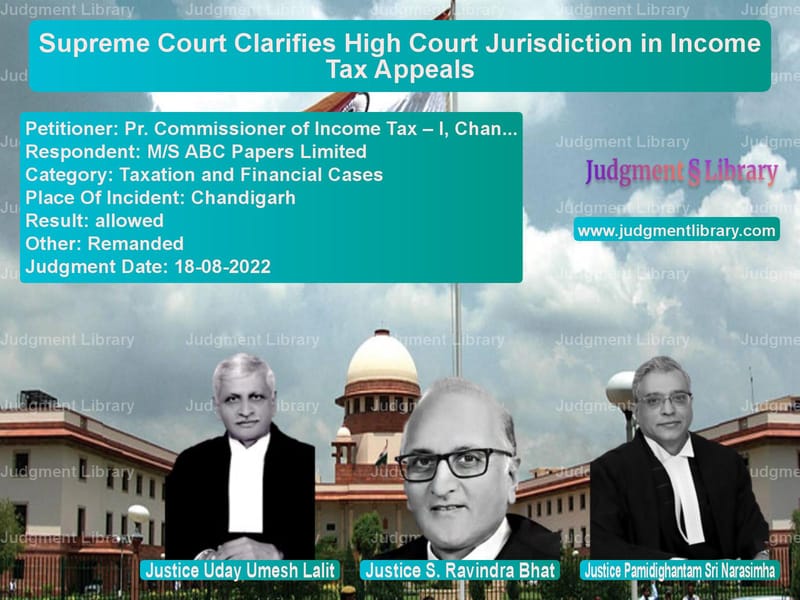

Supreme Court Clarifies High Court Jurisdiction in Income Tax Appeals

The case of Pr. Commissioner of Income Tax – I, Chandigarh vs. M/S ABC Papers Limited revolved around a crucial question of law regarding which High Court has jurisdiction over income tax appeals when an assessing officer is transferred from one state to another. The Supreme Court was tasked with resolving the conflicting views of different High Courts and providing clarity on the correct forum for filing appeals under Section 260A of the Income Tax Act, 1961.

Background of the Case

The dispute arose when M/S ABC Papers Limited, a company engaged in manufacturing writing and printing paper, was subjected to income tax assessment for the financial year 2008-09. The company initially filed its tax returns in New Delhi, where the assessing officer (AO) processed the case. The Deputy Commissioner of Income Tax (DCIT), New Delhi, issued a notice under Section 143(2) and subsequently passed an assessment order on December 30, 2010.

Aggrieved by the assessment order, ABC Papers Limited filed an appeal before the Commissioner of Income Tax (Appeals) – IV, New Delhi, which was decided in its favor on February 16, 2012. The Revenue further appealed to the Income Tax Appellate Tribunal (ITAT), New Delhi, which upheld the Commissioner’s decision and dismissed the Revenue’s appeal on May 11, 2017. Consequently, the Revenue approached the High Court of Punjab & Haryana for further appeal under Section 260A of the Income Tax Act.

Key Legal Questions

The case presented two critical legal questions:

- Which High Court has jurisdiction over an income tax appeal when an assessing officer is transferred to a different state under Section 127 of the Income Tax Act?

- Does an administrative transfer of an assessing officer change the jurisdiction of the High Court under Section 260A?

Arguments Presented

Petitioner (Revenue) Arguments

- The Revenue contended that once a case is transferred to another assessing officer in a different state under Section 127, the jurisdiction of the High Court also changes accordingly.

- They relied on the Delhi High Court’s decisions in CIT v. Sahara India Financial Corporation Ltd. and CIT v. Aar Bee Industries Ltd., which held that when an assessing officer is transferred, the case’s jurisdiction shifts to the High Court under whose territorial jurisdiction the new AO falls.

- The Revenue asserted that since the case had been transferred from New Delhi to Ghaziabad and subsequently to Chandigarh, the Punjab & Haryana High Court lacked jurisdiction.

Respondent (ABC Papers Limited) Arguments

- The company argued that the jurisdiction of the High Court under Section 260A is based on the location of the original assessing officer who passed the initial assessment order.

- They cited the Delhi High Court’s ruling in Seth Banarsi Dass Gupta v. Commissioner of Income Tax, which established that appeals under Section 260A should be filed in the High Court where the assessing officer originally had jurisdiction.

- The company further contended that an administrative transfer under Section 127 does not alter the jurisdiction of the High Court.

Supreme Court’s Analysis and Judgment

The Supreme Court examined the conflicting views of the Punjab & Haryana High Court and the Delhi High Court regarding appellate jurisdiction in income tax cases. The Court reviewed previous rulings and statutory provisions to determine the correct interpretation of Section 260A.

Key Observations by the Supreme Court

- The Court reaffirmed that the jurisdiction of a High Court under Section 260A is determined by the location of the assessing officer who passed the original assessment order, not by subsequent administrative transfers.

- It clarified that Section 127 of the Income Tax Act governs the transfer of cases between assessing officers but does not dictate the jurisdiction of High Courts for appeals.

- The Court emphasized that allowing an administrative order of transfer to determine High Court jurisdiction would undermine judicial independence and allow the executive branch to manipulate the forum for appeals.

- It overruled the Delhi High Court’s decisions in Sahara India Financial Corporation Ltd. and Aar Bee Industries Ltd., holding that these rulings were incorrect in shifting jurisdiction based on administrative transfers.

Key Court Statement

“The jurisdiction of a High Court under Section 260A of the Act is determined by the location of the assessing officer who passed the assessment order. An administrative transfer under Section 127 does not change the forum for appeals.”

Final Judgment

- The Supreme Court allowed the appeal and held that the Punjab & Haryana High Court had jurisdiction to hear the appeal as the original assessing officer was located in Chandigarh.

- It overruled the Delhi High Court’s approach of shifting jurisdiction based on administrative transfers.

- The case was remanded to the Punjab & Haryana High Court for a decision on the merits.

Implications of the Judgment

This ruling has significant implications for income tax litigation in India:

- It establishes that High Court jurisdiction is fixed based on the original assessing officer, providing clarity and consistency in tax appeals.

- It prevents the executive branch from manipulating judicial forums through administrative transfers under Section 127.

- It ensures that tax litigation remains predictable for taxpayers and the Revenue, reducing unnecessary jurisdictional disputes.

- It upholds the principle that appellate jurisdiction must be independent of executive decisions.

Conclusion

The Supreme Court’s decision in this case provides much-needed clarity on the jurisdiction of High Courts in income tax appeals. By ruling that administrative transfers do not affect the jurisdiction of High Courts under Section 260A, the Court has reinforced judicial independence and consistency in tax litigation. The judgment ensures that taxpayers and the Revenue have certainty regarding the correct appellate forum, reducing unnecessary jurisdictional conflicts in future cases.

Petitioner Name: Pr. Commissioner of Income Tax – I, Chandigarh.Respondent Name: M/S ABC Papers Limited.Judgment By: Justice Uday Umesh Lalit, Justice S. Ravindra Bhat, Justice Pamidighantam Sri Narasimha.Place Of Incident: Chandigarh.Judgment Date: 18-08-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: pr.-commissioner-of-vs-ms-abc-papers-limit-supreme-court-of-india-judgment-dated-18-08-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Evasion Cases

See all petitions in Banking Regulations

See all petitions in Corporate Compliance

See all petitions in Judgment by Uday Umesh Lalit

See all petitions in Judgment by S Ravindra Bhat

See all petitions in Judgment by P.S. Narasimha

See all petitions in allowed

See all petitions in Remanded

See all petitions in supreme court of India judgments August 2022

See all petitions in 2022 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category