for foreign currency transactions.

Background of the Case

The appellant, Shah Originals, is a 100% Export-Oriented Unit (EOU) engaged in garment exports. For the assessment years 2000-01 and 2001-02, the appellant claimed tax deductions under Section 80HHC of the Income Tax Act, arguing that the foreign exchange gains from its EEFC account should be treated as business profits derived from exports.

The Income Tax Department disallowed this claim, contending that:

- Gains from foreign exchange fluctuations in the EEFC account do not directly arise from export activities.

- EEFC accounts serve as a business convenience rather than a necessity for exporters.

- Foreign exchange gains from such accounts are incidental and cannot be categorized as export-derived income.

Legal Issues Examined

The Supreme Court analyzed the following key legal questions:

- Whether gains from foreign exchange fluctuations in an EEFC account qualify as income derived from exports under Section 80HHC.

- Whether the term “derived from” in Section 80HHC includes incidental earnings such as exchange rate appreciation.

- Whether the income tax authorities correctly denied the deduction based on the interpretation of the Income Tax Act.

Arguments by the Appellant (Shah Originals)

The appellant argued:

- Foreign exchange gains in the EEFC account are directly linked to export proceeds, as the funds originate from international transactions.

- The EEFC account is maintained for business purposes, and fluctuations in foreign currency value affect export profitability.

- Section 80HHC permits deductions on “profits of business from exports,” and currency gains are part of such profits.

- Precedents such as Commissioner of Income Tax v. Woodward Governor India Pvt. Ltd. support the claim that foreign exchange fluctuations impacting business operations should be considered part of business income.

Arguments by the Respondent (Income Tax Department)

The Commissioner of Income Tax-24, Mumbai, countered:

- The phrase “derived from” in Section 80HHC has a narrow interpretation and applies only to income directly generated from exports.

- Foreign exchange fluctuations are not a direct consequence of export activities but rather financial gains from currency holdings.

- Maintaining an EEFC account is a voluntary choice and not a mandatory part of conducting an export business.

- Relying on the precedent in Pandian Chemicals Ltd. v. Commissioner of Income Tax, the Department argued that indirect or incidental income cannot be considered export profits.

Supreme Court’s Analysis

1. Interpretation of “Derived From” in Section 80HHC

The Court emphasized that the phrase “derived from” implies a direct and immediate nexus between the income and the primary export business. It ruled:

“The profits or gains must be directly linked to the export activity and not arise incidentally due to currency fluctuations.”

2. EEFC Account as a Business Convenience

The Court examined the role of EEFC accounts and found that while they provide a financial advantage, they are not a compulsory part of export operations. It observed:

“The EEFC account is a facility rather than a statutory requirement for exporters. Gains from foreign currency appreciation in these accounts cannot be equated with profits derived from exports.”

3. Precedents Supporting the Ruling

The Court referred to previous rulings, including:

- Sterling Foods v. Commissioner of Income Tax – Income must have a direct nexus with the primary business activity to qualify for deductions.

- Pandian Chemicals Ltd. v. Commissioner of Income Tax – The phrase “derived from” has a strict interpretation, excluding incidental income.

- Commissioner of Income Tax v. Woodward Governor India Pvt. Ltd. – While exchange rate fluctuations impact business transactions, they do not automatically qualify as export-derived income.

Final Judgment

The Supreme Court upheld the High Court’s ruling and dismissed the appeal, concluding:

- Foreign exchange gains from EEFC accounts do not constitute export-derived profits under Section 80HHC.

- The phrase “derived from” excludes incidental earnings that do not directly stem from the export business.

- The decision of the Income Tax Department to deny the deduction was legally valid.

- Exporters cannot claim tax benefits on currency fluctuations unless explicitly permitted under the law.

Conclusion

This landmark ruling establishes that:

- Only direct export income qualifies for deductions under Section 80HHC.

- Maintaining an EEFC account does not entitle exporters to claim tax deductions on foreign exchange gains.

- The phrase “derived from” is to be interpreted strictly, preventing businesses from claiming incidental financial gains as export profits.

- Exporters must carefully assess whether income components qualify under tax exemptions before claiming deductions.

The ruling serves as an essential precedent for tax authorities and exporters, ensuring clear distinctions between business profits and incidental financial gains.

Petitioner Name: Shah Originals.Respondent Name: Commissioner of Income Tax-24, Mumbai.Judgment By: Justice B.V. Nagarathna, Justice S.V.N. Bhatti.Place Of Incident: Mumbai, Maharashtra.Judgment Date: 20-11-2023.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: shah-originals-vs-commissioner-of-inco-supreme-court-of-india-judgment-dated-20-11-2023.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Evasion Cases

See all petitions in Tax Refund Disputes

See all petitions in Banking Regulations

See all petitions in GST Law

See all petitions in Judgment by B.V. Nagarathna

See all petitions in Judgment by S.V.N. Bhatti

See all petitions in dismissed

See all petitions in supreme court of India judgments November 2023

See all petitions in 2023 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category