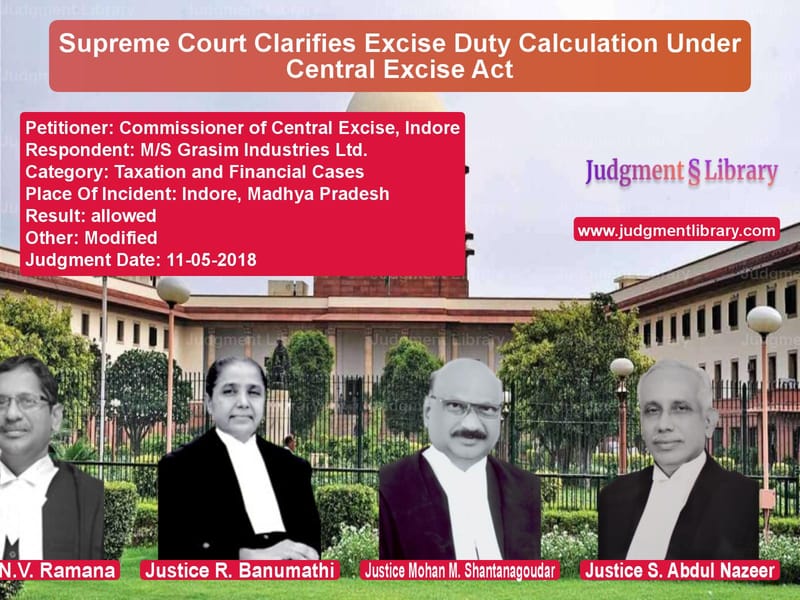

Supreme Court Clarifies Excise Duty Calculation Under Central Excise Act

The Supreme Court of India, in its judgment on May 11, 2018, in Commissioner of Central Excise, Indore vs. M/S Grasim Industries Ltd., addressed a significant legal issue regarding excise duty valuation under the Central Excise Act, 1944. The judgment clarified whether charges such as packing, rental, wear and tear, and other ancillary expenses should be included in the calculation of excise duty.

The ruling resolved conflicts between previous Supreme Court decisions and provided clarity on how excise duty should be calculated based on transaction value.

Background of the Case

The respondent, Grasim Industries Ltd., and other assessees manufactured industrial gases, liquid chlorine, and other allied products. They supplied these products to customers using containers such as tonners, cylinders, carboys, paper cones, and HDPE bags. The company charged customers various fees under different heads, including:

- Packing charges

- Wear and tear charges

- Facility charges

- Service charges

- Delivery and collection charges

- Rental charges

- Repair and testing charges

The tax authorities contended that these charges should be included in the assessable value for determining excise duty under Section 4 of the Central Excise Act, 1944, as amended on July 1, 2000. The assessees, on the other hand, argued that these charges were unrelated to manufacturing costs and should not be considered for excise duty calculations.

Legal Questions Considered

- Should ancillary charges such as packing, rental, and service fees be included in the transaction value for excise duty calculation?

- What is the scope of transaction value under Section 4 of the Central Excise Act, 1944?

- Does the revised definition of transaction value align with the fundamental principles of excise duty?

- Should the Supreme Court reconsider previous decisions in Union of India vs. Bombay Tyre International Ltd. and Commissioner of Central Excise, Pondicherry vs. Acer India Ltd.?

Petitioner’s Arguments

The Commissioner of Central Excise contended:

- Excise duty should be assessed on the entire amount paid by customers, including all additional charges.

- The amended Section 4 introduced the concept of ‘transaction value,’ which was broader than the earlier definition based on normal price.

- All amounts payable by the buyer as a condition of sale should be included in the assessable value.

- Grasim Industries Ltd. was attempting to artificially exclude charges that were directly linked to the supply of goods.

Respondent’s Arguments

Grasim Industries Ltd. and other assessees argued:

- Excise duty should be limited to the manufacturing cost plus manufacturing profit.

- The additional charges were related to ancillary services and should not be included in the assessable value.

- The Supreme Court’s ruling in Acer India Ltd. supported the exclusion of certain charges that were unrelated to manufacturing.

- Including these charges would amount to an unfair expansion of excise duty beyond the intended scope of the Central Excise Act.

Supreme Court’s Observations

The Supreme Court examined the legislative intent behind the amendments to Section 4 of the Central Excise Act, 1944. The Court noted that:

“Excise duty is a levy on manufacture, but the measure of tax can be determined based on transaction value, which includes additional charges if they are conditions of sale.”

The Court further observed:

“The measure of the levy must not be confused with the nature thereof, though there must be some nexus between the two.”

The Supreme Court reaffirmed the key principles established in Bombay Tyre International Ltd. and overruled any inconsistent interpretations from Acer India Ltd.. The Court ruled that transaction value includes all charges that contribute to the price payable by the buyer.

Final Judgment

The Supreme Court upheld the position of the Commissioner of Central Excise and ruled that:

- All amounts charged to the buyer, including packing, rental, and testing fees, were part of the transaction value.

- Excise duty should be calculated based on the total amount payable as a condition of sale.

- The decision in Bombay Tyre International Ltd. was reaffirmed as the correct interpretation of excise duty valuation.

- The revised definition of transaction value under the 2000 amendment to Section 4 was aligned with the fundamental principles of excise duty.

The Court concluded:

“The measure of the levy contemplated in Section 4 of the Act will not be controlled by the nature of the levy. So long as a reasonable nexus is discernible between the measure and the nature of the levy, both Section 3 and 4 will operate in their respective fields.”

Key Takeaways from the Judgment

- The Supreme Court clarified that transaction value under Section 4 includes all amounts payable by the buyer.

- The ruling reaffirmed the principle that excise duty can include charges beyond just manufacturing costs.

- The Court resolved conflicts between previous judgments, providing consistency in excise duty valuation.

- The decision has broad implications for manufacturers who seek to exclude additional charges from excise duty calculations.

This ruling provides critical clarity on the calculation of excise duty and ensures that manufacturers cannot artificially reduce their tax liabilities by excluding essential components of the transaction value.

Petitioner Name: Commissioner of Central Excise, Indore.Respondent Name: M/S Grasim Industries Ltd..Judgment By: Justice Ranjan Gogoi, Justice N.V. Ramana, Justice R. Banumathi, Justice Mohan M. Shantanagoudar, Justice S. Abdul Nazeer.Place Of Incident: Indore, Madhya Pradesh.Judgment Date: 11-05-2018.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Commissioner of Cent vs MS Grasim Industrie Supreme Court of India Judgment Dated 11-05-2018.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in GST Law

See all petitions in Tax Evasion Cases

See all petitions in Judgment by Ranjan Gogoi

See all petitions in Judgment by N.V. Ramana

See all petitions in Judgment by R. Banumathi

See all petitions in Judgment by Mohan M. Shantanagoudar

See all petitions in Judgment by S. Abdul Nazeer

See all petitions in allowed

See all petitions in Modified

See all petitions in supreme court of India judgments May 2018

See all petitions in 2018 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category