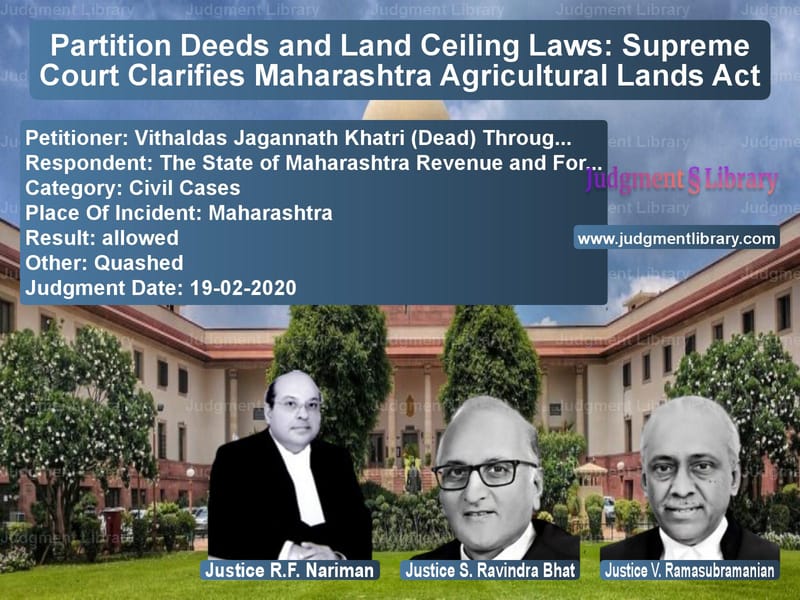

Partition Deeds and Land Ceiling Laws: Supreme Court Clarifies Maharashtra Agricultural Lands Act

The case of Vithaldas Jagannath Khatri (Dead) Through Smt. Shakuntala Alias Sushma & Ors. vs. The State of Maharashtra Revenue and Forest Department & Ors. is a crucial judgment clarifying the interpretation of the Maharashtra Agricultural Lands (Ceiling on Holdings) Act, 1961. The Supreme Court ruled on whether a partition deed executed before the cut-off date of September 26, 1970, could be ignored under the Act’s provisions regarding ceiling limits on agricultural land.

Background of the Case

The case originated when the Maharashtra Revenue Department declared that certain lands belonging to the appellants were in excess of the ceiling limits under the Maharashtra Agricultural Lands (Ceiling on Holdings) Act, 1961 (referred to as the “1961 Act”). The dispute revolved around a partition deed executed on January 31, 1970 and registered on July 1, 1970, which divided the agricultural land among the family members.

Following the implementation of the 1961 Act, which set a ceiling on landholdings, the authorities determined that some of the land exceeded the permissible limit. The appellants challenged this decision, arguing that the partition deed was executed before the cut-off date and, therefore, could not be ignored while calculating the ceiling limit.

The Revenue Department contended that the partition was a sham, executed to circumvent the ceiling laws, and thus should be disregarded. After prolonged litigation, the case reached the Supreme Court.

Arguments of the Petitioner (Vithaldas Jagannath Khatri & Ors.)

- The appellants argued that the partition deed was executed before the cut-off date of September 26, 1970, making it valid and binding under the law.

- They contended that the authorities had no power under the 1961 Act to question a partition deed executed before the cut-off date.

- They relied on the legal principle that a partition is a recognized mode of property division within Hindu law and should not be treated as a transfer.

- They cited past judgments where pre-cut-off partitions were upheld as valid and could not be ignored under land ceiling laws.

Arguments of the Respondent (State of Maharashtra Revenue and Forest Department)

- The respondents argued that the partition was a sham and was created with the intent to circumvent the ceiling laws.

- They contended that even though the partition was executed before the cut-off date, it was made in anticipation of the law and should be ignored.

- They relied on Section 11 of the 1961 Act, which allows authorities to disregard any partition made after September 26, 1970, and argued that even earlier partitions could be scrutinized if found to be fraudulent.

- The respondents emphasized that the family continued to cultivate the land collectively, indicating that the partition had no real effect.

Supreme Court’s Judgment

A bench comprising Justice R.F. Nariman, Justice S. Ravindra Bhat, and Justice V. Ramasubramanian ruled in favor of the appellants, overturning the Bombay High Court’s decision. The Supreme Court made the following key observations:

“The scheme of the 1961 Act is that transfers or partitions of land made after September 26, 1970, may be ignored for determining ceiling limits. However, in the present case, the partition deed was executed and registered before this date, and there is no legal basis to declare it a sham.”

The Court further stated:

“If the legislature intended to scrutinize pre-cut-off transactions in the same manner, it would have explicitly stated so. The authorities exceeded their jurisdiction by disregarding the partition deed.”

The Court also rejected the argument that the partition was a mere arrangement without legal effect:

“A partition deed, duly executed and registered, creates distinct legal rights. The burden of proving it was a sham lies on the State, and in the absence of such proof, it must be given full legal effect.”

The Court held that the authorities failed to provide evidence that the partition was fraudulent:

“The presumption of legality applies to registered documents, and mere suspicion or assumption cannot be a basis for ignoring them.”

On procedural aspects, the Court criticized the authorities for proceeding against the appellants without making all affected parties part of the litigation:

“The failure to implead necessary parties vitiates the entire process. Any decision impacting individuals must involve them directly in the proceedings.”

Finally, the Court restored the order of the Sub-Divisional Officer, which had upheld the partition as valid.

Key Takeaways from the Judgment

- Pre-cut-off partitions are valid: A partition executed before the cut-off date cannot be ignored under the 1961 Act.

- Registered documents carry legal sanctity: A registered partition deed is presumed valid unless proven fraudulent.

- Authorities cannot exceed their powers: The Revenue Department lacks the jurisdiction to ignore pre-cut-off partitions based on mere suspicion.

- All affected parties must be impleaded: Legal proceedings impacting individuals must involve them directly to ensure fair adjudication.

Impact of the Judgment

This ruling has significant implications for land ceiling laws in Maharashtra:

- It prevents authorities from arbitrarily rejecting pre-cut-off partitions.

- It strengthens legal protection for registered transactions.

- It clarifies the scope of government scrutiny under the 1961 Act.

- It sets a precedent for similar cases involving land ceiling disputes.

The judgment provides much-needed legal certainty for families who executed partitions before the cut-off date, ensuring their rights are protected.

Conclusion

The Supreme Court’s decision in Vithaldas Jagannath Khatri & Ors. vs. The State of Maharashtra Revenue and Forest Department & Ors. affirms that partition deeds executed before the cut-off date of September 26, 1970, are legally valid and cannot be ignored under the Maharashtra Agricultural Lands (Ceiling on Holdings) Act, 1961. This ruling ensures fairness in the implementation of land ceiling laws and upholds the sanctity of registered documents.

Petitioner Name: Vithaldas Jagannath Khatri (Dead) Through Smt. Shakuntala Alias Sushma & Ors..Respondent Name: The State of Maharashtra Revenue and Forest Department & Ors..Judgment By: Justice R.F. Nariman, Justice S. Ravindra Bhat, Justice V. Ramasubramanian.Place Of Incident: Maharashtra.Judgment Date: 19-02-2020.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Vithaldas Jagannath vs The State of Maharas Supreme Court of India Judgment Dated 19-02-2020.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Property Disputes

See all petitions in Succession and Wills

See all petitions in Landlord-Tenant Disputes

See all petitions in Judgment by Rohinton Fali Nariman

See all petitions in Judgment by S Ravindra Bhat

See all petitions in Judgment by V. Ramasubramanian

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments February 2020

See all petitions in 2020 judgments

See all posts in Civil Cases Category

See all allowed petitions in Civil Cases Category

See all Dismissed petitions in Civil Cases Category

See all partially allowed petitions in Civil Cases Category