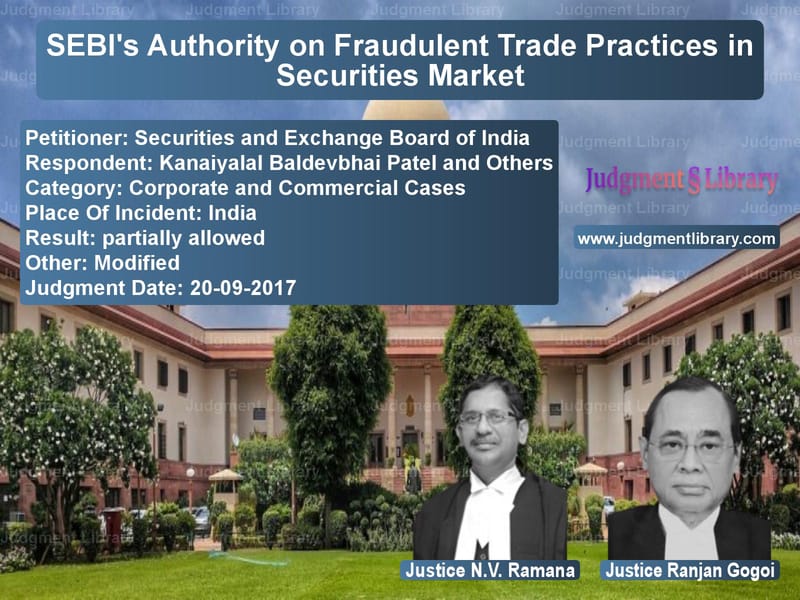

SEBI’s Authority on Fraudulent Trade Practices in Securities Market

The Supreme Court of India recently ruled on a significant case involving the Securities and Exchange Board of India (SEBI) and various individuals accused of engaging in fraudulent trading practices, commonly referred to as front-running. This case examined whether non-intermediary front-running is a violation under the SEBI (Prohibition of Fraudulent and Unfair Trade Practices Relating to Securities Market) Regulations, 2003 (FUTP 2003). The court addressed multiple appeals filed by SEBI as well as private individuals, culminating in a detailed judgment on the scope of fraudulent and unfair trade practices.

Background of the Case

The case involved multiple individuals and entities accused of engaging in trading activities that exploited non-public information. One of the key allegations was that certain traders placed orders ahead of large institutional investors, allowing them to profit from price movements induced by bulk transactions.

The investigation revealed that individuals such as Kanaiyalal Baldevbhai Patel and Dipak Patel were involved in such transactions. SEBI accused them of using confidential information to trade in advance of substantial client orders, thereby manipulating market prices for personal gains.

Legal Provisions and SEBI’s Regulatory Framework

SEBI’s case was based on the provisions of FUTP 2003, particularly Regulation 3, which prohibits fraudulent trading, and Regulation 4, which explicitly bans manipulative, fraudulent, and unfair trade practices. SEBI argued that front-running, even by non-intermediaries, falls within the purview of these regulations.

Regulation 3 of FUTP 2003 states that no person shall directly or indirectly deal in securities in a fraudulent manner. Regulation 4 further elaborates that any act which manipulates market prices or induces others to trade based on deceptive practices constitutes a violation.

Arguments Presented

Petitioner (SEBI)

- SEBI contended that non-intermediary front-running amounts to market manipulation, as it unfairly exploits confidential information.

- It argued that the regulation should be interpreted broadly to cover all fraudulent practices, not just those by intermediaries.

- SEBI cited amendments to FUTP 2003, emphasizing that the intent of the law was to prevent market abuse in all its forms.

Respondents

- The accused traders contended that front-running by non-intermediaries was not explicitly covered under Regulation 4(2)(q), which specifically mentions intermediaries.

- They argued that applying the regulation to non-intermediaries would be an overreach, as the law must be interpreted strictly in penal provisions.

- The defense also highlighted that SEBI failed to establish a direct link between the traders’ actions and fraudulent intent.

Key Observations by the Court

Justice N.V. Ramana, delivering the judgment, emphasized that the objective of FUTP 2003 is to protect the integrity of the securities market. The court observed:

- Fraud is broadly defined under Regulation 2(c) to include any act of misrepresentation, omission, or concealment committed to induce others to trade.

- Market integrity is fundamental, and fraudulent practices must be addressed comprehensively.

- Even if Regulation 4(2)(q) explicitly mentions intermediaries, it does not mean that non-intermediary front-running is permitted.

The judgment relied on the principle that regulatory provisions should be interpreted in a manner that prevents exploitation of market mechanisms. The court noted:

“The SEBI Act and the regulations framed thereunder are intended to protect the interests of investors and ensure fair trading practices in the securities market.”

Final Verdict

The Supreme Court ruled in favor of SEBI in certain appeals while dismissing others. It held that:

- Non-intermediary front-running is a fraudulent trade practice under FUTP 2003.

- The accused traders had engaged in market manipulation by leveraging privileged information.

- The regulatory framework must be applied expansively to prevent loopholes that could undermine market fairness.

The court thus reinstated penalties imposed by SEBI on several traders while dismissing some appeals based on insufficient evidence.

Conclusion

This ruling reinforces SEBI’s authority in regulating market practices and ensuring fair trading. By upholding SEBI’s interpretation of front-running, the Supreme Court has sent a strong message against fraudulent trading activities. The decision underscores the importance of maintaining market integrity and protecting investors from manipulative practices.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Securities and Excha vs Kanaiyalal Baldevbha Supreme Court of India Judgment Dated 20-09-2017.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Corporate Governance

See all petitions in Fraud and Forgery

See all petitions in Company Law

See all petitions in Judgment by N.V. Ramana

See all petitions in Judgment by Ranjan Gogoi

See all petitions in partially allowed

See all petitions in Modified

See all petitions in supreme court of India judgments September 2017

See all petitions in 2017 judgments

See all posts in Corporate and Commercial Cases Category

See all allowed petitions in Corporate and Commercial Cases Category

See all Dismissed petitions in Corporate and Commercial Cases Category

See all partially allowed petitions in Corporate and Commercial Cases Category