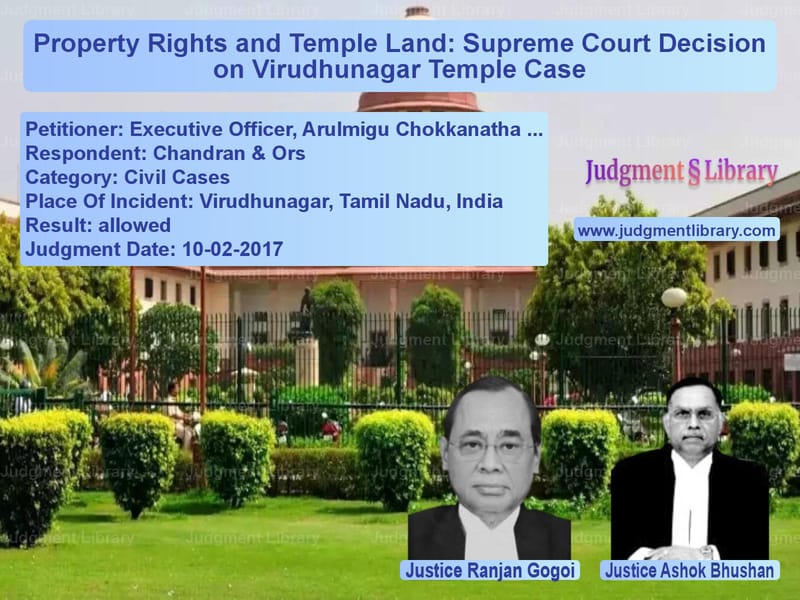

Property Rights and Temple Land: Supreme Court Decision on Virudhunagar Temple Case

Introduction

The case of Executive Officer, Arulmigu Chokkanatha Swamy Koil Trust, Virudhunagar v. Chandran & Ors deals with a complex dispute over land ownership and temple property rights. The Supreme Court of India was called upon to determine the legitimacy of the claim made by the plaintiff for ownership of a parcel of land that was recorded under the possession of a temple trust. The legal battle revolved around issues of title ownership, the validity of sale deeds, and the role of revenue records in determining property claims.

Background of the Case

The dispute arose when Chandran (the plaintiff) filed a suit in the trial court seeking a declaration of ownership and a mandatory injunction to correct revenue records in his favor. He claimed that he had purchased 2 acres and 73 cents of land from an individual who had inherited it. However, the land in question was recorded as part of the Arulmigu Chokkanatha Swamy Koil Temple Trust, leading to a legal conflict.

The trial court and the first appellate court ruled against the plaintiff, stating that the property was temple land and had never been privately owned. However, the Madras High Court overturned these decisions and ruled in favor of the plaintiff, prompting the temple trust to appeal to the Supreme Court.

Key Legal Issues

- Can a property claimed by a temple trust be transferred through private sale deeds?

- Does the absence of revenue records in favor of the plaintiff invalidate his claim?

- Is the suit maintainable despite the non-joinder of a necessary party?

- Does a temple’s recorded ownership in revenue documents hold greater weight than private sale transactions?

Arguments by the Appellant (Temple Trust)

- The temple has been the recorded owner of the land for decades, as evidenced by official property records.

- The plaintiff’s claim was based on invalid sale deeds that did not confer legal title.

- The sale deeds in the plaintiff’s favor did not reference the specific survey numbers correctly, making the transfer legally ineffective.

- The suit was defective because it did not include Janaki Ammal, a necessary party who had a recorded interest in part of the disputed property.

Arguments by the Respondent (Chandran)

- He purchased the land through a valid sale transaction.

- The temple trust was only entitled to part of the land, and the remaining portion belonged to private individuals.

- The High Court correctly ruled that since the entire survey number could not belong to the temple, his claim should be recognized for the remaining portion.

Supreme Court’s Judgment

The Supreme Court ruled in favor of the temple trust, setting aside the High Court’s judgment and restoring the decisions of the lower courts. The Court found that:

“Revenue records establish continuous possession of the temple over the property, and the plaintiff has failed to produce any document proving private ownership over the disputed portion.”

On the issue of misjoinder of parties, the Court emphasized:

“The plaintiff himself admitted that a portion of the land was recorded in the name of Janaki Ammal, yet no steps were taken to include her in the suit. The suit is therefore defective and cannot be maintained.”

The Court further held that:

“A claim for declaratory relief without seeking possession is not legally maintainable when the plaintiff is not in actual possession of the property.”

Analysis of the Judgment

The Supreme Court’s decision rests on the following principles:

- Revenue Records and Ownership: Long-standing revenue records showing temple ownership outweigh private sale deeds.

- Failure to Join Necessary Parties: The absence of a necessary party (Janaki Ammal) made the suit untenable.

- Specificity in Property Transactions: Incorrect description of property in sale deeds can render a claim legally weak.

- Relief for Possession: A declaratory suit must include a prayer for possession if the plaintiff is not in actual control of the land.

Key Takeaways from the Judgment

- Religious trusts have strong legal protection over their properties.

- Revenue records play a crucial role in determining ownership.

- Sale deeds must be accurate and refer to the correct survey numbers.

- A suit for declaration alone is insufficient if the plaintiff is not in possession.

- Failure to join necessary parties can render a suit non-maintainable.

Impact of the Judgment

This ruling strengthens the legal standing of religious institutions in property disputes and reaffirms that ownership recorded in government documents cannot be easily displaced by private transactions. Future claimants must ensure they:

- Have clear and accurate sale deeds.

- Include all necessary parties in their suits.

- File for possession if they are not in actual control of the property.

Conclusion

The Supreme Court’s decision in this case upholds the rights of temple trusts and emphasizes the importance of revenue records in property disputes. The ruling reinforces that mere private transactions cannot override legally recognized ownership of religious institutions.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Executive Officer, A vs Chandran & Ors Supreme Court of India Judgment Dated 10-02-2017.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Property Disputes

See all petitions in Specific Performance

See all petitions in Landlord-Tenant Disputes

See all petitions in Judgment by Ranjan Gogoi

See all petitions in Judgment by Ashok Bhushan

See all petitions in allowed

See all petitions in supreme court of India judgments February 2017

See all petitions in 2017 judgments

See all posts in Civil Cases Category

See all allowed petitions in Civil Cases Category

See all Dismissed petitions in Civil Cases Category

See all partially allowed petitions in Civil Cases Category