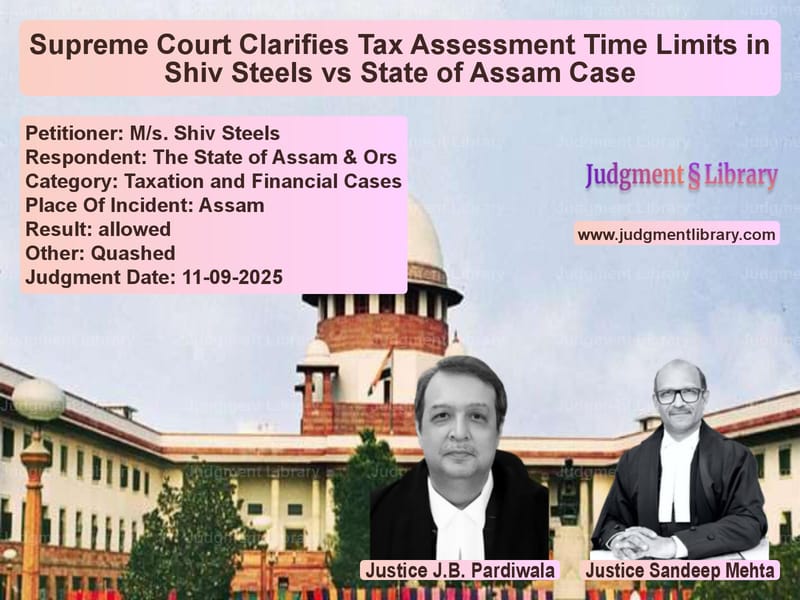

Supreme Court Clarifies Tax Assessment Time Limits in Shiv Steels vs State of Assam Case

In a significant ruling that provides clarity on tax assessment time limits, the Supreme Court of India recently delivered an important judgment in the case of M/s Shiv Steels versus The State of Assam & Ors. The case involved three civil appeals concerning assessment years 2003-2004, 2004-2005, and 2005-2006 under the Assam General Sales Tax Act, 1993, and centered around whether tax authorities could reopen assessments that had already been declared time-barred.

The Case Background

The legal dispute began when M/s Shiv Steel challenged reassessment orders dated March 31, 2011, passed by the tax authorities. The company contended that the original assessments for the three assessment years had been declared time-barred under Section 19 of the Assam General Sales Tax Act, 1993. However, the tax department later obtained sanction from the Commissioner and invoked Section 21 of the Act to bring fresh assessments within the limitation period.

The appellant, dissatisfied with this approach, challenged the reassessment before the Gauhati High Court. The High Court, in its judgment dated September 21, 2012, dismissed the writ petition, holding that the reassessment was within limitation under Section 21 of the Act since sanction had been duly granted by the Commissioner on March 21, 2011.

The Legal Framework

The case revolved around the interpretation of two crucial sections of the Assam General Sales Tax Act, 1993. Section 19 of the Act deals with the time limit for completion of assessment and reassessments. It specifies that no assessment shall be made under Section 17 after the expiry of three years from the end of the year in respect of which the assessment is made.

Section 21 of the Act, titled “Assessment in certain cases,” provides that where no assessment has been made under any of the foregoing provisions within the time limits specified in Section 19, the assessment can be made within four years from the date of expiry of the limitation period with prior sanction from the Commissioner.

The High Court’s Reasoning

The Gauhati High Court had accepted the revenue department’s arguments that “the reassessment was within limitation under Section 21 of the Act which provides for outer limit of seven years if reassessment was made with the sanction of the Commissioner. In the present case, sanction was duly granted by the Commissioner on 21.03.2011 and therefore, reassessment was within time.”

The High Court further noted that “quashing of earlier assessment as barred by limitation in absence of grant of sanction by the Commissioner did not debar the assessment being made after the sanction was granted.” The court disposed of the petitions with a direction that the earlier ex parte assessment may not be acted upon and fresh assessment be made after giving hearing to the petitioner.

The Supreme Court’s Analysis

The Supreme Court, comprising Justices J.B. Pardiwala and Sandeep Mehta, took a different view of the matter. The court emphasized that “the plain reading of Section 21 of the Act, 1993, referred to above, would indicate that in cases where no assessment has been made under any of the provisions within the time limits specified in Section 19, then, notwithstanding anything contained in that Section the assessment would be permissible within four years from the date of expiry of the limitation period with prior sanction from the Commissioner.”

The court made a crucial distinction: “Here is a case wherein the assessments undertaken for the three years were already held to be invalid because of being time barred, in view of Section 19 of the Act, referred to above. Later, by virtue of obtaining sanction from the Commissioner, the revenue could not have taken recourse to Section 21 of the Act to say that the reassessment within four years is permissible with prior sanction from the Commissioner.”

The Supreme Court clarified that “Section 21 would apply only in cases where no assessment has been made under any of the provisions of the Act within the time limits specified in Section 19. The interpretation of the two provisions of the Act at the end of the High Court is completely incorrect.”

Principles of Fiscal Statute Interpretation

In its judgment, the Supreme Court reiterated fundamental principles of interpreting tax laws. The court stated that “In construing fiscal statutes and in determining the liability of a subject to tax one must have regard to the strict letter of law. If the revenue satisfies the court that the case falls strictly within the provisions of the law, the subject can be taxed. If, on the other hand, the case is not covered within the four corners of the provisions of the taxing statute, no tax can be imposed by inference or by analogy or by trying to probe into the intentions of the legislature and by considering what was the substance of the matter.”

This principle emphasizes that tax laws must be interpreted strictly, and taxpayers cannot be subjected to tax liability unless the case clearly falls within the explicit provisions of the statute. The court cannot extend tax liability through interpretation or by considering the supposed intention behind the legislation.

The Outcome and Implications

Based on its analysis, the Supreme Court allowed the appeals filed by M/s Shiv Steels and set aside the common judgment and order passed by the High Court. The court held that once assessments had been declared time-barred under Section 19 of the Act, the revenue authorities could not use Section 21 to revive those assessments by obtaining sanction from the Commissioner.

The judgment reinforces the importance of statutory time limits in tax assessments and protects taxpayers from having to face reassessment proceedings for periods that have already been closed due to the expiry of limitation periods. This Supreme Court judgment has significant implications for tax administration and taxpayer rights across India. It establishes that tax authorities must complete assessments within the statutory time frames prescribed by law and cannot use provisions meant for exceptional circumstances to bypass these limitations once they have expired.

The ruling also serves as an important reminder that tax laws must be interpreted strictly, and revenue authorities cannot create tax liabilities through creative interpretation of statutory provisions. This provides certainty and predictability for businesses and individuals in their tax planning and compliance activities. For the state tax administrations, the judgment underscores the importance of efficient tax administration and timely completion of assessment proceedings.

The Supreme Court’s approach in this case aligns with the fundamental principle of tax jurisprudence that there should be certainty in tax matters, and taxpayers should be able to plan their affairs with the knowledge that once statutory time limits have expired, they will not be subject to further assessment proceedings for those periods. This judgment will likely be cited in future cases involving interpretation of limitation periods in various tax statutes across India.

Petitioner Name: M/s. Shiv Steels.Respondent Name: The State of Assam & Ors.Judgment By: Justice J.B. Pardiwala, Justice Sandeep Mehta.Place Of Incident: Assam.Judgment Date: 11-09-2025.Result: allowed.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: ms.-shiv-steels-vs-the-state-of-assam-&-supreme-court-of-india-judgment-dated-11-09-2025.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Tax Refund Disputes

See all petitions in Tax Evasion Cases

See all petitions in Income Tax Disputes

See all petitions in Judgment by J.B. Pardiwala

See all petitions in Judgment by Sandeep Mehta

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments September 2025

See all petitions in 2025 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category