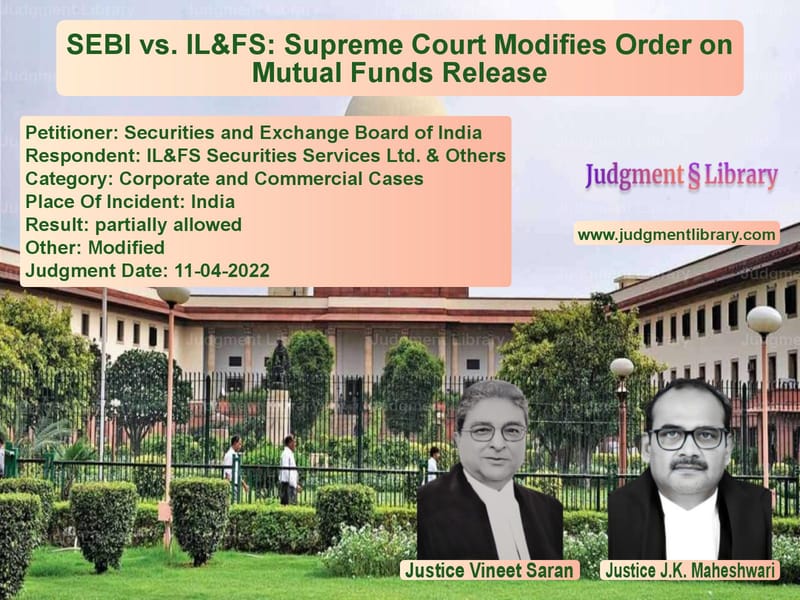

SEBI vs. IL&FS: Supreme Court Modifies Order on Mutual Funds Release

The Supreme Court of India recently ruled in Securities and Exchange Board of India vs. IL&FS Securities Services Ltd. & Others, modifying previous orders concerning the release of mutual funds valued at approximately ₹350 crores. The judgment highlights the judicial approach in handling financial disputes involving regulatory authorities and large corporations, ensuring a balanced resolution of competing claims.

The case revolves around the financial entanglements between SEBI, IL&FS Securities Services Ltd. (ISSL), and Dalmia Cement (Bharat) Ltd. The dispute primarily concerns the rightful ownership and release of mutual fund units held by ISSL but claimed by Dalmia Cement. The Supreme Court’s ruling modifies the earlier orders and provides clarity on the conditions under which the mutual fund units should be released.

Background of the Case

The dispute emerged from financial transactions involving IL&FS Securities Services Ltd. and Dalmia Cement (Bharat) Ltd., with SEBI overseeing the regulatory aspects. The matter involved allegations of financial mismanagement and fraudulent pledging of securities, prompting investigations by the Serious Fraud Investigation Office (SFIO) and the Economic Offences Wing (EOW).

In 2019, the Supreme Court issued an interim order allowing Dalmia Cement to encash its mutual funds, provided that the equivalent amount was deposited in a fixed deposit in a nationalized bank. This order was subsequently modified in March 2021, allowing the release of mutual funds into Dalmia Cement’s demat account, subject to furnishing a bank guarantee equivalent to the value of the mutual funds.

Petitioners’ Arguments

Dalmia Cement (Bharat) Ltd., the applicant, contended that:

- It was the rightful owner of the mutual fund units in question.

- The requirement to furnish a bank guarantee of ₹344.07 crores was placing an undue financial burden on the company.

- The supplementary charge sheet filed by the EOW found that ISSL had fraudulently pledged securities, supporting its claim for unconditional release of mutual funds.

- Since SEBI and SFIO reports indicated fraudulent transactions by ISSL, Dalmia Cement should not be required to provide additional securities.

Respondents’ Arguments

SEBI, ISSL, and other respondents opposed the modification request, arguing that:

- The original conditions imposed by the Supreme Court were necessary to protect investors and maintain market integrity.

- The EOW charge sheet was not conclusive, as investigations were still ongoing.

- Releasing the mutual funds without adequate security could impact stakeholders relying on SEBI’s regulatory oversight.

- The order dated 21.09.2021, which required a ₹100 crore bank guarantee and ₹300 crore security, was already a relaxation from the previous order.

Supreme Court’s Judgment

The Supreme Court bench, comprising Justices Vineet Saran and J.K. Maheshwari, ruled in favor of modifying the previous order while ensuring a balance between financial security and fairness. The key observations made by the Court were:

- Ownership of Mutual Fund Units: The Court reaffirmed that Dalmia Cement had a legitimate claim over the mutual fund units.

- Modification of Bank Guarantee Requirements: Instead of a ₹344.07 crore bank guarantee, the Court directed Dalmia Cement to provide a ₹100 crore bank guarantee and furnish a corporate guarantee for ₹300 crores.

- Consideration of Investigation Reports: The Court acknowledged the findings of SFIO and EOW but clarified that the ongoing investigation should not prejudice the financial security provided in the case.

- Protection of Stakeholder Interests: The ruling ensured that the release of mutual funds did not undermine regulatory safeguards, providing a structured financial mechanism for resolving disputes.

- Judicial Oversight on Financial Disputes: The Court emphasized that in high-value financial cases, a balanced approach was necessary to prevent undue financial strain on corporations while ensuring regulatory compliance.

Implications of the Judgment

The ruling has several important implications for financial markets and corporate law:

- Clarity on Securities Release Conditions: The decision sets a precedent for handling disputes involving mutual fund units and financial guarantees.

- Judicial Review of Regulatory Orders: The Supreme Court’s oversight reinforces the importance of ensuring fairness in regulatory decisions.

- Corporate Accountability: The judgment underscores that financial institutions must adhere to transparency and legal compliance in securities transactions.

- Investor Protection: By balancing security conditions, the ruling helps safeguard investor interests while allowing legitimate claims to be resolved fairly.

Conclusion

The Supreme Court’s ruling in Securities and Exchange Board of India vs. IL&FS Securities Services Ltd. & Others is a landmark decision clarifying the conditions for the release of disputed financial assets. The judgment ensures that corporate entities are not subjected to excessive financial constraints while maintaining necessary safeguards for regulatory compliance. This ruling will serve as a guiding precedent for future cases involving mutual fund disputes and financial security requirements.

Petitioner Name: Securities and Exchange Board of India.Respondent Name: IL&FS Securities Services Ltd. & Others.Judgment By: Justice Vineet Saran, Justice J.K. Maheshwari.Place Of Incident: India.Judgment Date: 11-04-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: securities-and-excha-vs-il&fs-securities-ser-supreme-court-of-india-judgment-dated-11-04-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Company Law

See all petitions in Bankruptcy and Insolvency

See all petitions in Corporate Compliance

See all petitions in Judgment by Vineet Saran

See all petitions in Judgment by J.K. Maheshwari

See all petitions in partially allowed

See all petitions in Modified

See all petitions in supreme court of India judgments April 2022

See all petitions in 2022 judgments

See all posts in Corporate and Commercial Cases Category

See all allowed petitions in Corporate and Commercial Cases Category

See all Dismissed petitions in Corporate and Commercial Cases Category

See all partially allowed petitions in Corporate and Commercial Cases Category