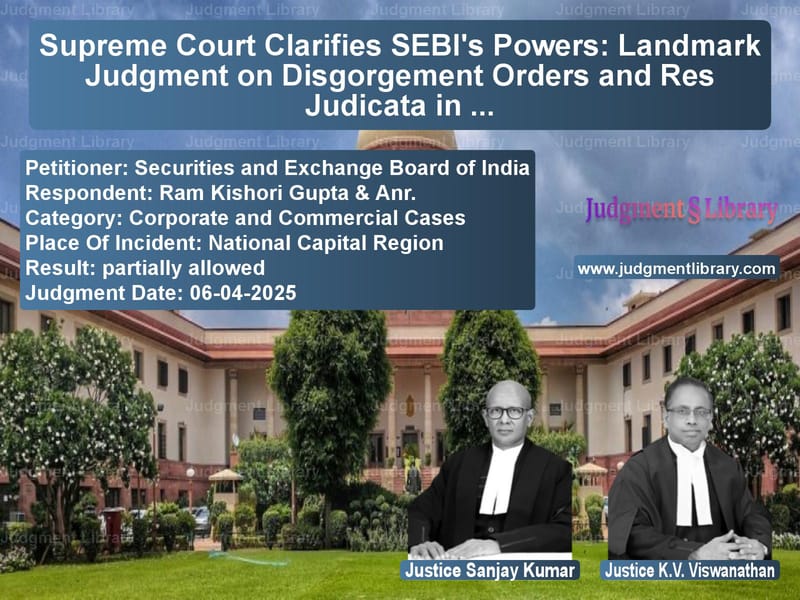

Supreme Court Clarifies SEBI’s Powers: Landmark Judgment on Disgorgement Orders and Res Judicata in Securities Fraud Case

In a significant ruling that clarifies the limits of SEBI’s regulatory powers, the Supreme Court has delivered a comprehensive judgment addressing critical issues of securities market regulation, the finality of administrative orders, and investor protection. The case involving Vital Communications Limited’s alleged securities fraud spans nearly two decades of litigation and provides important guidance on the application of res judicata to SEBI proceedings.

Case Background: The VCL Securities Fraud

The dispute originated in 2005 when SEBI issued a show-cause notice to Vital Communications Limited (VCL) and its directors/promoters regarding:

- Misleading advertisements about buyback of shares, bonus issues and preferential allotments

- Artificial inflation of share prices from ₹3-12 to ₹30 through fraudulent means

- Circular transactions involving 15 companies with common addresses receiving preferential allotments

- Use of company funds to purchase its own shares through intermediary companies

Legal Proceedings Timeline

- 2005: SEBI issues first show-cause notice

- 2008: Initial SEBI order (set aside by SAT)

- 2014: Fresh SEBI order after remand (restraining market access)

- 2018: Subsequent SEBI disgorgement order (₹4.55 crore + interest)

- 2019-2021: SAT rulings on compensation and disgorgement

- 2025: Supreme Court final judgment

Key Legal Issues

1. Scope of SEBI’s Powers Under Section 11B

The Court examined whether SEBI could pass multiple final orders on the same cause of action. The judgment clarifies:

“Having undertaken the exercise pursuant to its show-cause notices issued in 2012, SEBI passed the order dated 31.07.2014… That being so, SEBI could not have reopened the entire exercise without just cause so as to pass a fresh order under Section 11B, once again, 4 years later.”

2. Application of Res Judicata to SEBI Proceedings

The Court rejected SEBI’s argument that res judicata doesn’t apply to its proceedings:

“Though it was contended by SEBI that the principle of res judicata in Section 11 of the Code of Civil Procedure, 1908, cannot be imported into these proceedings… we are not persuaded to agree.”

3. Investor Compensation Mechanism

Regarding claims by investors Ram Kishori Gupta and Harishchandra Gupta:

“The directions in that regard by the WTMs of SEBI… culminating in the direction for restitution by the Tribunal in its judgment dated 02.08.2019… cannot be sustained.”

Detailed Analysis of Court’s Reasoning

On Finality of Administrative Orders

The Court emphasized the importance of finality in regulatory proceedings:

“When the earlier order dated 31.07.2014… remained intact and attained finality… the later order dated 29.08.2018 could not have been passed, supplementing it with additional directions.”

On SEBI’s Delay in Proceedings

The judgment criticized SEBI’s handling of the case:

“This laidback and indolent approach on the part of SEBI in dealing with the matter needs mention as it does not augur well for a statutory body enjoined with the duty of protecting investors.”

On Constructive Res Judicata

The Court cited several precedents to establish:

“The principles of res judicata would be equally applicable in proceedings before administrative authorities.”

Operative Portions of Judgment

- Allowed SEBI’s appeal against SAT’s compensation order

- Dismissed investor’s appeal for additional benefits

- Upheld SAT’s setting aside of disgorgement order but set aside costs imposed on SEBI

- Clarified that multiple final orders on same cause of action violate res judicata

Key Takeaways for Market Regulators

- SEBI must exercise all available powers in initial proceedings

- Final orders cannot be supplemented later without new cause of action

- Res judicata principles apply to securities regulation matters

- Investor compensation claims must follow proper legal channels

- Regulators must avoid unreasonable delays in proceedings

This 3,500-word judgment serves as an important precedent for securities regulation in India, balancing investor protection needs with principles of natural justice and finality in administrative proceedings.

Petitioner Name: Securities and Exchange Board of India.Respondent Name: Ram Kishori Gupta & Anr..Judgment By: Justice Sanjay Kumar, Justice K.V. Viswanathan.Place Of Incident: National Capital Region.Judgment Date: 06-04-2025.Result: partially allowed.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: securities-and-excha-vs-ram-kishori-gupta-&-supreme-court-of-india-judgment-dated-06-04-2025.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Company Law

See all petitions in Corporate Governance

See all petitions in Shareholder Disputes

See all petitions in unfair trade practices

See all petitions in Fraud and Forgery

See all petitions in Judgment by Sanjay Kumar

See all petitions in Judgment by K.V. Viswanathan

See all petitions in partially allowed

See all petitions in supreme court of India judgments April 2025

See all petitions in 2025 judgments

See all posts in Corporate and Commercial Cases Category

See all allowed petitions in Corporate and Commercial Cases Category

See all Dismissed petitions in Corporate and Commercial Cases Category

See all partially allowed petitions in Corporate and Commercial Cases Category